The incredible story of beef quality

Ted Schroeder from Kansas State University provides a detailed interpretation and understanding of evolving economic information related to consumer demand for beef.

April 16, 2024

For nearly four decades I have worked with the cattle and beef industry to help interpret and understand evolving economic information related to consumer demand for beef.

By the early 1990s, after the industry had suffered through more consecutive years of declining consumer beef demand than any of us care to remember, cattle producers decided it was time to change course. The industry launched a concerted effort to start to move away from a commodity mind-set where all cattle essentially brought the same price at harvest regardless of quality, to producing cattle capable of producing higher and more consistent quality beef. However, to accomplish this across the industry, the most critical factor was that producers making investments in higher quality beef production needed to be rewarded with price premiums for the added costs incurred. Enter grid pricing and the incredible story of enhanced beef quality began.

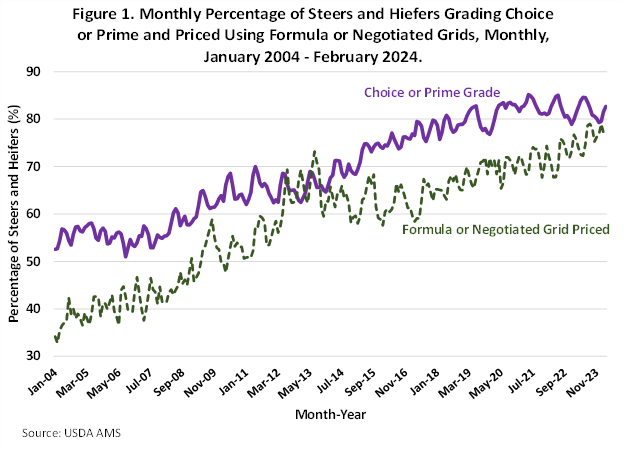

Figure 1 illustrates the story well. In the early 2000s formula trade, most of which uses grids to establish net prices (see USDA summary here) and negotiated grid pricing of fed cattle started to become more prominent. Formula and negotiated grid pricing increased from around 40% of fed steer and heifer marketing in 2004 to 50% by 2009 and it never looked back hovering around 75% in recent years. Not surprisingly, the percentage of cattle grading Choice plus Prime followed the increase in grid pricing as market signals for producing higher quality beef flowed directly to producers. The incredible part of the quality grade increase is the velocity by which producers were able to respond to the higher quality market signals by increasing the percentage of fed cattle grading Choice and higher from 55% in 2004-05 to consistently 80% or greater today (with small seasonal dips below 80% in the fall).

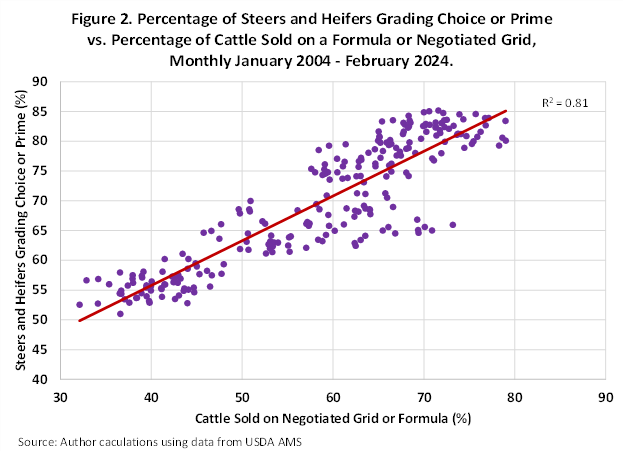

The association between formula and negotiated grid pricing and enhanced beef quality grade is obvious from Figure 1 and shown even clearer in Figure 2 where the percentage of steers and heifers grading Choice and higher are charted against the percentage marketed using formula or negotiated grids. The correlation between percentage of beef grading Choice and higher and grid pricing prevalence is 90%. This is resounding evidence of causality as market premiums offered producers through grid pricing, incentivized enhanced quality beef production.

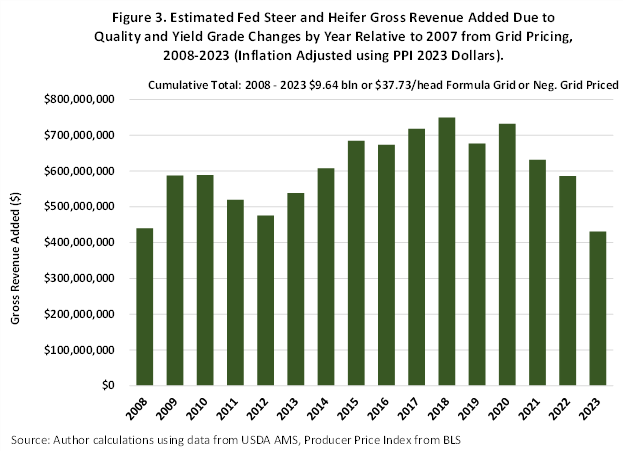

The economic impact of this increase in beef quality is noteworthy. To estimate this economic impact, I estimated the increased gross revenue beef cattle producers have earned from grid price premiums associated with enhanced beef quality over time adjusted for changing yield grades. This is not a trivial task, and it requires some assumptions, but the ballpark estimates are astounding. In short, what I did was using USDA AMS data, I took the percentage of fed steers and heifers that were grid priced (assumed to be conservatively 80% of formula plus negotiated grid sales) times the average carcass weight times head to obtain total dressed pounds produced annually that were grid priced. I then used the percentage breakdowns of steer and heifer quality grades (Prime, Choice, Select, and Standard) and yield grades (YG1 – YG5) each year and their associated premiums or discounts to estimate the added value quality and yield grade changes generated for producers each year. I calculated the enhanced value starting in 2008 going forward since Figure 1 showed the increase in quality grade started to accelerate around 2008 after greater adoption of grid pricing. I compared each year to a base year 2007. Thus, the annual value added I calculated is the gross added revenue producers selling using grids received by year relative to had quality and yield grades stayed constant at 2007 values.

With that calculation briefly described, Figure 3 shows the gross revenue added to beef cattle feeders each year relative to 2007 from just changing the production mix of quality and yield grades over time together with the actual market premiums and discounts received. The differences across years are associated with changing quality and yield grade distributions (quality grade mostly improved with more Choice and up graded beef and yield grades tended to numerically increase modestly as longer days on feed and heavier cattle weights occurred over the years). The estimated total gross revenue added to producers bottom line from 2008-2023 was $9.64 billion or just under $38/head for steers and heifers sold on a grid. This is likely a conservatively low estimate as although it ignores more potential discounts associated with heavy-weight carcasses, it also ignores premiums for special program (branded) specifications well as certified upper Choice grades. Any added costs producers incur to produce and market steers and heifers on a grid are not included and would be needed to convert the gross revenue to a net return impact.

Grid pricing of fed cattle has generated considerable revenue for cattle producers through incentives realized to enhance the quality of beef produced. Premiums for high quality are largely passed down to cow-calf producers by providing incentives for genetic selection capable of producing high quality beef. Furthermore, consumers have benefitted from better quality beef available in the grocery store and in food service. Consumer demand for beef rests heavily on the product offering a consistent high-quality eating experience. Market signals from grid pricing incentivizing production of higher quality beef have been a major win-win.

About the Author(s)

You May Also Like