Producers need to determine what market they want to find the best margin.

March 16, 2023

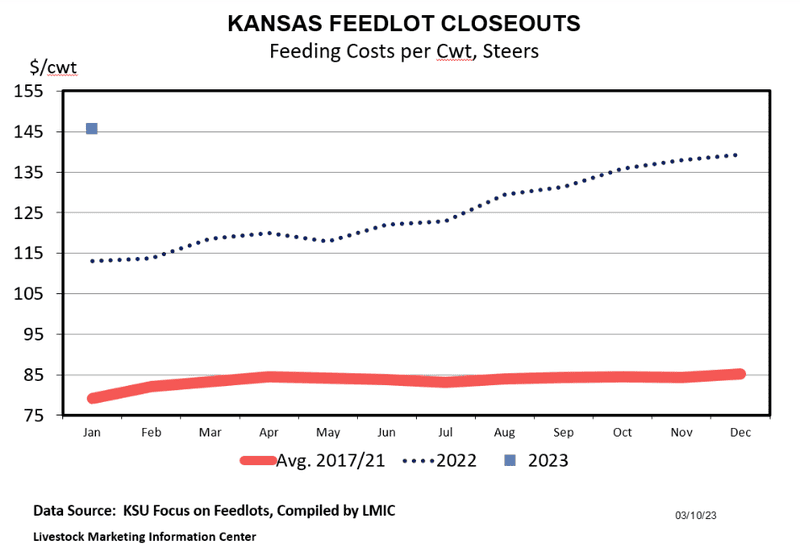

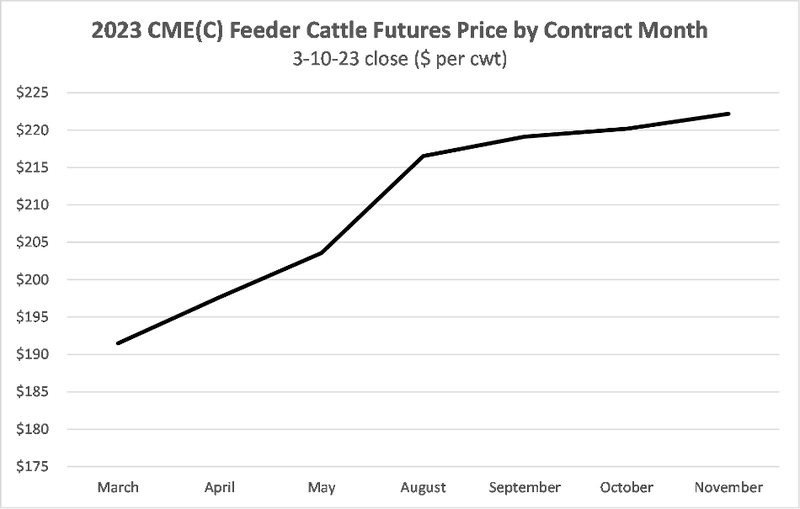

While there are always a number of factors that can impact cattle markets, things appear to be setting up well for stocker operations in 2023. First, high feed costs are likely to result in very high value of gain on calves this year. The chart below shows estimated feed cost per lb of gain from Kansas State’s Focus on Feedyards newsletter. Note the estimated cost of gain for January was over $1.45 per lb. And secondly, there is an incredible amount of carry in feeder cattle futures markets. As I write this, the November contract is trading at a $30 premium over March (see the chart at the bottom, updated from last week). This means that the expectation is for heavy feeder cattle prices to increase throughout the year, which will only add to the value of pounds that are added through growing programs. And we are starting to get a clearer picture of what calf values are going to be this spring.

Astute margin operators are regularly running budgets for their programs. They use the futures market to predict the value of feeder cattle when sold in the future, estimate the cost of growing calves until sale, and use that to determine what can be paid for those calves at placement. In truth, these returns will vary depending on the type of calves that are placed into their programs. Some operators like to place steers, while others prefer to grow heifers. Some producers choose to buy preconditioned calves, while other may choose to buy lighter calves that are fresh off the cow. Others have found niches for buying discounted bull calves, castrating them, and selling them later as feeder steers. The point is that there are a lot of potential programs that may allow for profit to be made.

When calves are placed into a growing program, money can often be made on the “buy.” By that I mean that getting a group of calves placed at an attractive price is a key first step to profitability. Sometimes producers need to look at multiple types of calves to determine where those attractive buying opportunities are. If producers are comfortable placing different types and weights of calves, they should run budgets for multiple systems and take advantage of profit opportunities when they come into view. This flexibility on the type of cattle being placed can allow producers to capitalize on different opportunities available at different times in the market.

Being opportunistic can also pay off when it come to pricing. Once calves are placed into a backgrounding or stocker program, very few things will have a larger impact on profit than what the market does between placement and sale. So, producers should be thinking about ways to manage price risk from the start. Calves are going to be very expensive this spring, which means that stocker operators will have a lot of money at risk from day one. In fact, they will likely have more than 80% of their total costs sunk the day they place those calves. So, producers may also want to be opportunistic about taking advantage of price risk management opportunities. With a fall board above $220 per cwt, the market is offering some pricing that we have not seen in quite some time. Profit opportunities will exist in 2023, but stocker operators need to be opportunistic when they get the chance to place cattle at an attractive margin and take advantage of pricing opportunities as they present themselves.

You May Also Like