Higher quality grading beef is more resilient to substitution by other meats as prices increase, according to recent research.

April 27, 2015

Dog-eared reality says that as the price of beef increases, consumers tend to eat less of it. At least in general layman’s terms, though, true beef demand continues to increase at historically high prices.

Both the Choice Retail Beef Demand Index (CRBDI) and the All Fresh Beef Demand Index (AFBDI) increased year over year for the past four consecutive years. From the third quarter of 2010 through the fourth quarter of 2014, the CRBDI was higher year over year in 15 of 18 quarters. The AFBDI was higher year over year in 17 of the 18 quarters. Keep in mind beef demand is lower in all years since the index benchmark year of 1990.

One reason for increasing beef demand, conceptually at least, is that a higher percentage of beef grading Choice or higher has enabled beef demand to grow because of its advantage in cross-price elasticity (a refresher about elasticity in a moment).

“Prime, Certified Angus Beef [CAB] and Choice have a lower cross-price elasticity than Select,” says Jillian Steiner, University of Missouri (MU) graduate student. “With greater production driving down the price of pork and chicken, we can expect a stronger substitution impact on Select than on the higher-quality grades.”

Steiner and Scott Brown, MU agricultural economist, concluded a study in December that was commissioned by CAB and comprised Steiner’s master’s thesis, titled “Should beef quality grade be a priority?” It explores the value of focusing on carcass quality in rebuilding the nation’s beef cow herd. In doing so, the study is one of the few that disaggregates beef demand for various quality grades.

Researchers used 10 years of USDA monthly load data along with CAB data to make empirical estimates of own-price, cross-price and income elasticities for Prime, the CAB brand, Branded/Choice (all of Choice including CAB) and Select beef.

“Looking at beef demand differentiated by quality type suggests beef quality should be a key component of any rebuilding strategy,” according to the study. “However, it is important to remember that quality beef is the result of many factors of production, such as genetics, handling, nutrition, etc.”

Elasticity equals responsiveness

By way of refresher, own-price elasticity refers to how responsive (elastic) the quantity demanded of a particular product or service is to a change in price of the product or service.

According to the MU study, Prime grading beef is the most elastic at -2.33%. As Prime price (cutout value) increases by 1%, consumption is expected to decrease by 2.33%. The own-price elasticity of CAB is -2.26%. The own-price elasticity of Select is -1.24%.

Steiner and Brown point out the reciprocal of own-price elasticity is price flexibility. It describes expected price changes relative to changes in supply. Select is less price-flexible than the higher grades.

“As the supply of Prime beef and CAB increases, the market premium is less likely to decline than when supplies of lower-quality grading beef increases,” the report authors explain. “A 1% increase in the Prime beef supply could bring a 0.43% decline in the price (Prime), but a similar increase in Select beef supply could bring nearly twice as much price decline.”

Income elasticity gauges the responsiveness of demand for a product or service as income increases for those demanding the product or service.

As logic might suggest, the study found strong income elasticity for most beef categories. As incomes increase, consumers tend to demand more higher-quality beef. Income elasticity was highest for CAB at 1.63%. As income increases by 1%, demand for CAB is expected to increase 1.63%.

Paradoxically, as mentioned earlier, Prime, CAB and Choice are less cross-price elastic than Select. Cross-price elasticity measures the response of quantity demanded of one product or service relative to a change in price for another product or service. In simple terms, how does a change in price of Select beef or of pork (beef substitutes) affect the quantity of Choice beef demanded, for instance?

70+ photos showcasing all types of cattle nutrition

Readers share their favorite photos of cattle grazing or steers bellied up to the feedbunk. See reader favorite nutrition photos here.

“Cross-price elasticities were positive across all beef categories, implying substitution among beef quality categories and between beef quality categories and competing meats,” according to the UM study. “However, the degree of substitution differs between quality categories. Lower-quality beef faces the strongest price-pressure from competing meats.”

