Nebraska, Iowa, South Dakota and Minnesota now represent nearly 40% of the top 10 inventory, vs. just 36% in 2000.

June 17, 2014

Late last year, National Beef announced plans to close its Brawley, CA, plant this spring. Meanwhile, Iowa beef producers are eagerly anticipating the Oct. 1 reopening of the Tama, IA, beef plant. These two events serve as a good opportunity to review some of the beef industry’s geographical differences; namely, the ongoing shift of regional differences within the cattle-on-feed population.

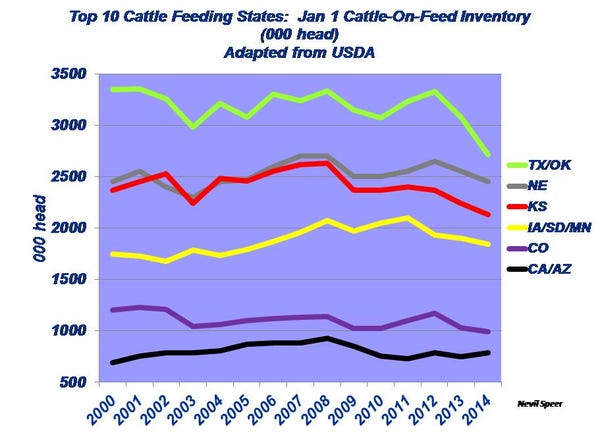

The accompanying graph reflects Jan. 1 cattle-on-feed inventories for the top 10 cattle feeding states, which represent about 86% of the total on-feed population. Not surprisingly, the overall inventory within these 10 states has declined nearly 890,000 head during the past 14 years. However, there are some important trends that exist within that broader trend.

The largest decline has occurred in the Texas/Oklahoma region, representing a loss of nearly 630,000 head. Meanwhile, Kansas represents an additional decline of 240,000 head, and Colorado has 210,000 fewer head in 2014 vs. 2000.

Conversely, Nebraska has maintained steady numbers. Furthermore, the regions comprising California/Arizona and Iowa/South Dakota/Minnesota have increased by 97,000 and 95,000 head, respectively.

Subscribe now to Cow-Calf Weekly to get the latest industry research and information in your inbox every Friday!

Clearly, the Brawley plant closure represents potential for shift of the California/Arizona feedyard inventory. Simultaneously, the feeding population continues to make a slow migration back to the Corn Belt states: Nebraska, Iowa, South Dakota and Minnesota now represent nearly 40% of the top 10 inventory (vs. just 36% in 2000).

What impact might this have on the processing industry going forward? This trend is also important to feeder cattle basis in the future. Finally, how do you foresee all of this playing out and the influence on the feeding sector over time? Leave your thoughts below.

You Might Also Like:

7 Lessons I Want To Teach My Ranch Baby

5 Essential Steps For Fly Control On Cattle

About the Author(s)

You May Also Like