While higher cattle markets are favorable, they underscore the ever-mounting need for the working capital required to maintain daily business operations.

January 2, 2014

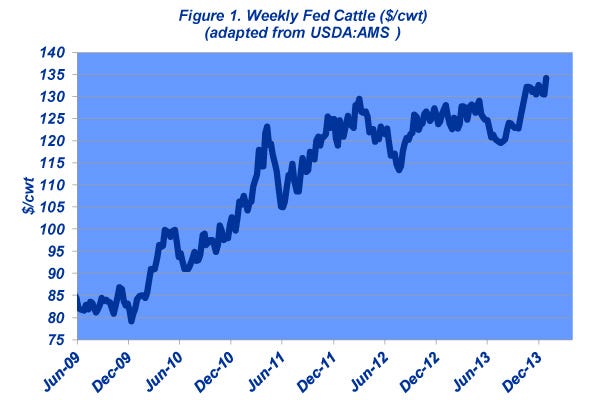

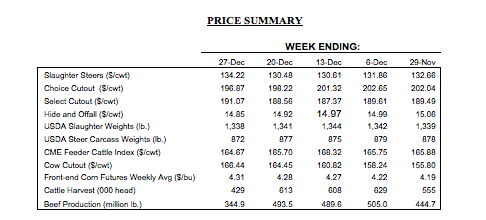

By the time most readers see this, they’ll be well aware of how the cattle market started 2014 on a very positive note. Fed cattle trade surged $4 higher in December’s final week of business, and cattle garnered a new all-time high, with the 5-Area Weekly Weighted Average jumping to $134+ (Figure 1). Better yet, the fed steer and heifer trade crossed $135 in the north.

Meanwhile, CME’s February and April futures contracts were retesting highs set in fall 2013. As such, it appears the cattle business is positioning for another leg up as we head into 2014.

Now consider that a fed steer, at these levels, is worth roughly $1,800, while feeder cattle are fetching upwards of $1,250-$1,300/head. While higher markets are favorable, they also underscore the ever-mounting need for the working capital that is required to maintain daily business operations. And unfortunately, margins on those investments are failing to keep pace (more on that later in light of some broader discussion about the business).

Because there’s been lots of coverage in recent weeks, most readers have likely come across some type of assessment of the beef industry’s response to BSE exactly a decade ago. Appropriately so, the discovery of BSE in the U.S. was a game changer.

Most importantly, it dramatically altered the foundation of international trade. BSE also resulted in several key regulatory revisions that have subsequently influenced the business in an important manner. Because of all that, the beef complex now works within a very different framework compared to 2003.

But there’s more. For outsiders, the temptation is to look back upon that event and draw the conclusion that all changes within the industry stem from Dec. 23, 2003. Unfortunately, the world isn’t that simple.

Along the way, the industry has had to endure some other confounding influences during the past 10 years. For example, consider the effects of ethanol, drought, working capital and the financial crisis. They’ve all converged to cause significant shifts for the beef industry.

The first three – BSE, ethanol and drought – are, in general, one-off events to which response has been fairly straightforward and predictable. The next item – working capital coupled with ever-shrinking margins – is becoming increasingly significant within the production sector and plays upon its very structure. Lastly, and most critical, comes the impact of the financial crisis, which plays on the beef industry in a number of ways.

With that said, the consequences surrounding capital and the financial crisis are inextricably linked. Moreover, the future is largely unknown and unpredictable, yet will dramatically influence decision making. That becomes especially true given the Federal Reserve’s December announcement that it intends to begin “tapering” in 2014. The announcement thus means turning the ship of monetary policy (from an unknown course to which we’ve become accustomed into some other unknown course).

What is known, though, is that the decision will force interest rates to begin creeping higher, thereby making the expanding base of working capital even more expensive. With that in mind, there are also considerations of consumer credit, confidence, and spending; and that all spills into factors of the economy’s ability to absorb the shift. Finally, there’s the prompting upon fiscal policy and government debt service obligations (which inherently ties back into consumers).

Subscribe now to Cow-Calf Weekly to get the latest industry research and information in your inbox every Friday!

So, as we embark on 2014, there are some very new dynamics at work. Given the uncertainty that existed following BSE, perhaps now is a good time to go back and review some core principles I shared 10 years ago. All of these are based on observations provided by BEEF columnist Harlan Hughes regarding producer attitudes and adjustments following BSE in Canada. Most notably, he pointed out there was seemingly a sharp contrast in how producers were responding to the situation, which was especially challenging for Canadian producers as their market was predominantly one of export.

• On one side were individuals who realistically recognized their inability to manipulate external influences. They subsequently increased focus upon various factors within their control, namely reducing unit cost of production and improved value-focused marketing strategies – both important steps towards risk management.

• The second group fretted about factors outside their control, impatiently waiting on the market to recover and continually emphasized desire to have everything back to “the way it was before.”

Clearly, the first group was inherently more empowered and felt more hopeful about the future.

Given all the uncertainty out there, those lessons learned from BSE provide a useful guide going forward. Namely, such a strategic attitude is hugely important toward ensuring success over the long run. With that, this column ends, as it does every month, with one key reminder – stay fully informed and remain objective around all aspects of the business! Happy New Year. May the year 2014 surround you with success!

You might also like:

Calving Checklist: Everything You Need To Know & Have Before Calving

5 Simple Steps To Up Your Cow Herd��’s Profitability

Breathtaking Photos Of Winter On The Ranch

10 Best Christmas On The Ranch Photos

Calving Tips For Diagnosing And Treating Coccidiosis In Calves

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)