This is the phase in the current cattle cycle that is the most challenging. Your most important management tool is your pencil, as selling weaned calves may not keep you in the black.

April 23, 2018

This is shaping up to be a different-looking year, making it important to be ever-alert as to where we are in the current cattle cycle. As this is being written, cattle prices have been reasonably strong this spring due to 19% more beef exports for the year to date, but beef prices may well weaken by fall. The month of March has been brutal to both Live Cattle futures and Feeder Cattle futures.

What’s more, there are a lot of cattle on feed. Drought in wheat country has led to fewer feeders on wheat pasture, so more and lighter feeders were moved to the feedlots. March 1 had 10% more cattle on feed than Feb. 1.

According to the Mid-March Drought Monitor, 28% of the U.S. cow herd is under some drought conditions. Ranchers are advised to watch the U.S. Drought Monitor closely this summer. A national drought in this phase of the cattle cycle is the most serious and affects all cattle producers — even those not in drought areas.

Earlier this spring, grass cattle were in high demand, leading to stronger feeder cattle prices compared to a year ago. Nebraska feeder cattle auction prices in mid-March were above feeder cattle prices in mid-February. I am projecting that feeder prices may come under some pressure this fall, pressuring 2018 cattle-off-grass prices.

The net result is that I am projecting an $80 lower gross margin for grass cattle in 2018 (i.e., per head value off grass minus per head value on grass). I am still projecting a positive net return to grass cattle in 2018 — just not as high as it was in 2017.

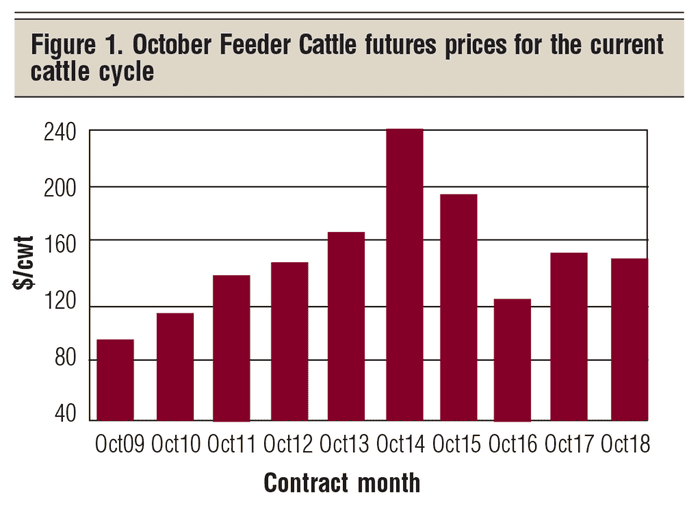

Fall 2018 calf prices are currently projected to hang in there just a little under fall 2017 prices, but above 2016 prices (Figure 1). All indications are that we still have two more years of the current cattle cycle through 2019.

Increasing feedlot cost of gain

Cost of feedlot gain is always a factor in determining feeder cattle prices. Corn prices appear to be on the upswing. Low profits for corn farmers are the driving factor in the rise in corn prices, leading to projected increased costs of gain in the feedlots. I am projecting a 5-cent increase in cost of gain for finishing 2018 calves over finishing 2017 calves.

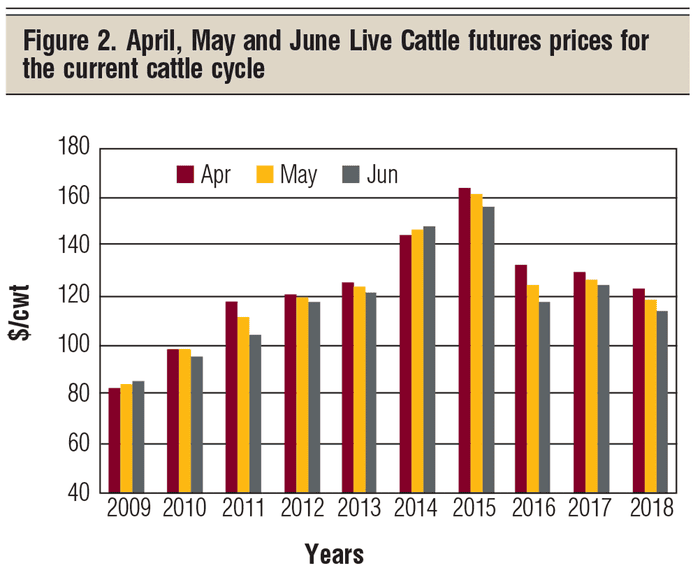

I find it useful to compare Live Cattle futures prices annually for a given month rather than month by month. For example, Figure 2 compares April, May and June over the current cattle cycle. Clearly, the cycle trend is for April Live Cattle prices to exceed May prices, with May prices exceeding June prices.

