Cattle market signals indicate full ahead, at least for now

2017 started off on the right foot if you’re a cattle feeder or cow-calf operator. The market’s advancement is important in retrospect, but what might happen going forward is always the overarching concern.

February 9, 2017

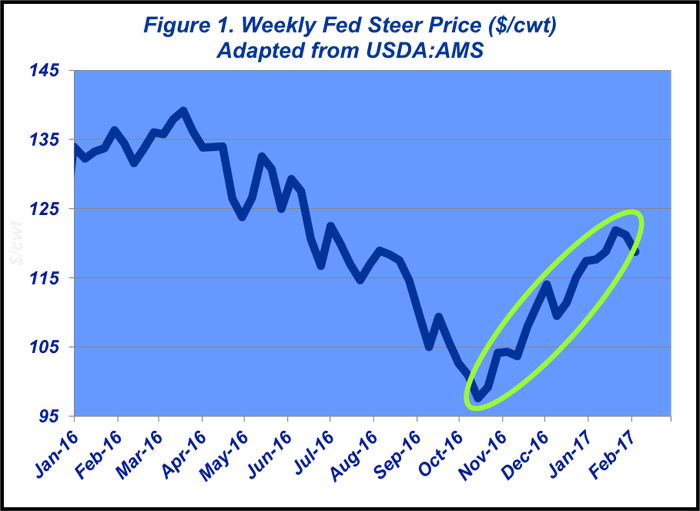

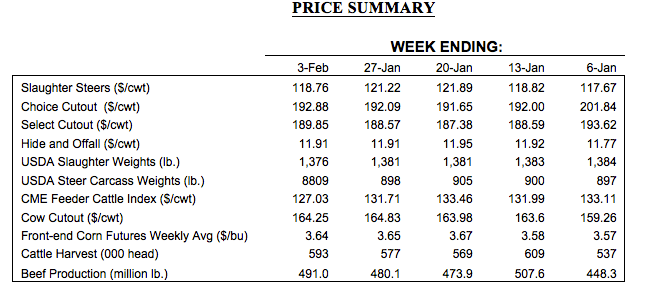

The New Year started off on a favorable note. January’s market traded mostly in positive territory, making it the third consecutive month of better prices. The fed market managed to stretch all the way to $122 per cwt in the middle of the month – almost $25 better versus the mid-October, sub-$98 low (Figure 1).

In the 16 weeks since that low, the market has scored 12 weeks to the upside and had to endure only four weeks to the downside. And while the month closed on a somewhat softer tone, January averaged $6 per cwt better than December. That follows December beating November and November besting October by $7 and $6, respectively. All in all, the monthly market average now stands nearly $20 ahead of last fall’s lows.

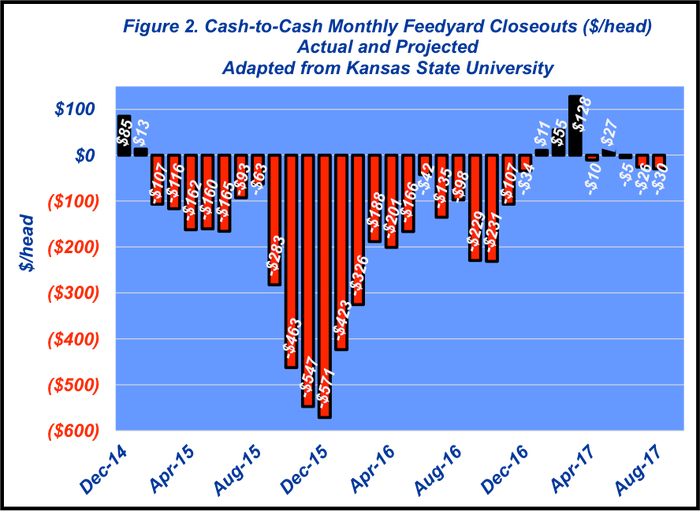

That’s been especially good news for cattle feeders who are finally (FINALLY) beginning to see some positive closeouts. Monthly feedlot net returns, calculated by Kansas State University, reflect opportunity for cash-to-cash cattle to produce some black ink: January, February, March and May are forecast to generate positive returns (Figure 2).

The market’s advancement is important in retrospect, but what might happen going forward is always the overarching concern. At press time, the April and June live cattle contracts were trading at $116 and $106, respectively.

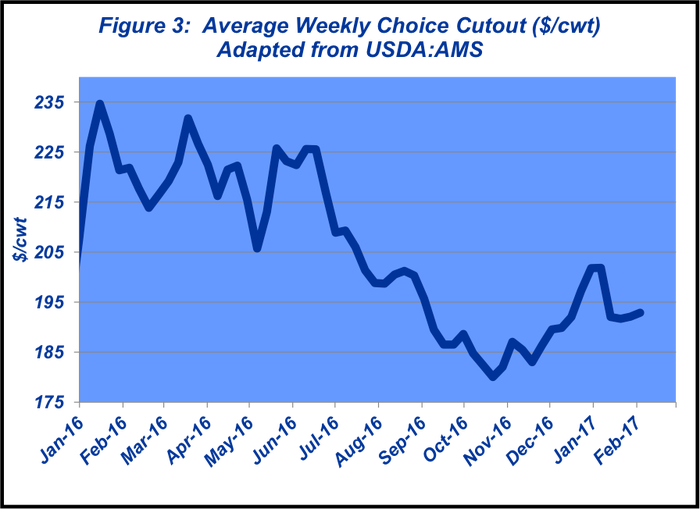

First, higher cattle prices, coupled with a disappointing wholesale market, have cut into packer margins during the past several months. The Choice cutout finished January at $193 for a weekly average – that’s just $13 better than the October low (Figure 3). As a result, processor returns have been negatively squeezed along the way and will likely factor into weekly negotiations as we transition into spring.

