Supply continues to be a major influence on the market, only now it’s in the opposite direction compared to 2014 and the first half of 2015.

April 6, 2016

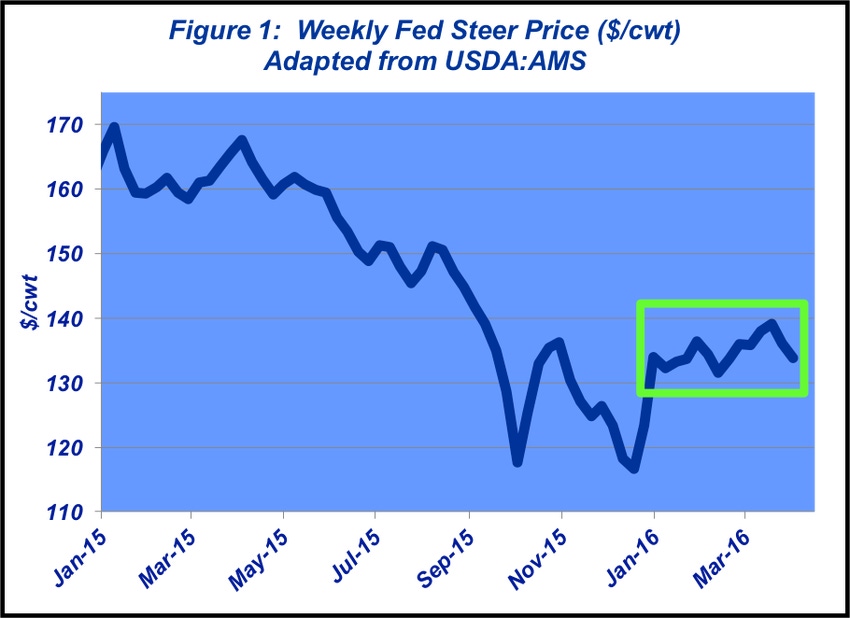

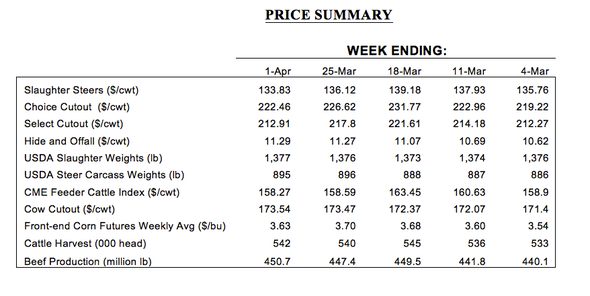

The March cattle market, if nothing else, managed to be persistent – at least through most of the month. The first three weeks had cash trade for fed cattle locked in a $3 trading range from $136 to $139. At the same time, the April live cattle futures contract caught some new life, breaking through $140 on the way to nearly $142 on the front half of the month.

Although short-lived, the futures action at the CME seemed significant as a prior rally in late February and early March couldn’t get past $140. As noted last month, “… March opened for business, the futures market ran out of gas. As such, hopes for a rally to, and ultimately past, $140 simply wasn’t in the cards. Seemingly, to overcome $140 resistance, the market will require some fresh, positive news and renewed cues from a stronger cash market. And given seasonal dynamics, coupled with things to occur in the coming month, such a rally may hold off until the market clears itself with current positioning and there’s more clarity around interest rates.”

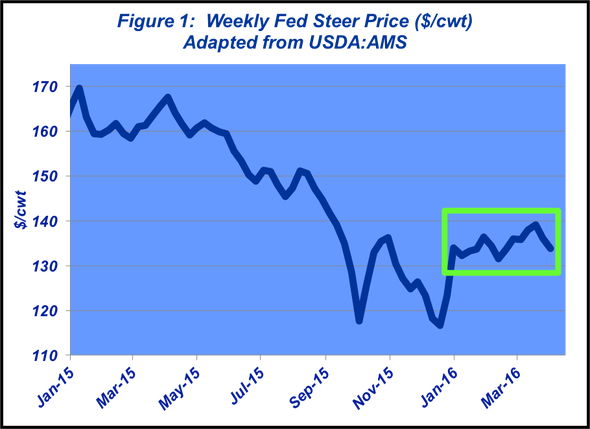

Along the way, the second rally brought some enthusiasm for the prospects for spring highs and help support $139 fed trade. That was further underpinned by active wholesale trade; the Choice cutout managed to add $15 in just three weeks, all the way up to $231 in mid-March.

But March’s good news ended there. The beef complex fizzled on the back half of the month. The April fed cattle contract slipped back to $133 as March closed for business. Meanwhile, cash trade also backed up in late March with the final week of finishing at $134 (Figure 1). That all came on the heels of weaker wholesale trade as the Choice cutout closed March out at $220 (Figure 2) and general concerns about beef movement amidst larger supplies in the coming months.

All that discussion calls attention to USDA’s March Cattle on Feed report and feedyard leverage heading into the heart of the spring marketing season. USDA’s survey pegged on-feed inventory at 10.77 million head – 1% larger than last year.

