The cattle market throughout 2017 held many surprises for beef producers. December closed the year in similar fashion.

January 5, 2018

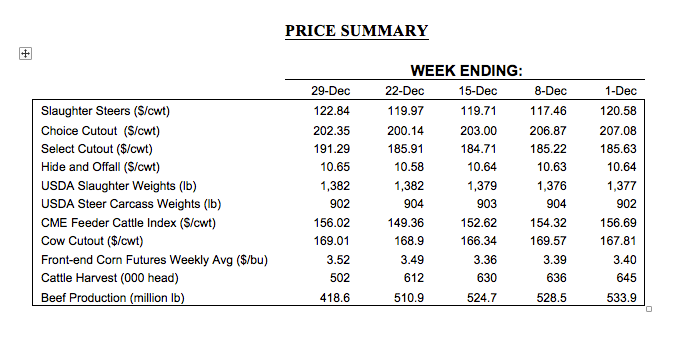

December brought some unexpected Christmas cheer to the cattle market. Fed trade started the month at $120-121 per cwt. However, holiday pressure appeared the following week; the market subsequently stepped back a few dollars. Normally, some negative follow-through would be expected in the weeks to come. But this market proves resilient; just when it appears there could be some tough weeks ahead, the market fight backs.

Following the setback to $117, cattle feeders fought back to $120 and ultimately captured $122-123 to close out the month. That’s a significant accomplishment. Consider last December, weekly beef production averaged about 480 million pounds – while fed trade average $113.50. Meanwhile, this year’s average weekly output during December was 3.5% bigger compared to 2016 at 496 million pounds, with corresponding fed trade averaging nearly 6% better year-over-year at $120.

Bigger production and better prices. Therein we find the enduring themes for the beef complex in the coming year. That is, the market will be mandated to absorb bigger supply. Meanwhile, beef demand appears to be negating the supply impact, and then some. With that in mind, those themes merit some discussion to set the stage for 2018.

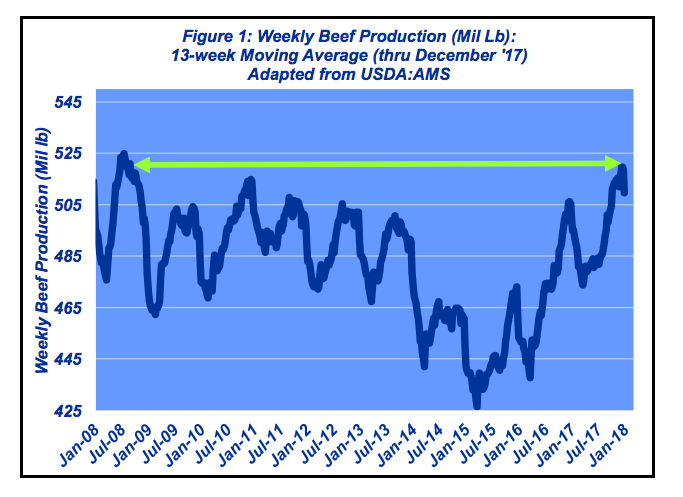

First, bigger numbers are nothing new. That’s been a recurring theme during the past year. Figure 1 depicts the 13-week moving average for weekly beef production. Throughput in late 2017 encroached 520 million pounds – that’s the biggest throughput the industry has experienced since August 2008.

That trend will likely continue. Cattle feeders have been resoundingly aggressive in placing cattle during 2017. And November was no exception as placements surprised to the upside. USDA’s Cattle on Feed report had cattle feeders taking delivery of 2.1 million head; the busiest November placement action since 2007.

But most important is the five month placement trend, with the earliest arrivals now being marketed. Through November, the five month total equals 10.2 million head – 825,000 head bigger versus 2016.

