African swine fever: The rising tide that lifts all export ships

U.S. beef fills markets while other countries tend to China.

November 4, 2019

Although most of the African swine fever news coming out of China has centered on pork export opportunities, there also is an important spillover into beef markets.

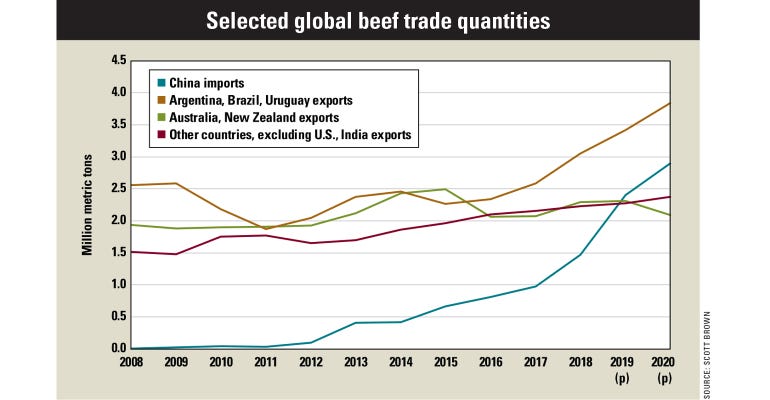

China had been increasing beef imports in recent years even before ASF became a major factor, but the current shortage in meat availability will further enhance the growth in beef demand. Recent projections from USDA for 2020 suggest that China will import nearly 3 million metric tons of beef next year, a figure equal to about 23% of next year’s expected U.S. beef production.

Filling market need

Even if the U.S. remains a relatively small factor in the China beef import market, the commitment from other major beef suppliers to ship increasing amounts of product to China will have a direct influence on the demand for and price of U.S. beef.

While 70% of China's beef imports originated from Brazil, Argentina and Uruguay in 2018, Australia recently has become the third-largest beef supplier to China. In fact, the Australian Bureau of Agricultural and Resource Economics and Sciences projects that China will account for nearly one-fourth of Aussie beef exports in the year to come, after comprising just over 10% of shipments from 2013 to 2017.

This has ramifications for U.S. beef shipments to both Japan and Korea, as Australia and the U.S. have combined for about 90% of the market share in both these countries in recent years. Every pound of beef that China purchases from Australia is one less pound that the U.S. is competing against in its top two beef export markets, which have absorbed about half of total U.S. beef exports in recent months. Also, Australia is an important source of U.S. beef imports, which are projected to decline by more than 5% next year.

Even though U.S. beef exports rarely go head-to-head against beef from South America in their most important markets because of differences in product, the fact that China is more than swallowing up the export increases from these suppliers means that global beef markets remain tight.

There are not a lot of other major beef suppliers once the U.S. and India, which exports only frozen water buffalo meat (carabeef), are excluded from remaining world totals. Although India exports large amounts of carabeef, this product mainly heads to developing countries, which are more price-conscious and not primarily seeking meat that is of a comparable quality to U.S. beef.

Benefiting U.S. beef

With all the uncertainty surrounding the severity and duration of the ASF situation, no one knows what the future holds for meat consumption in China. But there is plenty of reason to be excited about how U.S. beef will fit into global markets in the years to come, both short term and long term.

The trend toward more beef demand in China has been underway for some time and is unlikely to disappear even after ASF disruptions fade out of the spotlight. And with other major suppliers rushing to fill the growing China market, U.S. beef exports will be primed to increase market share into other important beef markets that could provide higher cattle prices to U.S. cattlemen in 2020.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)