The more important number, though, lies in the mix. That is, the 120+ day inventory is 4.423 million head – about 41% of all cattle on feed. The proportion is record-large for March and represents the biggest population to work through since April 2013.

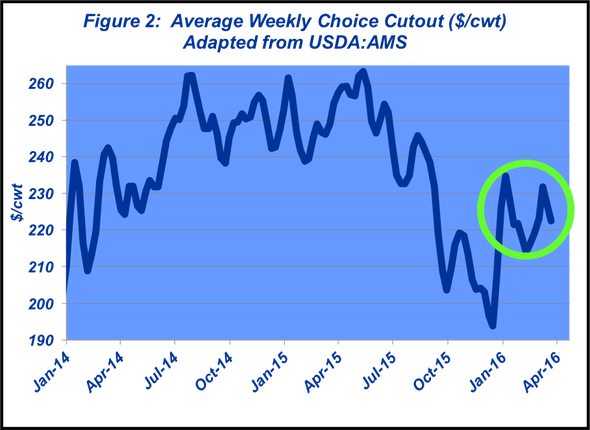

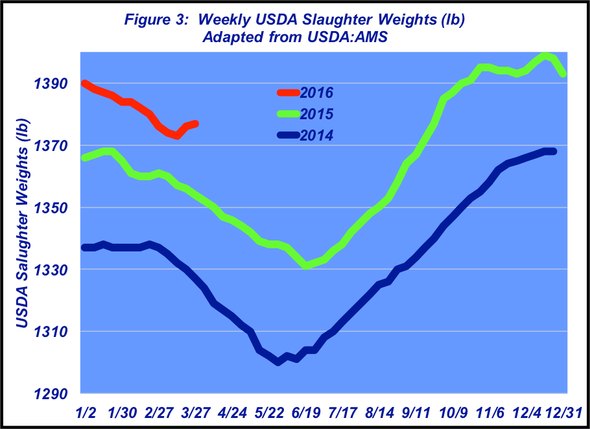

Meanwhile, it’s tonnage that really matters. Slaughter weights continue to trend at new seasonal records (Figure 3), not to mention 2016 has seen a contra-seasonal jump in recent weeks. That’s not totally unexpected. Heavier weights are consistent with a long-term trend (see this week’s Industry At A Glance). Additionally, feedyards have persistently made the heaviest category of placements (800+ pounds) the biggest part of the placement mix—heavy in, heavy out.

Bottom line, though, both live and carcass weight is running about 25 pounds ahead of last year. And as Ed Czerwein, USDA Market News, explains in his weekly boxed beef report, that additional weight, compared to last year, is equivalent to adding approximately 13,000 beef carcasses to the sales cooler each week.

Confounding all that is the reality that fed supply seasonally expands from here. Moreover, there’s little incentive to not keep cattle on feed longer. In other words, weights will remain in the current trend. Steve Kay, Cattle Buyers Weekly, citing Shawn Walter, Professional Cattle Consultants, explains it like this:

“… there is still no financial incentive to cut days on feed. Cost of gains as a percentage of live cattle values are still close to the same level as they were last year and well outside of normal. Feeder cattle prices are still too high to compete for pen space with cattle currently on feed and feeding profitability is still negative. If adding a few more days will lower the breakeven, the will be added ….”

The key to the market’s direction and overall level for the remainder of spring and going into summer all revolves around currentness and subsequent leverage. If feedlot marketings begin to lag, the result will be further downward pressure on the market. With respect to currentness, as explained last October, the phenomenon becomes a self-reinforcing phenomenon:

Cattle feeders are backed up with respect to the front-end supply

The packer thus has leverage and able to force the market lower

The cattle feeder subsequently becomes reluctant to market cattle

Cattle get even heavier; thereby even fewer head are needed by the packer and hastens the leverage disparity even further.

Turning quickly to the corn market, the beef complex received a favorable surprise at the end of June. First, USDA’s quarterly grain stocks inventory pegged corn stocks at 7.81 billion bushels (4.34 and 3.47 billion bushels on-farm and off-farm, respectively) – 1% ahead of last year’s mark. More importantly, the agency’s prospective plantings report noted 93.6 million corn acres in 2016 – well ahead of average estimates going into the report. Accordingly, May corn was down sharply and feeder cattle finished limit up on the reports.

To close out, supply continues to be a major influence on the market only now it’s in the opposite direction compared to 2014 and the first half of 2015. The market will continue to be somewhat edgy as it finds its way through these new fundamentals. Producers need to be well prepared for what might come their way. As noted last month, producers should be persistently investing time and effort toward monitoring the business environment to stay up with the markets and ensure objective decision making.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

Get to know the 2016 Seedstock 100 operations

5 tips to make bull buying easier

Cow prolapsing? Here's what to do

March cattle markets In like a lamb and out like a lion

Why the USDA suspension of the midyear Cattle report is troubling

Here's how attaining zero calf sickness is absolutely possible

About the Author(s)

You May Also Like