Progressive commercial producers are likely to continue investing in top genetics that fit their specific needs, carving a wider gap of opportunity through the downturn.Read more from Seedstock 100 owners:Improving efficiency is lynchpin to successThink you are just buying bulls? Think again...Seedstock consolidation set to continueBalance tops bull buyers' list

December 28, 2015

Like the commercial cow-calf producers they serve, seedstock producers were rewarded with historically high prices, on average, in 2015.

That’s especially true of those operations with lots of years of commercial focus to their credit.

You don’t stick around long if your product or service routinely fails customers. And, it’s hard to sell 200 bulls or more each year without plenty of repeat customers.

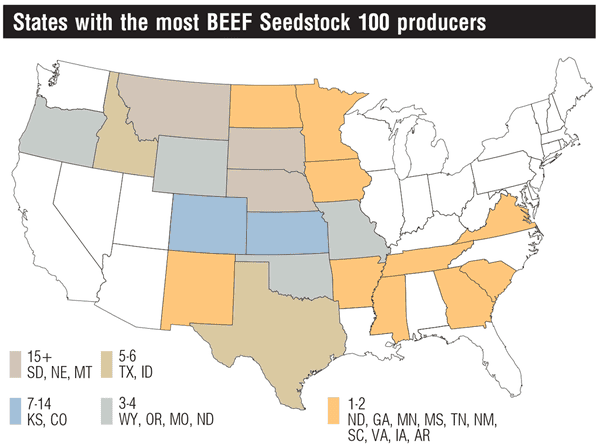

That’s the minimum of bulls marketed last year by those on the BEEF Seedstock 100. They come from 25 states. Their offering of 52,161 bulls represents at least 34 breeds and breed composites.

BEEF Seedstock 100 List

Looking for a new seedstock provider? Use our UPDATED Seedstock 100 listing to find the largest bull sellers in the U.S. Browse the list here.

Keep in mind that the relative influence of those on the list, individually and collectively, belies the fact that the seedstock business remains far from concentrated.

The 25 states represented by BEEF’s Seedstock 100 in 2015 accounted for 82.6% of all beef cows that calved in 2014, according to the Jan. 1 2015 Cattle report from USDA’s National Agricultural Statistics Service.

A little quick cowboy math* suggests the 52,166 bulls represented by Seedstock 100 producers in those 25 states accounted for 14.5% of the annual bull need.

Even the most optimistic logic suggests bull prices must wane with the cyclical erosion to calf and feeder cattle prices. At the same time, progressive commercial producers are likely to continue investing in top genetics that fit their specific needs, carving a wider gap of opportunity through the downturn.

Even the most optimistic logic suggests bull prices must wane with the cyclical erosion to calf and feeder cattle prices. At the same time, progressive commercial producers are likely to continue investing in top genetics that fit their specific needs, carving a wider gap of opportunity through the downturn.

Common threads gleaned from BEEF Seedstock 100 producers

Increased focus on efficiency

“From a profit standpoint, I feel like the industry’s real opportunity is to make cattle more feed efficient,” says Marty Schurr of Schurrtop Angus and Charolais Ranch at Farnam and Maywood, Neb. “If you can run more cows on the same number of acres without sacrificing performance, why wouldn’t you?”

More customer use of AI for heifers

“Less than 20% of our customers utilize AI, but 100% of those who do, utilize it for breeding heifers,” says Bob Prosser of Bar T Bar Ranch, headquartered near Winslow, Ariz. “The cost of semen and synchronization have remained fairly stable and there are plenty of people providing the service. For breeding heifers, AI continues to offer the best bang for the buck.”

Growing focus on the total system

“The biggest thing we’re seeing in the cattle business is that it used to be all about the weight at weaning and then you put them on the truck and let someone else try to make something out of them if there was something to be made,” says Mike Adams of Adams Land and Cattle at Ft. Pierce, Fla. “One thing we’re trying to do is close the loop a little bit, exploring offering a branded beef product. You trade on a cash basis, and it’s getting narrower every day. I don’t know how you value cattle unless you back into it from the retail side.”

“High quality food will be the standard rather than the exception and knowing where our food comes from—a great eating experience with a story behind it. I think that’s where the real challenge and opportunity is for us,” says John Raftopoulos of Diamond Peak Cattle Co. at Craig, Colo.

Pushing for more selection accuracy

As genomic tools are used more frequently—as part of proprietary genetic profiles and tests and to increase the accuracy of Expected Progeny Differences, especially for young cattle—Larry Mehlhoff of 5L Red Angus at Sheridan, Mont., explains, “There’s a great need to validate genetics with phenotypic data as prediction tools are used more and more.”

For that matter, some seedstock producers believe there is a need to revisit the accuracy of some of the most basic selection tools.

“Most (breed) carcass data is based off of breeding stock grown on a low-energy ration to a year of age,” says Jerry Wulf of Wulf Cattle at Morris, Minn. “In the real world, we feed cattle on a high-energy ration until they’re 18 months old or so.

“…As an industry, I believe we need to look at some different traits or look at some of the current traits differently.”

Genetic worth is growing in value

“We’re finally to the point where added value from genetic merit is more than perception,” says Donnell Brown of R.A. Brown Ranch at Throckmorton, Texas. “I think we’ll see more feeder cattle buyers bid for cattle based on genetic merit. In this age of value-based marketing, their cattle may be worth significantly more if we can help our customers communicate the genetic merit and healthfulness of their cattle.”

BEEF Seedstock 100 List

Looking for a new seedstock provider? Use our UPDATED Seedstock 100 listing to find the largest bull sellers in the U.S. Browse the list here.

“We don’t need to sell more bulls for more money, we just need to help our customers get a premium for their heifers,” says Tim Ohlde of Ohlde Cattle Co. at Palmer, Kan. “You can raise the best steer that walks and you might get a dime per pound premium. You raise the best heifers that walk and you can get $1 per pound premium. Rather than having one to five bidders for the steers, you can have a hundred for the heifers.”

Growing value of reliability

“When things get tough, we all tend to want to deal with people we’ve dealt with before, someone we know puts out a solid product,” says Dave Nichols of Nichols Farms at Bridgewater, Iowa. “I know that’s how I am. I want to buy from someone where I know there won’t be any surprises.”

*Assumptions: 24.51 million beef cows (Jan. 1) in the 25 states represented by the Seedstock 100, minus 5% bred via artificial insemination=23.29 million cows for natural breeding. Assume a third were bred to yearling bulls (17 cows per bull) and the remainder to mature bulls (25 cows per bull). That’s 1.08 million bulls. If the average bull’s production life is three years, then annual need is 359,174 bulls. The 52,166 bulls represented by Seedstock 100 producers in those states accounts for 14.5% of that need.

You might also like:

7 ranching operations who lead in stewardship, sustainability

Why we need to let Mother Nature select replacement heifers

Photo Gallery: Laugh with Rubes cow cartoons

Beta agonists wrongly blamed for fatigued cattle syndrome

Lessons from the 2015 cattle market wreck

About the Author(s)

You May Also Like