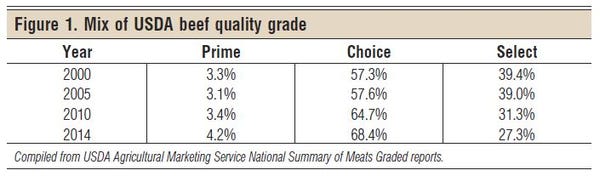

The percentage of federally inspected beef carcasses grading Choice or higher continues to grow. In 2005, 60.7% graded Choice or higher, according to the National Summary of Meats Graded from USDA’s Agricultural Marketing Service. In 2014, 72.6% graded Choice or higher (Figure 1).

So, tossing a loop from the opposite direction (not a stated conclusion in the report), the advantage in cross-price elasticity suggests overall beef demand would have been more challenged if less beef grading Choice and higher had been available as beef prices increased.

None of this is to suggest that more carcasses grading Choice or higher is the sole reason for increasing beef demand. It’s hard to argue against it being part of the reason, though.

'Typical' beef consumer evolves

Also at a conceptual level, Glynn Tonsor, Kansas State University agricultural economist, believes there are a couple of other reasons beef demand remains stronger than many predicted as retail prices increase.

First, Tonsor believes the definition of the typical beef consumer — a person willing and able to buy beef — has evolved in that the consumer is less price-sensitive than in the past. That’s not saying that price doesn’t matter.

It’s saying that typical beef consumers, who increasingly may have incomes higher than the average of the general population, will continue to buy beef despite the cost, much as consumers of gasoline adjust their budgets in other areas.

“The other shift that is occurring is that more pounds of beef are finding their way to the consumer via food service rather than retail,” Tonsor says. He explains food service operators have more opportunity than consumers buying packages of beef at retail to build a plate of goods that includes beef at a price point that meets expectations.

The MU study included a logarithmic trend to account for additional factors that may influence beef demand. The trend is significant across beef quality types.

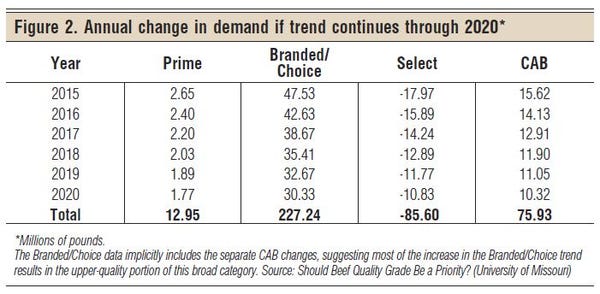

“This existing trend suggests additional factors are increasing demand for Prime and at least the upper end of Branded/Choice beef, and decreasing demand for Select beef,” according to the study. “While it’s difficult to quantitatively identify exactly what is causing this trend, there are significant changes in demand of each quality category (Figure 2) if the trend were to continue through 2020. While Prime and Branded/Choice beef consumption would increase, Select beef consumption would drastically decrease under the assumption of a continued trend.”

Specifically, projected to 2020, the logarithmic trend suggests increased demand for 10.6 million more pounds of Prime and 175.23 million more pounds of Branded/Choice beef (60 million pounds of that CAB). At the same time, the trend suggests declining demand for 62.32 million fewer pounds of Select beef.

“Beef production and management decisions made in the near term will determine the future success of cattle herds across the U.S.,” Steiner and Brown say. “A focus on quality appears to be a viable plan to rebuild the U.S. cattle inventory and sustain and build beef demand going forward.”

Elasticity definitions

Own-price elasticity – a measure of how responsive (elastic) the quantity demanded of a particular product or service is to a change in price of the product or service.

Cross-price elasticity – a measure of the response of the quantity demanded of one product or service relative to a change in price to another product or service.

Income elasticity – a gauge of the responsiveness of demand for a product or service as income increases for those demanding the product or service.

You might also like:

60 stunning photos that showcase ranch work ethics

Must-Read: Montana couple uses "construction" cones to help herd cattle

6 steps to low-input cow herd feeding

Meet the U.S. cattle operations honored for stewardship efforts

How to diagnose and treat bloody scours (coccidiosis) in calves

About the Author(s)

You May Also Like