Second, as highlighted in this week’s Industry At A Glance, the non-commercial (speculator) position has been solidly building on the long side of the trade at the CME during the past several months. The segment has added nearly 83,000 contracts to their net long position between October and January. If speculators decide, for any number of reasons, to unwind those positions, live cattle futures will be pressured. That’s a big if, but that reality underscores the importance of making some sales now amidst the recent market rally.

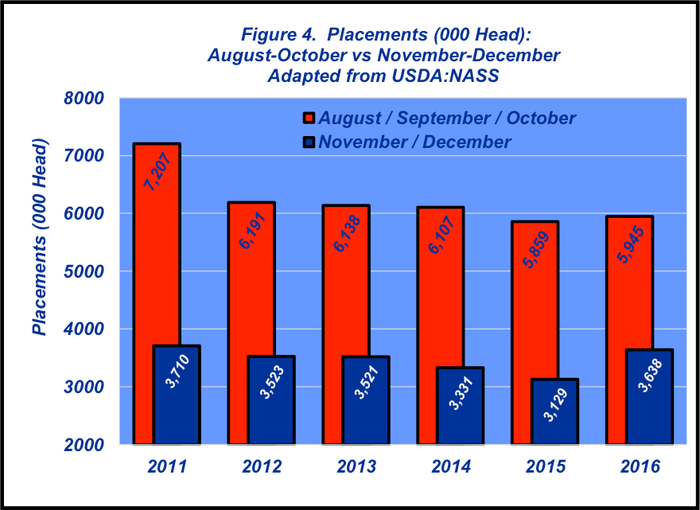

And third, USDA’s January Cattle on Feed report could prove to be a significant indicator of coming pressure for the market in late spring-early summer. In early January, Industry At A Glance highlighted some of the implications around the 2016 fall run. Most notably, “…pre-report expectations for November placements were clearly biased towards compensation – that is, November would see more feedyard purchasing activity because of the relative slowness in September and October. Those expectations proved accurate. The report indicated 1.843 million head were placed in November – up 241,000 head or 15% versus last year.”

December placements fell right in line with November. Cattle feeders placed 1.795 million head in December – that exceeds last year’s mark by 268,000 head. In combination, November and December placements account for an additional 509,000 head (16%) compared to 2016 (Figure 4). That’s a big slug to plow through on the other side as the market evolves into May and June.

To that end, most readers by now have likely absorbed news of USDA’s cattle inventory numbers. That is, cow-calf operators added another million head of beef cows in 2016. The current inventory of 31.2 million cows exceeds the 2014 low by 2.12 million head.

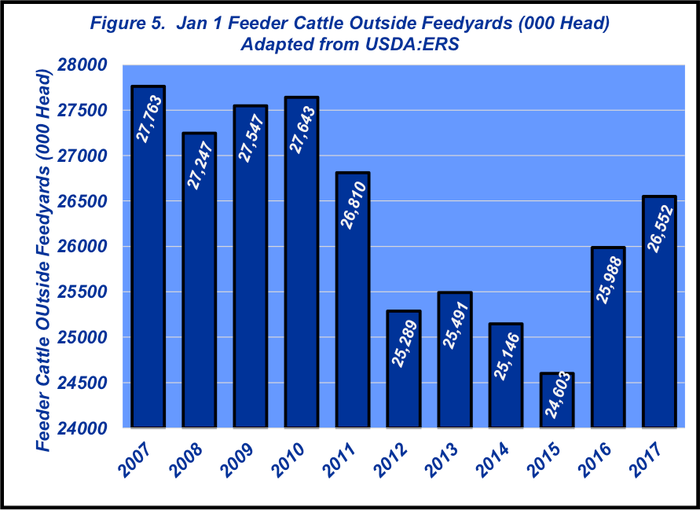

However, more important to the immediate market is the implied feeder cattle supply. The inventory of feeder cattle outside feedyards stands at 26.55 million head, versus 25.99 million head last year – and nearly 2 million head bigger than 2015’s low of 24.6 million head (Figure 5).

Clearly, the past several weeks have also been important with respect to discussion around trade. For specific perspective regarding NAFTA exports, see “Beef Trade with Mexico and Canada. Summary data for the entirety of 2016 just became available from USDA. Despite a stronger dollar, last year’s beef export value of $6.195 billion topped 2015 by $53.4 million.

That’s roughly equivalent to a $23.75 per cwt market premium for every steer and heifer marketed in the U.S. As a side note, total export dollars exceeded 2015. However, the market premium is slightly lower because of a large number of cattle marketed in 2016 versus 2015 – see Figure 6. Export gains are a highly favorable signal about the availability, quality and consistency of U.S. beef from the international market – and clearly significant to overall beef industry revenue.

With any new administration, there’s always lots of uncertainty around policy going forward. That’ll take time to sort out. And as noted last month, traders will be watching carefully and likely prove reactive, given the recent run, to any negative news. That becomes even more important in light of bigger supply. Markets hate uncertainty and surprises. As such, they’ll be more prone to downside adjustment versus upside potential.

With that said, it’s worthy of repeating every month—every producer should ensure they have access to objective information. That information should be filtered with careful analysis thereby increasing the likelihood of making good business decisions going forward.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)