With more beef being graded Prime and Choice, consumers have greater availability of high quality beef and a better opportunity for a positive eating experience. And that means more dollars coming into the beef industry.

April 11, 2017

Last week, we highlighted the recent landmark established in terms of increased quality grade in beef carcasses. The article noted that, “…during the past 25 years, the industry has struggled to surpass a rate of 60% of carcasses grading Prime or Choice.”

However, during the past several years, the beef industry has made tremendous progress. To that end, the industry established a new high-water mark in 2015 with the slaughter mix producing 75% of carcasses grading either Prime or Choice.

Then, beef industry achieved a whole new landmark in January with 80% of carcasses achieving the Choice or Prime designation. But better yet, in mid-March, nearly 8% of carcasses graded Prime, while 74% graded Choice for a combined 82% mark.

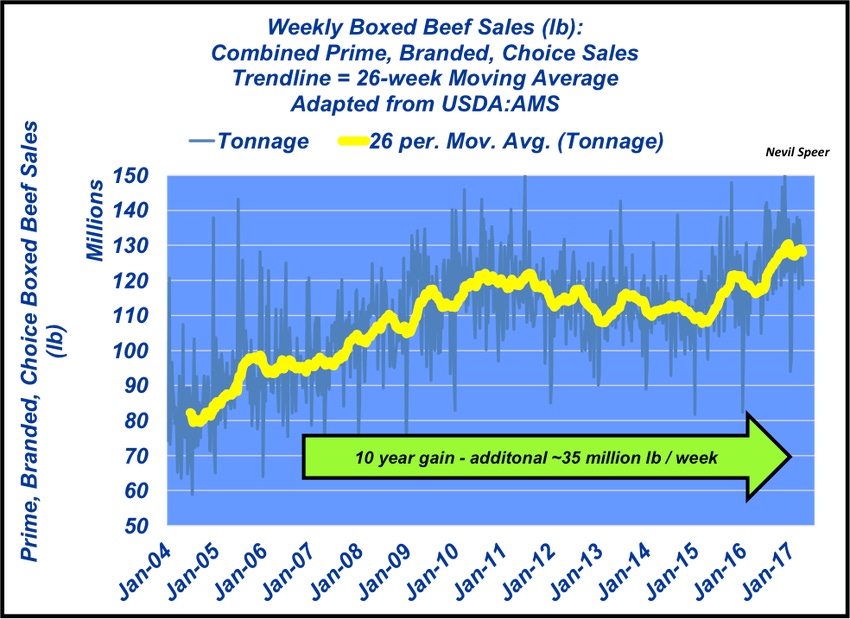

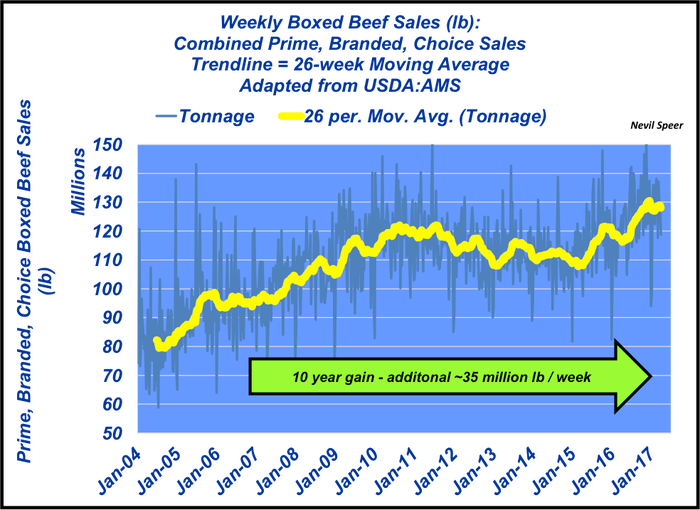

That can all seem a bit squishy in terms of real outcome. So this week’s graph demonstrates the accomplishment in a slightly different way. That is, the performance of the cattle and the carcasses they produce, translate into real tonnage in terms of sales. The chart expresses combined weekly Prime, branded and Choice tonnage sales.

The industry set a new record for weekly Prime, branded and Choice tonnage last November at 152 million pounds. However, most important is the long-term trend. The yellow trend line represents the six-month moving average. That average is currently running around 130 million pounds versus 10 years ago when it was about 95 million pounds.

In other words, the beef industry has boosted its ability to sell Prime, branded or Choice product by 35 million pounds every single week. More tonnage at the higher end of the value structure means more dollars coming into the industry.

These trends are an important driver of beef demand. Better beef means more consistency and leaves consumers with a more favorable assessment of their respective eating experience. That typically leads to more repeat purchases whether dining out or making purchases at the grocery store and boosts pricing power.

These are favorable trends. How do you foresee the beef industry’s position with consumers? What does the industry need to do going forward to maintain a favorable position with its customers? Leave your thoughts in the comments section below.

Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

About the Author(s)

You May Also Like