Canada doesn’t believe the MCOOL rule changes proposed by USDA on March 8 address World Trade Organization concerns, and contends the proposed food labeling changes actually increase U.S. discrimination against Canadian cattle and hogs.

March 13, 2013

The reaction of Canada’s government to USDA’s proposed “fix” for mandatory country-of-origin labeling (MCOOL) was predictable and swift. Canadian Agriculture Minister Gerry Ritz stated, among other things, Canada was “extremely disappointed with the proposed regulatory changes” and would consider all options, including retaliatory measures, should the U.S. not meet the May 23, 2013, deadline set by the World Trade Organization (WTO) for U.S. compliance.

Canada doesn’t believe the rule changes proposed March 8 accomplish that and pointed out that it believes the changes, in fact, increase the discrimination against Canadian cattle and hogs.

Regardless of your opinion of the value or need for origin labeling, the goal here must be to avoid retaliatory tariffs on U.S. products.

Should the U.S. actions be deemed insufficient, Canada and Mexico will have great latitude in picking the retaliation targets and U.S. beef and pork are logical choices since those products:

Directly involved in the dispute,

Represent large values for U.S. producers and

Are represented by two pretty effective lobbies in Washington.

There would be little point in picking on someone who can’t be of help in the policy battles, so we think Canada will choose their targets carefully.

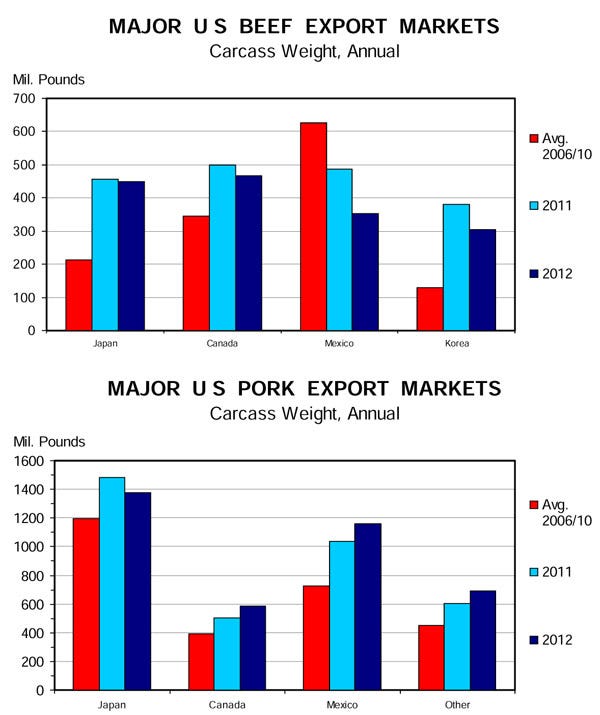

And plenty is at stake here! Canada was the largest market for U.S. beef exports last year, taking 467.2 million lbs. of carcass weight product. That total represented 19% of all U.S. beef exports, and just edged out the 449.6 million lbs. (18.3% of the total) sent to Japan. Mexico was our third-largest beef market at 351.8 million lbs. carcass weight (14.3% of the total), but that number is less than half of the total beef we sent southward in 2008 and was down 28% from 2011 largely due to higher U.S. beef prices.

Canada was also our largest beef export market in terms of value last year, taking product worth $1.148 billion, which accounted for 21.2% of the total value of U.S. beef exports. Mexico continues to be our largest customer for beef variety meats, purchasing 80,477 mt, worth $209 million in 2012. Mexico’s beef variety meat purchase shares are 25% for quantity and 29.8% for value.

Meanwhile, Japan is still the largest market for U.S. pork muscle cut exports, but Mexico is now a close second and Canada ranks fourth, just behind China/Hong Kong.

Any way you cut it, Canada and Mexico are critical for U.S. beef and pork shipments and, in spite of (or perhaps because of) USDA’s proposed rule change, are in grave danger. An important final point is that reconciling this situation will take awhile; even if the U.S. rules are found insufficient by the WTO, it will be at least several months before any tariffs are imposed.

In fact, it may well be 2014 before U.S. exporters must deal with them. The specter of tariffs may dampen some business relationships in the short run, but actual price increases – and resulting quantity decreases – for U.S. product in these markets are still down the road a ways. Much can happen in the meantime. Let’s hope it does!

You might also like:

Export Interest In U.S. Breeding Cattle Has Skyrocketed

Ram Truck Super Bowl Ad Shares The Heart Of Ag

You May Also Like