Industry At A Glance: Beef Price Spreads – Prime Explodes Over Select

Price spreads are a key factor within the boxed-beef market that drives business decision-making at the production level.

September 22, 2014

Over the past several weeks, we have focused on some of the more important dynamics occurring within the wholesale market over time, with a primary focus upon the volume and revenue trends more affected by the consumer side. This week, we’ll look at the production side, in particular price spreads, which are one of the key factors within the boxed-beef market that drive business decision-making at the production level.

Weekly price differences are important, of course, but the real planning occurs from a longer-run perspective. Investments in genetics and management changes are made only if price signals can be sustained over a long period of time.

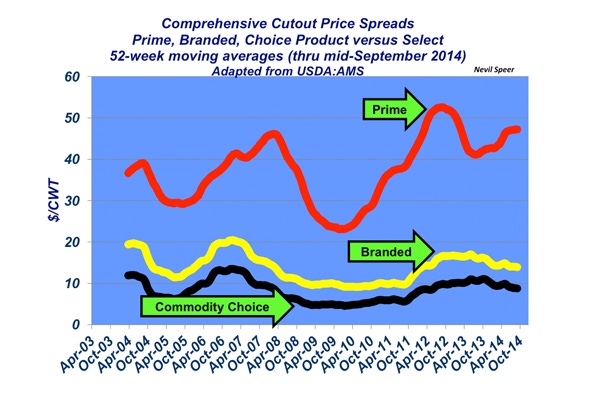

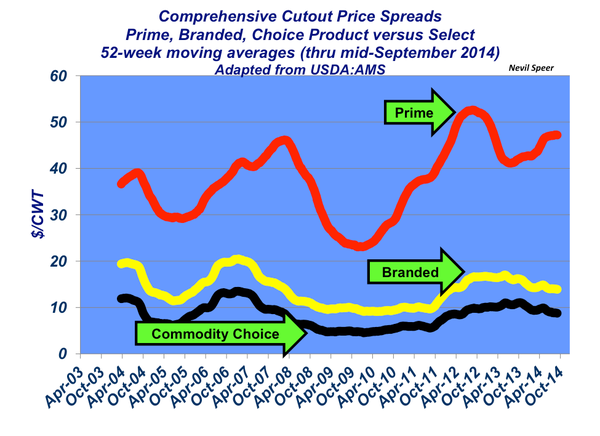

The accompanying chart highlights those long-run price signals detailing price differences (52-week moving average) between Choice, branded and Prime carcasses vs. those in the Select quality grade. Clearly, the most significant price difference is for Prime, which has again surpassed a premium of $50/cwt. over Select. Meanwhile, the branded and commodity Choice deviations continue to run around $15 and $10/cwt., respectively.

At first view, the $15 and $10 figures seem somewhat mundane, as it hasn’t really changed over time. Keep in mind, however, that the beef complex has dramatically ramped up its production of carcasses that fit both categories. In other words, the industry is producing more Choice beef (relative to Select) and continues to be rewarded for its volume improvement. That’s a strong indication of consumer preference for Prime, Choice and branded products over Select.

How do you perceive the quality grade differences evolving over time in the coming years? Will the price spreads get even bigger? And if so, will the industry continue to respond accordingly and produce even more product that fits into these premium markets? Leave your response below.

You might also like:

Photo Tour: World's Largest Vertically Integrated Cattle Operation

Calf And Feeder Prices Widen Gap With Fed Cattle-Beef

55 Beef Cartoons From Leigh Rubin

Obama Administration Takes Aim At Antibiotic Resistance

4 Tips For Extending Fall And Winter Grazing

How To Prevent & Treat Pinkeye In Cattle

9 Things To Consider Before Culling A Cow

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)