2018 review of beef price cycle and profit

You need to analyze your entire year to really understand the big picture when it comes to the cattle cycle and beef price cycle.

February 20, 2019

We now have 2018 behind us, completing the fourth year of the downward side of the current beef price cycle. I have decided to view these last four years, 2015-18, in some detail in hope of motivating my readers to continue thinking “cattle cycle” and its related “beef price cycle.”

How we ended the year

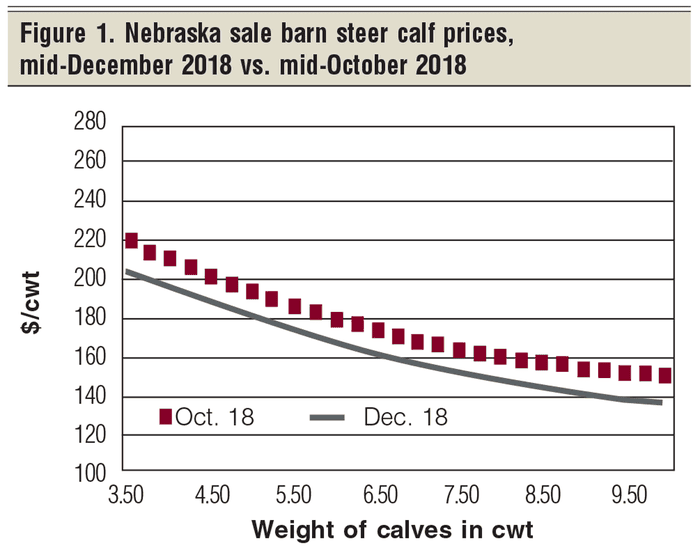

Figure 1 presents my mid-December 2018 sale barn price chart for alternative weights of feeder steers. The dotted maroon line represents the Nebraska sale barn average prices for mid-October 2018. The black line represents Nebraska’s average sale barn prices for mid-December 2018.

It turns out that October 2018 sale barn prices were a little higher, overall, than December prices. November prices, not on the graph, were in the middle of these two. This indicates that overall, sale barn prices were highest in October 2018 and lowest in December 2018. My study herd manager received $181 per cwt for his 2018 steer calves versus $186 per cwt for his 2017 steer calves.

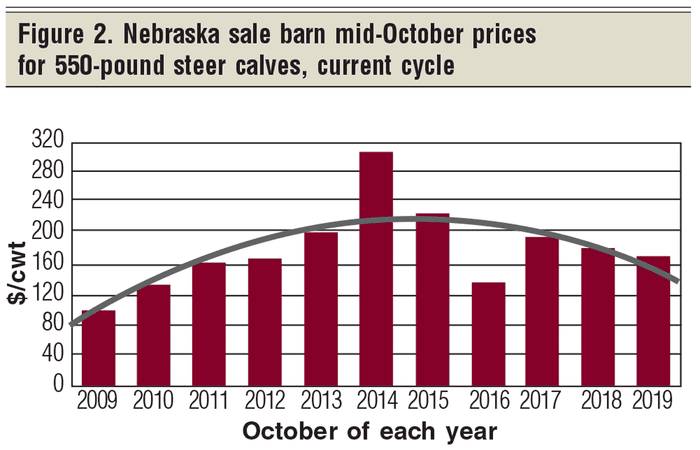

Figure 2 summarizes Nebraska sale barn prices for 550-pound steer calves for the current beef price cycle (2009-19). The curved trend line illustrates that steer calf prices trended upward for the first five years, peaking in 2014, and then they trended downward the next five years. Note the 2019 price is my projected fall 2019 price. Year 2020 is currently projected to finish this price cycle, and year 2021 is projected to start the new cycle.

Description of the study herd

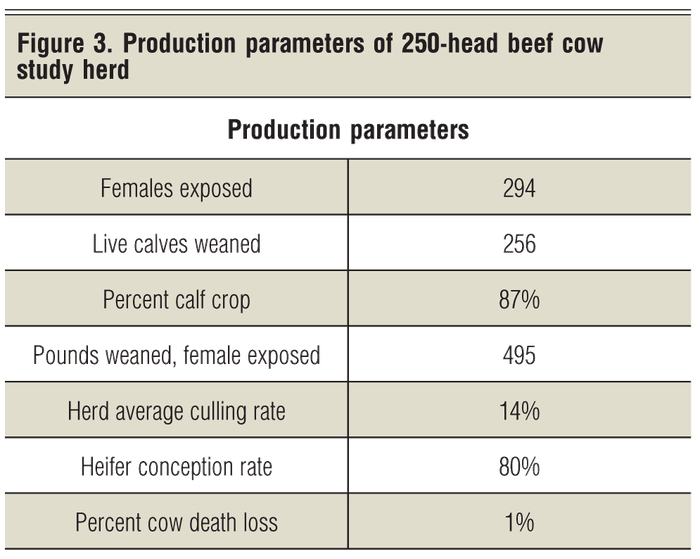

My study rancher is a typical eastern Wyoming-western Nebraska rancher who farms and runs a 250-head beef cow herd. He typically sells his calves at weaning. Figure 3 summarizes some selected 2018 production parameters for the study herd.

In 2018, as in most years, the calf crop was sold at October weaning. Only in 2016 did this study rancher not sell at weaning. Calf prices at weaning time in 2016 were so low that he held off selling his calves and preconditioned them for 90 days or so, and sold them shortly after the first of the year. This turned out to be a favorable move on his part.

