Prospective Plantings, feed prices and implications for feeder cattle markets

Corn price dynamic has changed over the last year, will likely continue to do so in the coming months.

April 3, 2024

Input prices have been a major topic of discussion over the last couple of years. As I write this, we are enjoying some extremely high cattle prices. But those high prices have been at least somewhat offset by increases in production costs. This has been true of feed, fertilizer, fuel, machinery, labor and many other inputs. On the heels of USDA’s “Prospective Plantings” report, it seemed to be a good time to discuss recent trends in feed prices and the impact this tends to have on feeder cattle values.

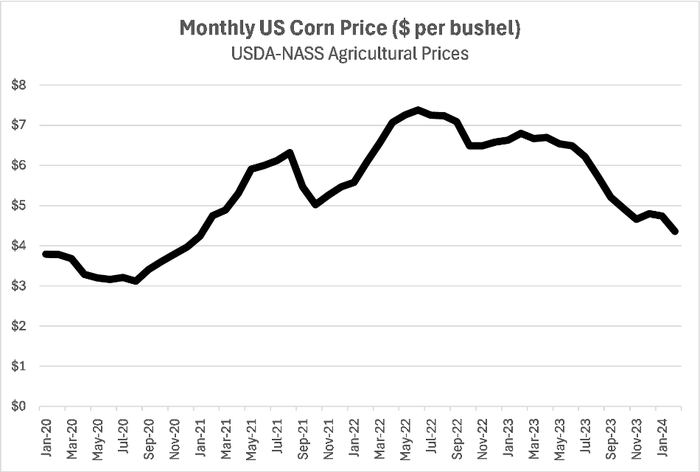

For some recent perspective, the U.S. average corn price per bushel is tracked in the figure above from January 2020 through February 2024. One can quickly see the low-price levels during COVID, price levels exceeding $7.00/bushel during 2022, and the significant price decreases seen through the 2023 season. Corn tends to be the market leader and trends in corn price are typically representative of other feedstuffs. Clearly, the corn price dynamic has changed over the last year and will likely continue to do so in the coming months.

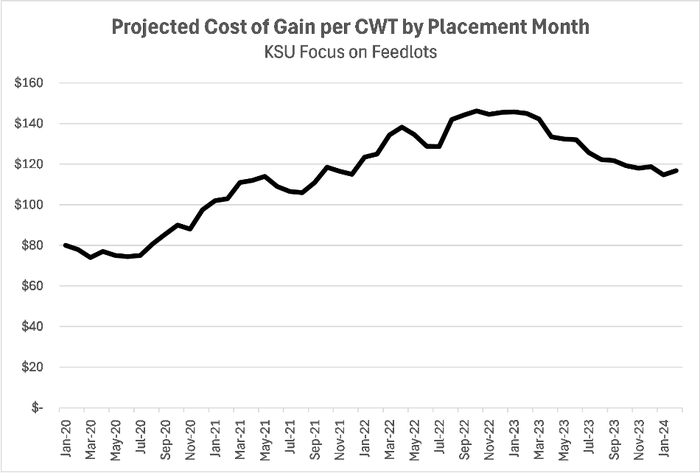

The demand for feeder cattle is derived from the demand for fed cattle. So, anything that impacts the profitability of finishing cattle will impact the value of feeders. For this reason, feeder cattle values are heavily impacted by the cost of taking those feeder cattle through to finish, and feed prices are the most significant cost of doing that. I am also showing projected cost of gain from Kansas State University’s “Focus on Feedlots” monthly reports in the second chart. Note how closely projected cost of gain follows corn price per bushel. As corn price rises and feedlot cost of gain increases, this gets reflected in lower feeder cattle values – feedlots cannot pay as much for feeders. As corn prices decrease, lower feedlot cost of gain leads to higher feeder cattle values as feedlots place feeders in the lower cost environment. While there are a large number of factors behind the strength of feeder cattle prices over the last year, lower feed prices have been part of story.

Finishing costs also impact value of gain on feeder cattle, which is reflected in the market through value differences across cattle at different weights. When finishing costs are high, feedlots tend to bid less aggressively on smaller calves and lean towards placing heavier feeder cattle. This tends to result in higher prices for heavy feeders relative to calves. This is sometimes described as a tightening, or narrowing, of price slides. As this happens, the value of pounds that are added prior to feedlot placement increases, and more incentive is created for cow-calf and growing operations to sell heavier feeder cattle. As feed prices have fallen recently, this incentive has also changed a bit. By no means am I suggesting that incentives to sell larger feeders don’t exist, but I do think the value of gain on feeder cattle has decreased from where it was this time last spring.

Coming full-circle, planting intentions impact feeder cattle markets because they impact the supply of feedstuffs and that has feed price implications. Late March’s “Prospective Plantings” report suggested a significant shift was expected with nearly a 5% decrease in corn acreage from 2023. The report also projected a 6.3 million acre decrease in prospective plantings of all principal crops, which would seem to suggest there is potential for more acreage to be planted in 2024. CME corn futures did increase after the report came out, but were down a bit as of April 1. In reality, this is just the beginning and actual planted acreage will respond to this information and many other factors this spring. But it definitely suggests the potential exists for tighter corn supplies going forward. The full “Prospective Plantings” report can be found here.

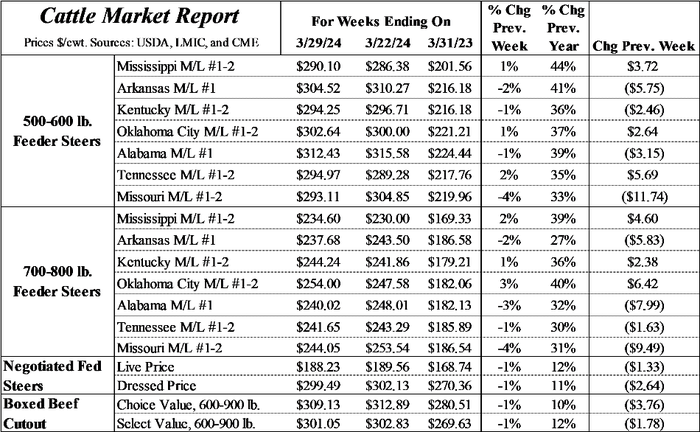

The markets

Prices for feeder cattle and calves were mixed last week, but still well above 2023 levels. Fed cattle and boxed beef prices were down slightly, but 10-12% above year-ago. Live and feeder cattle futures were both lower last week and I think that is partially due to the detection of HPIA in some dairy herds. The markets still seem to be processing this information and will continue to do so as we learn more. Corn futures were largely flat week over week but were lower early in the week and rose Thursday after USDA's Prospective Plantings report. Note that the weekly comparisons of futures were from Thursday to Thursday since markets were not open on Good Friday.

You May Also Like