Hay supplies tight; Record hay prices

The dry summer has taken a toll on hay production in 2022.

The August Crop Production report released recently by USDA-NASS included forecasts for hay production in selected states and the U.S. Total production of alfalfa hay in 2022 is forecast at 49.1 million tons, down 0.3 percent from 2021 levels and 13.6 percent below the ten-year average from 2011-2020. All other hay production for 2022 is forecast at 67.7 million tons, down 4.6 percent year over year and down 7.4 percent from the ten-year average. Total 2022 U.S. hay production is forecast at 116.8 million tons, down 2.9 percent from one year ago and down 10.1 percent from the 2011-2020 average. Alfalfa and other hay prices are forecast at record levels in 2022.

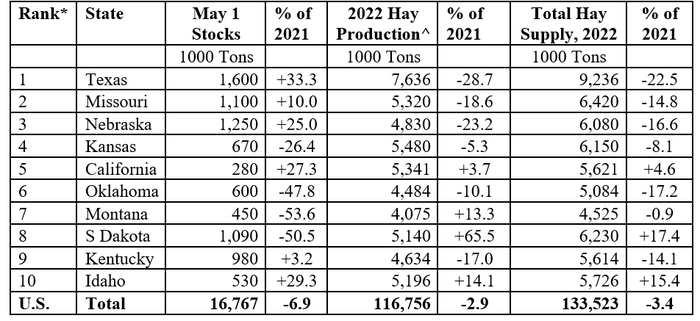

Drought reduced hay production in 2021 with continued impacts in 2022. May 1 hay stocks were down 6.9 percent year over year but were down 16.9 percent from the 2011-2020 average.The total hay supply for the 2022-2023 hay crop year (May-April) is the sum of May 1 (beginning) hay stocks and 2022 hay production. The total hay supply is projected to be down 3.4 percent year over year and is down 11.0 percent from the ten-year average (Table 1).

Table 1. May 1 Hay Stocks, Hay Production and Total Hay Supply,

Top Ten States and U.S., 2022.

^Forecast; USDA-NASS, Crop Production, August 2022

Among six of the top ten hay states, either reduced May 1 stocks or reduced 2022 hay production or both are contributing to significant reductions in hay supplies (Table 1). Low May 1 stocks reflects carryover drought impacts from 2021. Reduced 2022 hay production is the result of drought and/or high input costs including fertilizer and fuel.The effects are cumulative.

For example, in Texas, which had relatively less drought 2021, May 1 stocks were up 33.3 percent year over year but a 28.7 percent decrease in hay production this year results in a 22.5 percent reduction in 2022 hay supply. Nebraska is in a similar situation.In contrast, South Dakota had severe drought in 2021 leading to a 50.5 percent decrease in May 1 2022 stocks.

South Dakota is seeing a 65.5 percent year over year increase in hay production in 2022.However, because of drought last year, total 2022 hay supply is up just 17.4 percent year over year compared to the 32-year low in 2021. Montana, like South Dakota, is also seeing recovery in hay production in 2022 (from drought-reduced production last year), up 13.3 percent year over year.

However, severely reduced carryover from last year means that total Montana hay supplies are down 0.9 percent from last year and are at the lowest level since 1989.Oklahoma had both reduced May 1 stocks and reduced hay production in 2022 leading to a 17.2 percent reduction in 2022 hay supplies and the lowest hay supply since 2012. In Missouri and Kentucky, where drought has not been a factor, reduced 2022 hay production is likely the result of high fertilizer prices and reduced input use.

Eight of the top ten hay states are also top ten beef cow states including Texas, Oklahoma, Missouri, Nebraska, South Dakota, Kansas, Montana and Kentucky. These eight states had 15.7 million beef cows on January 1, 2022. The other two, California and Idaho, are the number one and three dairy cow states, respectively.

With the growing season winding down amid continuing drought, the 2022 hay supply data illustrate why so much herd liquidation has occurred this year. It also speaks to the continuing challenges that cattle producers will face to get through the winter before the 2023 growing season could provide the next opportunity for improved forage conditions.

Source: Derrell Peel, Oklahoma State University, who is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)