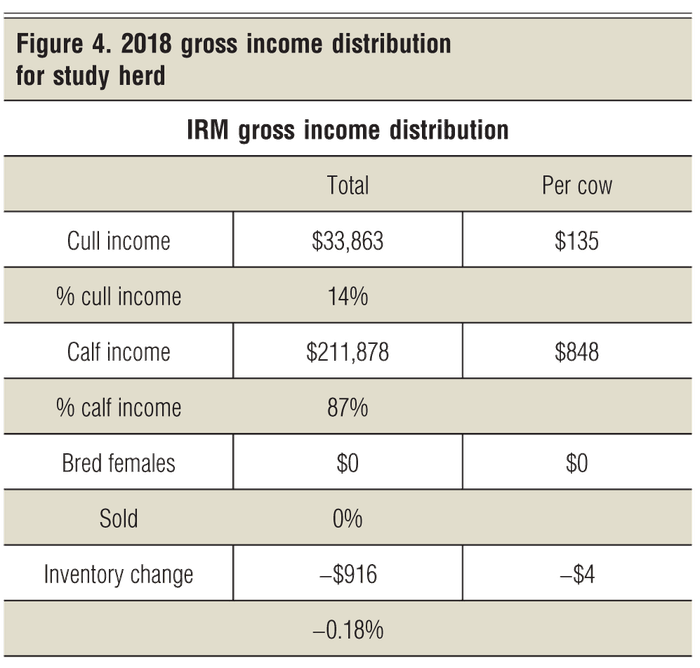

Figure 4 summarizes the ranchers beef cow income for his 2018 calf crop that was marketed in October 2018 at weaning time. The second column in Figure 4 is on a per-cow basis for his 250-head cow herd. For accounting purposes, he does not change the inventory dollar value of his cow herd during any given year.

Cull income includes cull cows; cull bulls; and culled, open replacement heifers. This year’s below-average cull income was due to the low prices of cull cows and cull bulls. In some years, cull price is up as in 2015. Cull price is down some years, such as 2018.

Replacement heifers are valued in the year-end beef herd inventory. The bottom-line inventory change in Figure 4 is due to the 2018 market value of the heifer calves held back as replacements in 2018, compared to the market value of the 2017 replacement heifers held back.

The value of replacement heifers held back does change from year to year due to the year-to-year market price change for replacement-type heifers. Yes, you need a year-end inventory — both a count and a dollar value.

Cost of raised replacement heifers

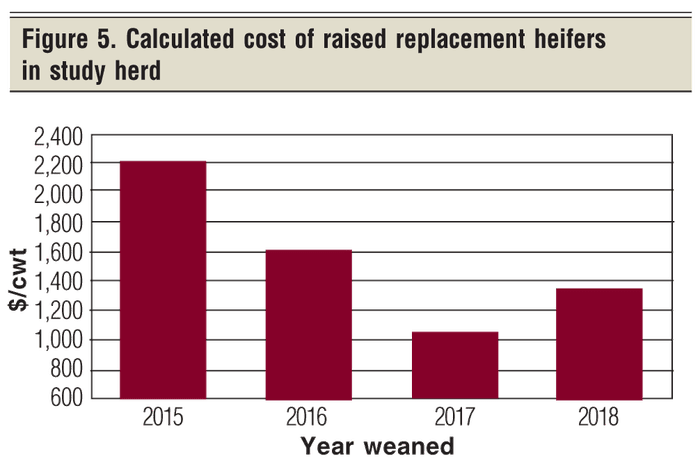

One cost that often is not documented by many ranchers is the full cost of raising replacement heifers. The costs calculated for my study herd are presented in Figure 5.

There are two main costs associated with raising replacement heifers. First is the opportunity cost of not selling replacement-quality heifers at weaning time. Second is the cost of developing replacement heifer calves into preg-checked females. Once a replacement heifer is checked pregnant, she is transferred into the regular breeding herd at her full cost of production.

The accumulated sum of the cost of all replacement heifers transferred into the beef cow herd, and remaining in that herd, becomes the capital invested in the beef cow herd. Bull investment costs are also added in.

Heifer calf prices peaked in 2014, as did steer calf prices. This study rancher held back his regular numbers of 44 high-priced, replacement-quality heifers in 2014 to be developed and placed into his 2015 fall breeding herd as bred heifers. His business plan is to calve these replacement heifers for the next seven years through year 2022 — provided they are not culled earlier for some reason.

The fact is that these high-cost 2015 preg-checked replacement heifers, and the relatively high cost 2016 preg-checked replacement heifers, are all calving during the price-decreasing years of the current beef price cycle — AND also calving in the lower-priced years of the next beef price cycle.

They are projected to be sold as cull cows during the lower phase of the cull cow price cycle. I fully expect these 2014 and 2015 replacement heifers will end up being low lifetime net income generators. The rancher’s business goal, however, is to run high lifetime net income generators.

Food for thought

The value of a beef cow to any rancher is the sum of the net incomes generated from all the calves she produces while in his herd, plus her cull cow income.

A heifer calf born in 2006 and developed in 2007 had her first calf in 2008; she then had six more calves, including a 2014 calf. She was culled in 2014 and was probably the most valuable female owned in the current beef price cycle. Cull income is a big contributor to the lifetime value of a beef cow.

Some preliminary detailed simulation work I am doing suggests that when cow age performance is included is the analysis, a heifer producing her first calf in 2009 and culled in 2015 (with the second-highest cull prices of the beef price cycle) earned the highest net income of my study beef cow herd over the current beef price cycle.

Maybe a constant number of beef cows over a beef price cycle is not the most profitable business plan?

My study rancher raised this question, and he has now requested that I conduct a study of how he should adjust his replacement numbers throughout the next cattle cycle to maximize net income through the next beef price cycle. This study is now underway. Stay tuned.

About the Author(s)

You May Also Like