November 22, 2016

While history will continue to analyze this year’s presidential election, ad nauseam no doubt, a couple of things seem clear: the majority of the nation wanted change; the opinion of the majority of the nation mattered, at least in this election.

Keep in mind, I say the majority of the nation, not the majority of voters.

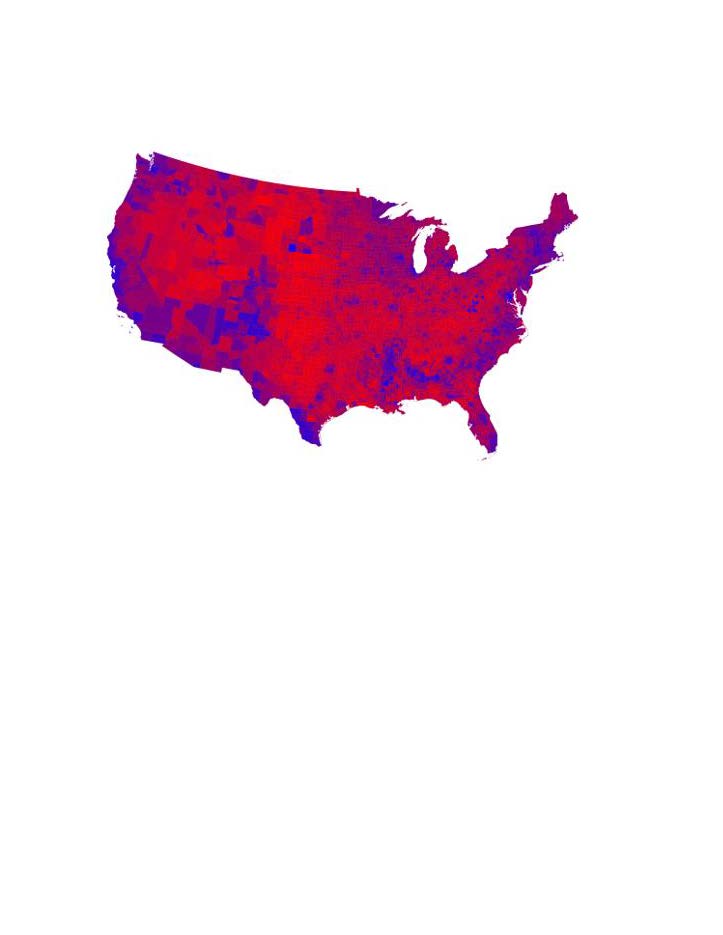

Look at election maps prepared by Mark Newman with the Department of Physics and Center for the Study of Complex Systems, University of Michigan, and Trump won hands down from a geographic perspective in terms of both state and county lines. Red indicates that a majority of voters selected Trump and blue designates where a majority of votes were for Clinton.

It’s easy to view these maps and declare cultural dividing lines primarily between the population centers of the West Coast and the Northeast. Easy, but not necessarily accurate.

The third map represents the percentage of votes cast for the candidates—from hardline red to blue with shades of purple in between. Red predominates, but there’s an awful lot of purple underlying it all. Incidentally, Newman also created cartograms, which expand and shrink the states and counties based on population; they offer a different view yet.

It’s the third map that paints the most realistic picture, in my opinion. Never mind the cultural divide between red and blue, there’s a whole lot of folks who buy some of each side’s values.

Though overly simplistic, it seems to me those same folks represent the most urgent challenge and opportunity to the U.S. cattle business and agriculture. They’re the segment of the population that is likely undecided about the value of the industry relative to the good of society. They could have the last word on which technologies and practices earn or continue to receive social license. And they’re everywhere.

Trump proves good for business so far

In the meantime, financial markets continue voting their support of a Trump victory. Between Election Day and Nov. 21, the Dow Jones Industrial Average was 623 points higher. The broader S&P 500 was up 58 points. This outside strength did nothing to dampen cattle markets, which finally began to perk up.

“Republican-controlled Executive and Legislative branches could mean swift action when the new administration takes office,” says Pablo Sherwell, Rabobank head of Food & Agribusiness Research and Advisory, North America. “Our analysts and others around the world are keeping a close eye on trade, labor, the upcoming Farm Bill and regulations impacting production agriculture, as these areas are where potential policy changes could have longer-term implications on the industry as a whole.”

In the short term, Rabobank analysts say agricultural markets may be affected by foreign exchange volatility, as well as changing business appetite and consumer confidence.

Brenda Boetel, agricultural economist at the University of Wisconsin-River Falls, notes in a recent issue of In the Cattle Markets that policy decisions regarding the Trans Pacific Partnership (TPP) and the proposed moratorium on the Waters of the United States (WOTUS) regulation could have the most direct impact on cattle markets.

“Trump has indicated he will propose a moratorium on new federal regulations not compelled by Congress,” Boetel explains. “If true to his word, this would include eliminating WOTUS. WOTUS is already in place, but there is a current legal stay on any regulation and Trump has the ability to make WOTUS go away. The elimination of WOTUS will have long-term impacts on the cattle markets due to the increased profitability potential by producers.”

As for trade, campaign rhetoric suggests the sledding could get stickier.

“Following Trump's victory, Obama has given up on promoting TPP,” Boetel says. “The now-defunct TPP could have boosted U.S. beef exports, as Japan is the leading market for U.S. beef. U.S. beef faces a Japanese import tariff of 38.5%, compared to Australia, which faces an import tariff of 28.5%...”

The Rabobank Food & Agribusiness Research and Advisory (FAR) group recently released a report on the possible implications of the election. In it, while acknowledging that any changes and subsequent impacts are uncertain, Rabobank analysts dissect key areas to watch, both short and long-term.

Looking toward next year, they say it will be critical to watch potential revisions to trade agreements, labor policies and business regulations, as well as the effects these elements will have on economic growth.

“Currently, the export share of U.S. agricultural production represents more than 20% in volume and value terms, making U.S. price formation highly dependent on foreign trade and therefore foreign currency,” Sherwell says.

You might also like:

4 tips for grazing corn stalks this fall

What's the big deal about fetal programming?

You May Also Like