Market volatility and cattle futures’ effectiveness as a risk management tool are separate issues. Part 5 of a multipart series.Part 1: When cash was king of the beef marketPart 2: Fed cattle cash price mattersPart 3: Changing industry, changing marketsPart 4: If price discovery is a public good, should private industry pay?

August 1, 2016

Whether cattle futures today remain an effective tool for price risk management depends mightily on whom you talk to, and whether you’re talking about live cattle or feeder cattle futures.

“Feeder cattle futures have become increasingly volatile in ways that often appear unrelated to market fundamentals,” says Derrell Peel, Extension livestock marketing specialist at Oklahoma State University. “Erratic futures price movements and increased basis volatility makes it difficult or impossible for the industry to use feeder futures for its two primary roles of risk management and price discovery.”

Peel was a long time getting to the point of believing feeder cattle futures are part of the current problem with price volatility and murky price discovery, rather than part of the solution.

“We need them. They’re good tools when they work right,” Peel says. “But I hear from producers all of the time who say they can’t use them anymore, because the basis is so unpredictable and because the volatility is too extreme. Cash prices for calves and feeder cattle are getting whipsawed because of it, and cash markets shouldn’t do that. I think the growing sentiment is that they [feeder cattle futures] are a less effective tool than they were before.”

George Enloe, a partner at Amarillo Brokerage Co. in Amarillo, Texas, is less pessimistic about feeder cattle futures but believes, “they expose the flaws of cash settlement because basis is so variable and unpredictable.”

Feeder flaws

One of the flaws, depending on your outlook, is that feeder cattle are settled financially with the CME Feeder Cattle Index. Live cattle are settled via delivery, causing convergence sooner.

For that matter, Peel says if you were to start from scratch, contract months would likely be different from what they are currently. For instance, consider the producer pulling yearlings off grass in the Flint Hills and Osage country in July. The nearest contract is May or August.

The most glaring flaw continues to be the lack of liquidity — too few players willing to accept the transfer of risk in that market. It’s worth remembering that the lack of liquidity doomed the stocker cattle futures that were offered for a brief time almost two decades ago.

Plus, Peel explains, more liquidity today represents market forces different from those in the past.

“A growing proportion of the outside [non-hedging] liquidity in feeder futures is, by many accounts, from sources motivated primarily by portfolio management rather than actually speculating based on feeder cattle market fundamentals,” Peel explains.

“Aided by computers and mechanical trading strategies, this type of activity tends to result in movements into and out of futures markets quickly and violently, resulting in increasing market volatility as underlying liquidity is exhausted … Unfortunately, erratic futures markets have a very real impact on actual cash feeder markets with consequences that impact the entire industry — and not only direct users or potential users of the futures market. Talk to producers or sit at most any cattle auction; it’s obvious that participants are watching futures prices, both feeder and live cattle.”

Live cattle futures

In the meantime, Enloe continues to believe live cattle futures remain an effective tool for managing price risk.

“If you’re trying to out-trade the futures market, then it has been a nightmare, considering the price moves caused by drought and herd liquidation, followed by massive herd rebuilding. But for the disciplined hedger, the correlation between futures and cash prices has been very good on a week-to-week basis for the last four to five years,” Enloe says.

“Futures prices can do whatever they want along the way, and hedging can still work if basis at closeout is fairly predictable,” explains Peel, who has more faith in live cattle futures. “The volatility doesn’t matter much, as long as it hasn’t messed with the cash market.”

Amarillo Brokerage Co. caters to hedgers. “We encourage them to be disciplined,” Enloe explains. “You need to decide your hedging percentage up front. If you try to decide whether or not to hedge each lot of cattle as you buy them, it is easy to get sidetracked in a year like 2015.”

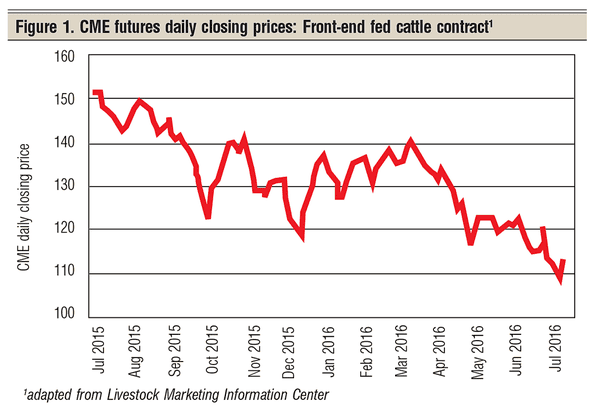

He’s referring to the price collapse that took a chunk of equity out of the cattle feeding business. It was precipitated in part by too many cattle fed for too long, which the market encouraged.

“In 2015, we were buying breakevens way above the cash and way above the board,” Enloe says. “It was the biggest spread between cost of gain and cattle price in history. We had every reason to over-feed cattle.”

“In 2015, we were buying breakevens way above the cash and way above the board,” Enloe says. “It was the biggest spread between cost of gain and cattle price in history. We had every reason to over-feed cattle.”

Unfortunately, Enloe estimates about 40% of fed cattle were hedged last year, compared to about 70% the previous year. Most of the big losses came on cattle that weren’t hedged.

“It isn’t easy to hedge cattle at a large loss,” Enloe says. But he explains that those disciplined enough to do so are more apt to survive wrecks like last year.

So far, Enloe says this year is shaping up just the opposite of last year. “We’re buying breakevens below the cash and close to the futures in many instances.”

Although Enloe believes improvements can be made to live cattle futures, he’s against lots of immediate change.

“Last year was an outlier year with an unprecedented price break. 2014 was an outlier, too, with an unprecedented price rally,” Enloe says.

“Let’s talk about potential changes and then allow the dust to settle, rather than make a lot of changes in the midst of the firestorm,” he says.

He cringes to think about having no futures market or other viable means of transferring risk.

“Can you imagine how much financial protection packers would have to take to contract fed cattle, or how much cattle feeders would have to take to contract calves and feeder cattle?” Enloe asks. “Can you imagine the amount of money banks would require you to put up as equity? The end result is that most producers would have to scale back, and consumers would end up paying for it.”

Risk management

“Effective futures markets enhance industries by providing additional risk management alternatives and by enhancing price discovery,” Peel says.

In their absence, he explains, more of the volatility surrounding price discovery is shoved into the cash market.

“For feeder cattle, the volatility would probably be more than it would be without an effective futures market, but I don’t know that it would be any more volatile than it is today with an ineffective futures market,” Peel says. “One problem is that feeder cattle markets already carry a big burden of price coordination.”

He points out the feeder cattle market is the one place that all production sectors come together.

65 Photos That Celebrate Cowgirls & Cattlewomen

Ranch women are often the backbones of our cattle operations. Enjoy these stunning photos here.

“Without hedging and options, producers would rely more heavily on cash forward contracts or other cash market forward-pricing schemes to manage risk,” Peel says.

“These are more restrictive in how and how much they can be used, so the industry is clearly worse off compared to having viable hedging alternatives.”

On the other hand, when it comes to feeder cattle, Peel believes today’s reality may be more untenable than having no futures market.

“In between the alternatives of having or not having futures markets is the situation now, where we have dysfunctional futures markets,” Peel says. “That is likely the worst situation of all.”

You might also like:

Best risk strategy options for cattle producers

Does it really take six years to cover your costs on a cow? NO!

Photo Gallery: Get to know the 2016 Seedstock 100 operations

About the Author(s)

You May Also Like