While feeder cattle marketing can prove to be complex, the ongoing trend in the fed-feeder relationship provides, at a minimum, a pricing benchmark to work from.

September 7, 2017

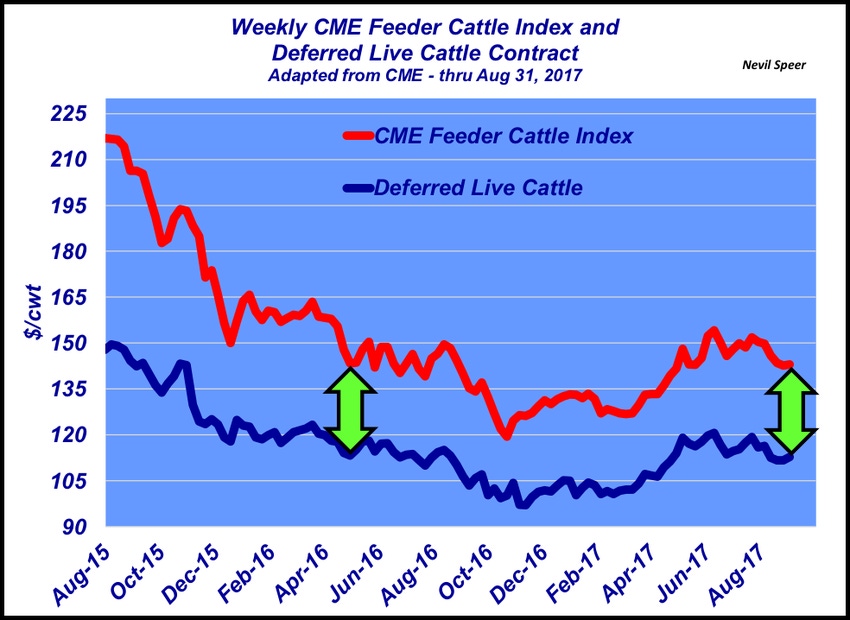

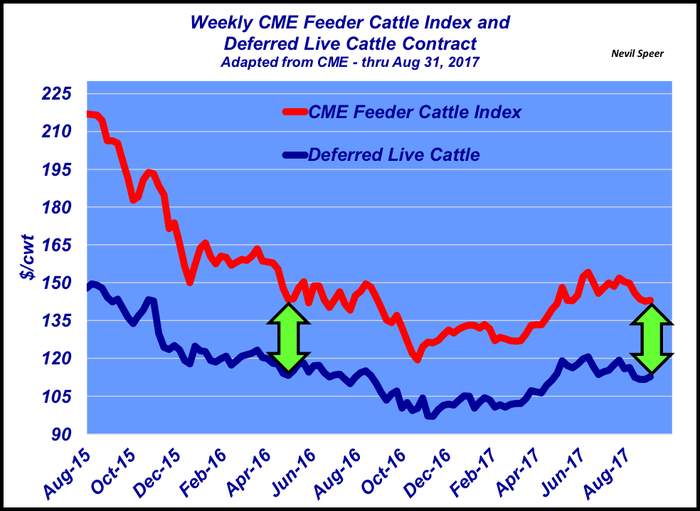

The fall run always generates producer attention on the market outlook. Questions inherently arise about options around marketing this year’s calf crop. Generally, the best rule of thumb answer, at least as a starting point, comes from looking at the trends in the relationship between deferred fed cattle futures and the feeder cattle index.

That’s an approach that Industry At A Glance has previously addressed. While feeder cattle marketing can prove to be complex, the ongoing trend in the fed-feeder relationship provides, at a minimum, a pricing benchmark to work from.

Accordingly, this week’s graph illustrates the price spread between feeder cattle and the deferred fed market. The graph reveals the narrowing spread and decreased risk appetite among cattle feeders as the fed market was declining in 2015. The spread narrowed sharply as feedyards began to take on the brunt of negative closeouts.

Thus far in 2017, the difference between feeder cattle and deferred fed has been hovering in the low $30 range. In other words, the feeder cattle index has generally been about $30 above the deferred fed price at any given time in recent months. That’s been a fairly consistent trend during the past 12 to18 months.

As such, that $30 difference between deferred fed futures and the CME feeder cattle index provides sellers a starting point for pricing feeder cattle. Adjustments for weight, sex, region and management would have to be made accordingly from there.

What’s your general outlook for prices going into this fall? Are you concerned about the fed market’s general direction? Do you think further losses in the feeding sector will weaken the relationship outlined above? If so, do you have plans to defer selling cattle this fall and putting them into a backgrounding program? Leave your thoughts in the comments section below.

Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

About the Author(s)

You May Also Like