Don’t expect the wild market swings of the past several months to subside anytime soon.

December 10, 2015

The market’s story has been fairly consistent during the past several months, and not in a good way. The beef complex can’t seem to shake free from the snare of bearishness and volatility. As such, November spelled more of the same, with the market giving and then taking away – and the market has now given back nearly all the gains made following September’s plunge.

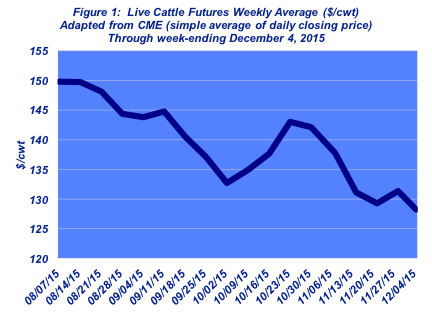

The December Live Cattle futures contract encroached $130 in late September (weekly average) but then managed to tack $10 back on through the end of October. However, since that time, the general direction has been negative and crossed through $130 in late November (Figure 1). And early December saw the two front-end contracts (December and February) undergo some big intra-day swings including a limit down close in the middle of the week.

The squeeze then worsened on December 7: all futures contracts were down sharply on news the World Trade Organization awarded Canada and Mexico over $1 billion in tariffs in the COOL ruling against the United States.

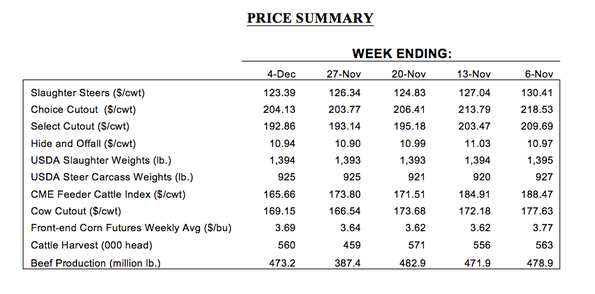

Meanwhile, over on the cash side, the fed cattle market regained a portion of the early fall slide with feedyard managers selling cattle for as much as $136 in late October, following $117 trade in late September. However, since that time, live sales have slipped $10 through November with the market ending the month at $126. The week following Thanksgiving regressed even further, with December opening at mostly $123-4.

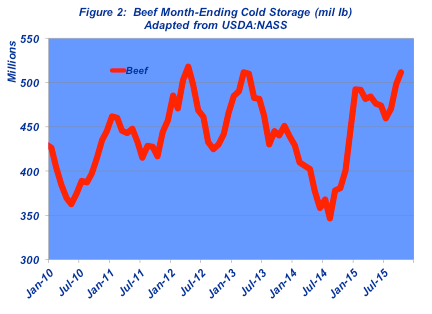

Several factors continue to swirl, making it tough for the market to get any traction, with one of the primary factors being a pipeline full of beef. September-ending beef inventories totaled nearly 497 million pounds – a new record for September and 31% bigger versus 2014.

Those stocks grew even bigger in October. The month-ending beef inventory grew to nearly 512 million pounds – 34% bigger versus 2014 and the largest October beef storage number on record (Figure 2).

Meanwhile, in a fashion similar to previous months, USDA’s November Cattle on Feed report indicated similar pressure on the live side. While it appears the peak of the front end has been cleaned up, the inventory of cattle on feed for more than 120 days now stands at 3.65 million head – that mark is the largest for November in the series.

The pipeline has plenty of supply – both on the live side and on the meat side. That pressure can’t, or won’t, be alleviated right away; improvement will require some time and work in the coming months.

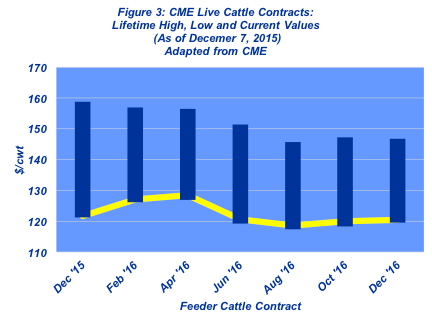

And until that occurs, it will effectively limit upside potential as the market transitions through the holiday and into early spring. The live cattle futures contracts reflect that working environment. Contract values are now trading near lifetime lows following the WTO tariff awards in the COOL case that Canada and Mexico brought against the United States (Figure 3).

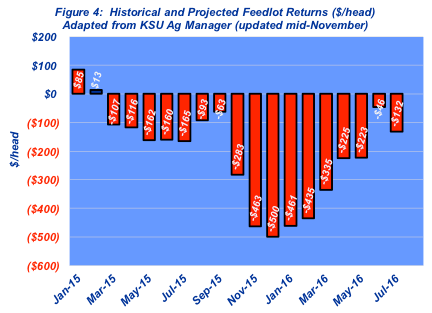

Most important in all this are the implications for producer profitability in the feeding sector (Figure 4) and then the subsequent influence of the feeder market going forward. That reality was appropriately outlined in the Livestock Marketing Information Center’s most recent Livestock Monitor:

In terms of breakeven sales prices, the first four months of 2015 required sales prices in the $180s per cwt to cover all estimated costs of production. From May through December, the breakeven was in the $160s to the low $170s. That picture will change for cattle sold as early and January 2016. At recent prices for a 700- to 800-pound steer, the breakeven sale price is projected to be about $140.00 per cwt. That will be the lowest level since the closeouts (when fed cattle were sold) in June 2014. Based on what has already happened to the price relationship between feeder and fed cattle, 2016 will not be a repeat for cattle feeders in terms of red ink. Still, it will likely take several years for cattle feeders to recover from the financial debacle of 2015.

Gaining equity back over time will undoubtedly mean additional backward pressure, beyond just cyclical supply influences, on feeder prices in 2016 and beyond. The Feeder Cattle Index is now below $170 (see table below) and feeder cattle futures are working in a deep trough in a pattern very similar to live cattle futures. As such, cow-calf operators face a different environment going forward versus the previous several years and are encouraged to very strategic about all their marketing decisions (Figure 4).

The market is trying to find its way. The turn of events – or at least the degree to which they occurred—for 2015 was unexpected. But those sharp moves aren’t likely to end any time soon. Markets have a tendency to over-correct.

With that in mind, as noted in previous months, “Trying to outguess or outsmart this market is nearly impossible to do and the consequences can be devastating. Given the continued pattern within the market, sharp moves are the primary challenge to be managed – both up and down.” Therefore, producers should be prepared for some rough sailing in the months ahead and plan accordingly. And amidst the whirlwind, careful analysis is especially important to ensure successful decision-making.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

Could we soon be taxed for eating meat?

13 new utility tractors for the ranch

7 ranching operations who lead in stewardship, sustainability

Trending Headlines: 10 tips for cutting cattle feeding costs

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)