Drought-induced attrition of livestock operations not as big as feared in 2011 but the trend to fewer operations continues.

March 16, 2012

USDA’s annual estimates of the number of livestock operations in the U.S. showed surprisingly little damage to beef cow operations numbers in 2011. We say “surprisingly little” because we had expected larger reductions due to the drought in Southwestern states last year.

The data, however, show little change from past national trends. There remain 734,000 beef cow operations in the U.S., down 8,000 from 2010. The 2011 number is just over 160,000 lower than in 1993. The land-extensive nature of cow-calf operations and the fact that there are few other uses of grasslands are major reasons for the large number of beef cow operations.

State data would very likely tell a different tale, especially for Oklahoma and Texas. But state level data for operations by size are now only available every five years in the Census of Agriculture, the latest of which was published in 2007.

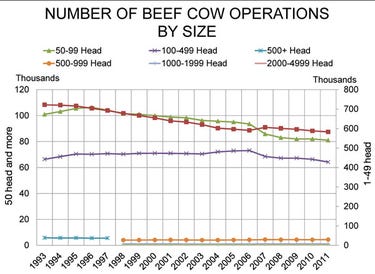

The chart “Number of Beef Operations by Size” shows U.S. beef cow operation numbers by size. Note that the line for 1-49 head is read off the right axis while all others are read off the left axis. The reason for that separation can be clearly seen in the differences between the two scales.

The chart “Number of Beef Operations by Size” shows U.S. beef cow operation numbers by size. Note that the line for 1-49 head is read off the right axis while all others are read off the left axis. The reason for that separation can be clearly seen in the differences between the two scales.

When it comes to number of operations, small herds still dominate the U.S. beef cow sector. There were still 583,000 herds with inventories of 1 to 49 cows last year. That is down 5,000 from the 2010 but is generally on the same trend line that has existed since 2004. The increase in small herd numbers in 2007 was primarily due to a change in estimation procedures at USDA. Note that the increase in the smallest category of herds was largely offset by reduction in the next two smallest (50-99 head and 100-499 head) categories of operations. Both of those categories also lost numbers in 2011 with the number of operations having 50-99 head declining by 1,000 to 81,000 and those having 100-499 head falling by 2,100 to 64,200.

As can be seen from the positions of the lines for larger operations, large beef cow operations are still rather rare. In the entire country, there are only 50 operations with 5,000 or more cows and only 280 with 2,000-4,999 cows. An estimated 5,470 operations had between 500 and 1,999 beef cows last year. Numbers for all of those size categories have been very, very stable since 1998 when they were first estimated by USDA.

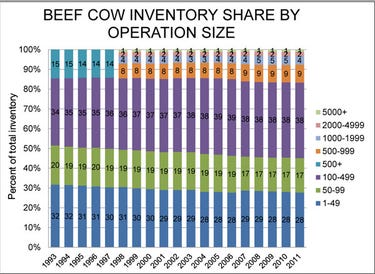

A look at herd shares by size group shows a different picture, of course, but even here the stability of the beef cow-calf sector and the dominance of small herds are pretty remarkable (“Beef Cow Inventory Share by Operation Size”).

A look at herd shares by size group shows a different picture, of course, but even here the stability of the beef cow-calf sector and the dominance of small herds are pretty remarkable (“Beef Cow Inventory Share by Operation Size”).

First consider that operations with fewer than 500 cows held 83% of all of the cows in inventory in 2011. That compares to a total share of 86% in 1993, indicating a substantial amount of staying power for these small herds. Those three smallest categories accounted for 99% of all operations. The smallest herds (1-49 head) account for 79.4% of all operations and hold 28% of the cows – not far off from the old 80-20 rule.

It is noteworthy, however, that within these three smallest size categories, it is the 100-499 cow category that has gained over the years (+4% since ‘93) while the two smallest groups have lost a combined 7%. We would characterize the 100-499 group as the smallest of the “professional” cow-calf operations since they are more likely to be full-time pursuits where smaller operations are generally part-time or hobby pursuits. There are very few, if any, families that can live on the profits from 100 beef cows in today’s economy.

The flip side of this is that full-time cow-calf operations (in which we include the 100-499 category) now hold 54% of all beef cows. That is an increase of 5% – but only 5% – since 1993. It still means that barely half of the national herd is in hands that depend upon those cows for a living. We believe this leaves a substantial portion of the beef supply chain that may not respond predictably or quickly to economic signals. While smaller than in the past, this “slow-response” sector is still large enough to complicate adjustments in the beef sector.

You May Also Like