Trends in family wealth show the rich continue to get richer.

September 8, 2016

Last week’s column focused on the general state of the economy and specifically the general trend in job creation since the financial crisis. The column noted that, “…one of the key indicators for consideration around monetary policy stems from the Bureau of Labor Statistics. The agency’s Jobs Report, formally known as the Employment Situation Summary, is highly anticipated every month by traders as proxy for economic growth. The August report marked 255,000 new jobs being created in July – well ahead of pre-report expectations.”

Meanwhile, the Congressional Budget Office (CBO) recently released a new report titled, Trends in Family Wealth, 1998 to 2013. CBO’s report focuses on shifts in family wealth distribution over time, along with consideration of additional factors including age and education.

CBO explains that, “In 2013, aggregate family wealth in the United States was $67 trillion (or about four times the nation’s gross domestic product) and the median family (the one at the midpoint of the wealth distribution) held approximately $81,000…” Moreover, CBO also details that, “In 2013, families in the top 10% of the wealth distribution held 76% of all family wealth, families in the 51st to the 90th percentiles held 23%, and those in the bottom half of the distribution held 1%.”

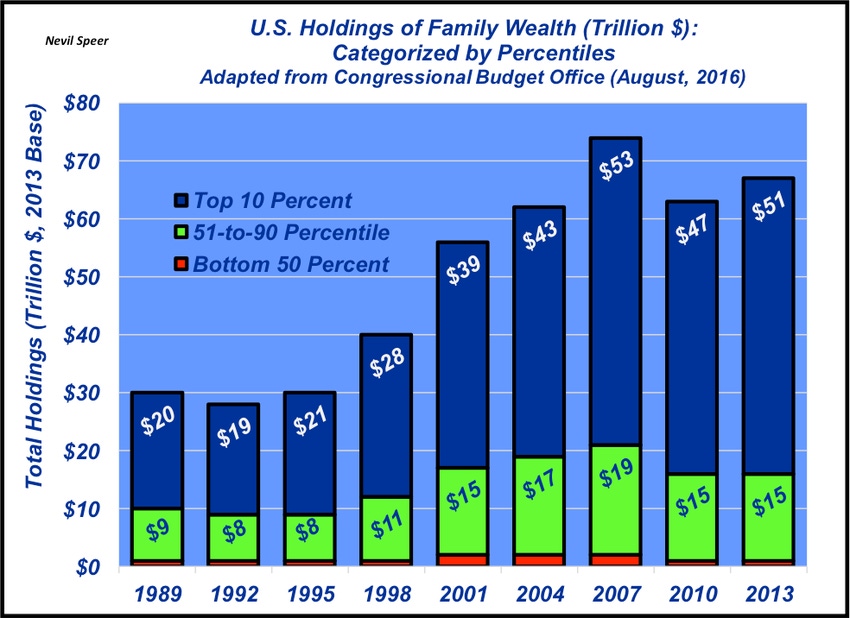

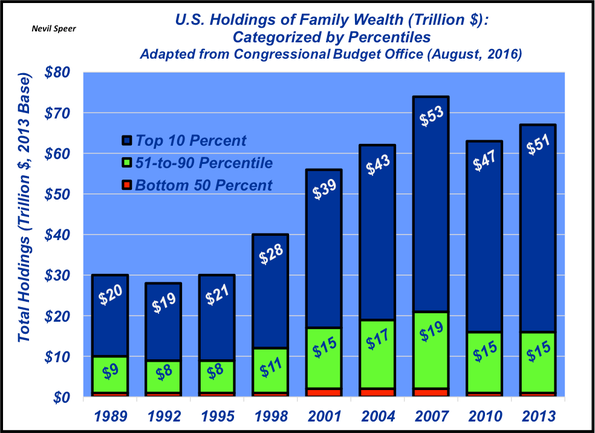

This week’s illustration highlights holdings of family wealth, categorized by percentiles, between 1989 and 2013. CBO articulates the relative shift over time:

The share of wealth held by families in the top 10% of the wealth distribution increased from 67% to 76%, whereas the share of wealth held by families in the bottom half of the distribution declined from 3% to 1%.

Two developments contributed to the change in the distribution of wealth: compared with families in the top half of the distribution, families in the bottom half experienced disproportionately slower growth in wealth between 1989 and 2007, and they had a disproportionately larger decline in wealth after the recession of 2007 to 2009.

In light of the election season, it’s important to note that none of this discussion is intended as political commentary in any form or fashion. Rather, it’s offered as background with respect for comparison purposes. Namely, it allows farm/ranch families to compare their relative change in family wealth over time in some perspective to the broader population. Secondly, it also possesses some implications to beef demand and pricing power.

With that in mind, how do you perceive the general shift of family wealth? How might, or might not, these data and trends be important to the beef industry? What other implications surround CBO’s new report for the beef, pork and poultry industries? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

Photo Tour: World's largest vertically integrated cattle operation

Are you the best ranch manager you can be?

60+ stunning photos that showcase ranch work ethics

About the Author(s)

You May Also Like