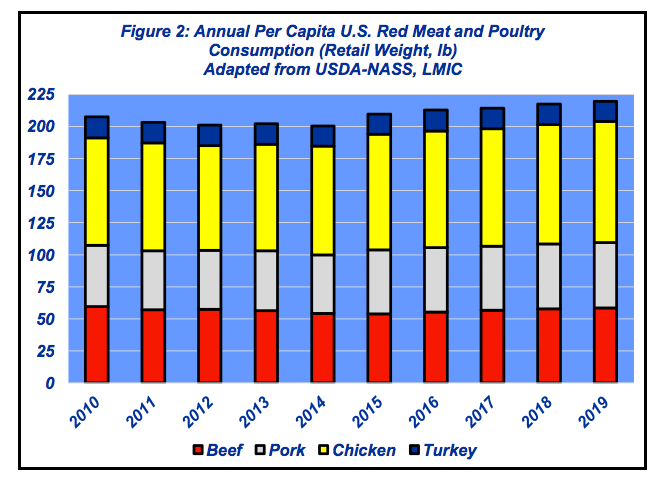

In other words, the fed market will have to work through an additional 825,000 head of cattle in the months of December through April. And all the while, there’s enduring pressure from competing protein sources. Aggregate beef, pork, chicken and turkey production totaled 213 pounds per capita in 2016; that increased to 214 pounds in 2017 and forecast to break through 217 pounds and encroach 220 pounds in 2018 and 2019, respectively (Figure 2).

But second, there’s also the issue of demand. And that is playing out favorably for the beef industry, at least for now. And as alluded above, that’s underpinning the fed cattle market. To that end, the Livestock Marketing Information Center explains the fed market like this:

Slaughter steer prices this fall have posted the biggest increase from September of any year in the last 11… The average change for that two-month span [September to November] during the prior 11 years was up by $1.42 per cwt. This year the price increase was $14.26. The biggest September-November price change since 2005 before this year was in 2014, which posted a gain of $9.82. In 2015, fed steer prices recorded the biggest September-November price drop in the last 11 years of $8.21. In 2016, November cattle markets started a rebound that continued into 2017.

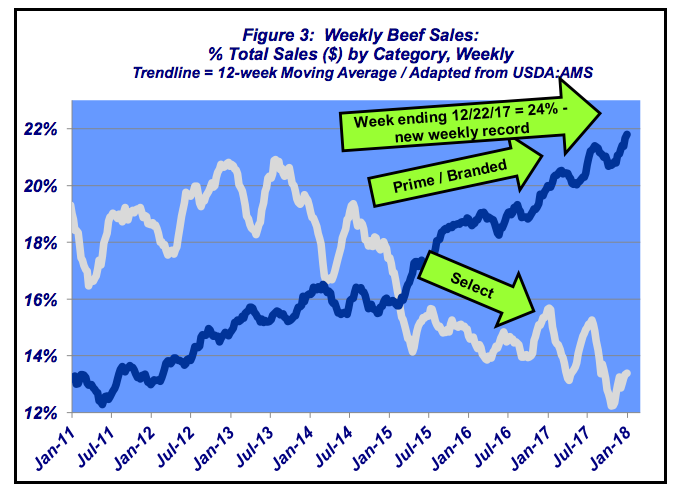

The indicators of favorable beef demand are two-fold. One, the Prime and branded market continues to grab market share from the lower end of the market. Figure 3 represents the 12-week moving average for market percentage comprised by Prime and branded versus Select, respectively. The trend is formidable. Moreover, the week prior to Christmas marked a new market share record for Prime and branded sales, comprising over 24% of value for the wholesale market.

Two, this week’s Industry At A Glance highlights an emerging divergence of middle meats versus end meats. In combination, it appears that consumers are increasingly focused on a high quality, consistent eating experience and willing to pay accordingly.

That’s not surprising. Included in last month’s column and worthy of repeating here, the Daily Livestock Report (Dec. 4) recently noted that, “…all year long we have seen beef demand defy expectations. The economy is in good shape, unemployment is low and the consumer appears willing and able to pay for beef.”

To that end, Industry At A Glance recently highlighted several key economic indicators – all trending in a favorable direction: 1) employment, 2) consumer sentiment, and 3) SP500 projected earnings. Given that reality, the beef industry should find some tailwinds to help underpin beef demand – at least through the first half of 2017.

All that said, this column is always focused on the importance of risk management. That consideration takes on two sides. First, there’s the concern of protection, and second, there’s also the need to ensure against missed opportunities. That’s not an easy line to walk – and one’s inherent bias of which side to walk depends upon many factors, including size of the operation, other business interests, relative debt, age, etc….

Accordingly, it’s always important to fully understand the business environment. Producers are encouraged to be aggressive about obtaining and analyzing meaningful information. Doing so helps to ensure making successful business decisions going forward – within the framework of one’s respective risk profile. And on that note, here’s wishing everyone great success and prosperity in 2018!

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

About the Author(s)

You May Also Like