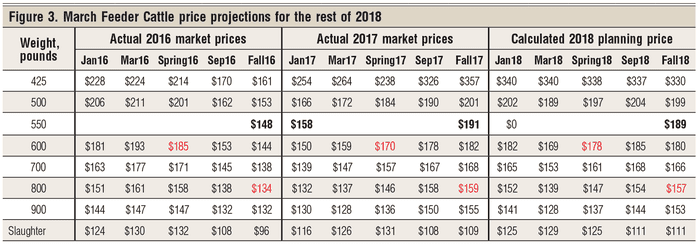

I am also currently expecting three monthly prices in 2019 to be a little lower than those same three monthly prices this year. My current monthly planning prices are presented in Figure 3. Red numbers are for grass cattle.

Eight-hundred-pound steers off grass in September are projected at $157 per cwt. Finished backgrounded calves in June are at $116, and May finished cattle are at $120 per cwt. This year’s grass cattle are projected on grass at $178 per cwt and off grass at $157 per cwt, ending with a -$21 buy/sell margin.

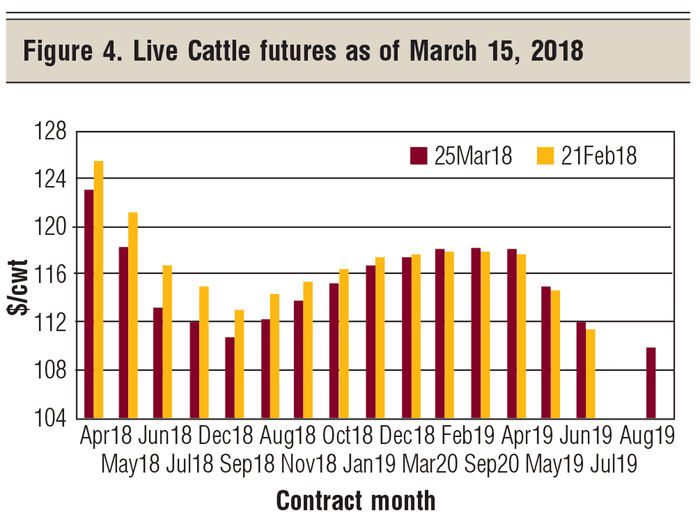

Figure 4 takes a peek at Live Cattle futures prices through 2018 into 2019 — the last year in the current cattle cycle. This chart does a reasonable job of illustrating the seasonal pattern for Live Cattle prices.

Springtime tends to see the annual high Live Cattle prices, while summer tends to see the seasonal lows. Comparing April, May and June 2018 Live Cattle futures with April, May and June 2019 contracts provides some insight into what might be coming down the road as we finish the current cattle cycle.

Figure 5 presents my current projections for marketing 2018 spring-born calves for my debt-free eastern Wyoming-western Nebraska study herd. My current projections suggest that selling at weaning should still be above breakeven — down only $39 per cow from 2017.

I am quite concerned, however, about being able to maintain this favorable marketing projection for 2018 weaned calves. More timely projections for marketing 2018 calves will be forthcoming later in the season.

Historically, my price projections for selling at weaning go down as I progress through the summer season. As projected weaning profits go down, some of that missed marketing opportunity transfers to postweaning marketing alternatives. My cattle cycle studies suggest that postweaning marketing alternatives typically become more appealing in the last years of the cattle cycle.

In summary, this is the phase in the current cattle cycle that is the most challenging. Your most important management tool is your pencil, as selling weaned calves may not keep you in the black.

Not all postweaning programs, however, will add to the bottom line. Use your pencil to select which postweaning program will add to your bottom line, and focus on that marketing alternative.

Hughes is a North Dakota State University professor emeritus. He lives in Kuna, Idaho. Reach him at 701-238-9607 or [email protected].

About the Author(s)

You May Also Like