Margin calls in a rapidly rising market

Sharp price increases can also create challenges for producers.

June 22, 2023

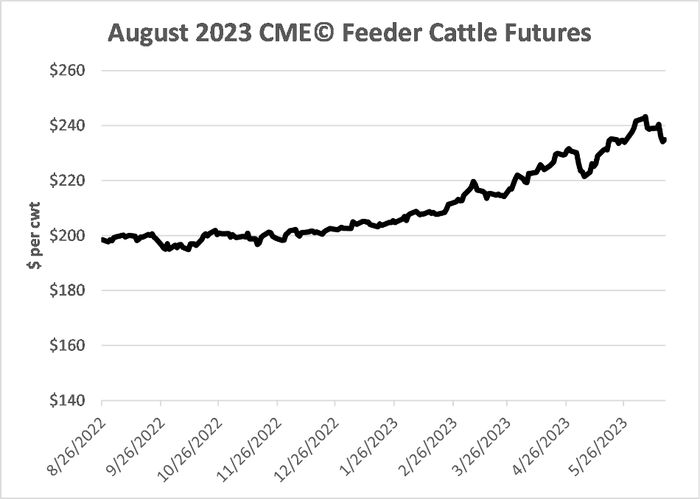

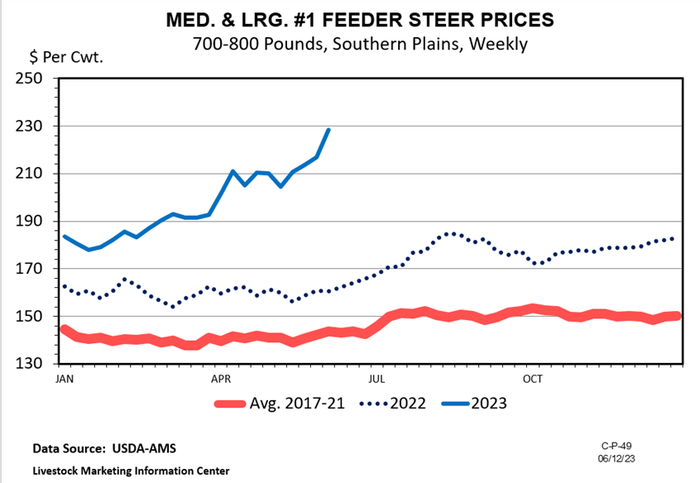

The feeder cattle market has been on a tear since fall of 2022. In most markets, heavy feeders are selling for $30-$50/cwt. more than they were in the fourth quarter. The price improvement in calf markets has been even greater. The August Chicago Mercantile Exchange feeder cattle futures contract that was trading below $200/cwt. in early fall is now trading in the mid-$230’s (see chart below). There is much reason for optimism as many profit opportunities exist in the current environment. But sharp price increases can also create challenges for producers, and I wanted to specifically discuss one of these challenges that came up last week as I was having lunch with a friend of mine that works in the agricultural lender sector.

While there are several price risk management strategies that can be employed by cattle producers, some of those strategies involve potential for margin calls. And a lot of margin can be needed when markets make major runs like the cattle markets have been doing. This can create a significant challenge for producers that assumed a short futures position (or wrote a call option) as part of their marketing plan. Sure, much of this will be recouped when cattle are eventually sold on the higher market. But the short-term liquidity strain can be a serious problem and is compounded today by much higher interest rates on borrowed money. I wanted to share a few thoughts on this situation that are applicable this year, and in future years.

First, farmers should have a fully transparent relationship with their lender. If a farmer’s risk management plan involves potential for margin calls, the lender should be aware of that from the start so that capital access can be discussed. While it may not be possible to plan for all possible scenarios, examining the impact of major market moves is important. Evaluating the effect of declining prices may be commonplace but walking through rising price scenarios is also important due to possible liquidity concerns when margin potential exists.

Secondly, producers should at least consider risk management strategies that do not involve the potential for margin. Forward contracts immediately come to mind and are used by some. But they can be pretty elusive in volatile times as buyers are hesitant to price far in advance. Put options and LRP insurance would also fall in this category as they allow a producer to have some downward price protection, while retaining upside potential. Premium is paid in both cases, but no margin is required as markets move.

Producers should also remember that there are ways to move out of a marginable position, and into something different, if conditions necessitate doing so. For example, someone with a short futures position could offset that position and purchase a put option or LRP insurance. And the price floor set would be reflective of the current, stronger market. Shifting to one of these strategies will require premium to be paid but will eliminate the potential for future margin calls. These strategies also have the added advantage of allowing the producer to capitalize if prices continue to rise, which they were unable to do with the short futures position.

Finally, producers that like the more solid downside price protection that comes from a short futures position, could also consider a synthetic put. An example of this would be keeping the short futures position but combining it with a call option. Premium is paid on the call option, but this also allows the producer to capitalize on rising prices as he/she gains on the call. Plus, as the call option becomes more valuable that works to offset the margin expense to some extent.

To be clear, there is nothing wrong with utilizing a risk management strategy that involves margin. In fact, there is good merit in many of those strategies. I like to say that if a farmer is not leaving money on the table occasionally, they are probably taking too much risk. However, I do think that producers should consider all risk management tools at their disposal, including those that do not carry potential for margin calls. And most importantly, they should fully think through the implications of major market swings in both directions.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)