Beef Outlook: A record-high number of cattle are in feedlots as the national beef herd shrinks.

November 8, 2021

2021 marks the third consecutive year with a declining beef cow herd and a smaller calf crop. Yet cattle slaughter and beef production are both on pace to top 2018 levels by more than 1% this year. It is not sustainable for cattle slaughter to continue to defy a shrinking national herd in the long run.

There are many short-term factors contributing to higher cattle slaughter numbers, and while it is difficult to pinpoint precisely when beef output will finally respond to years of smaller calf-crop numbers, that day is coming soon. And when it does, there is a strong potential for sharply higher cattle prices.

A look at feedlots

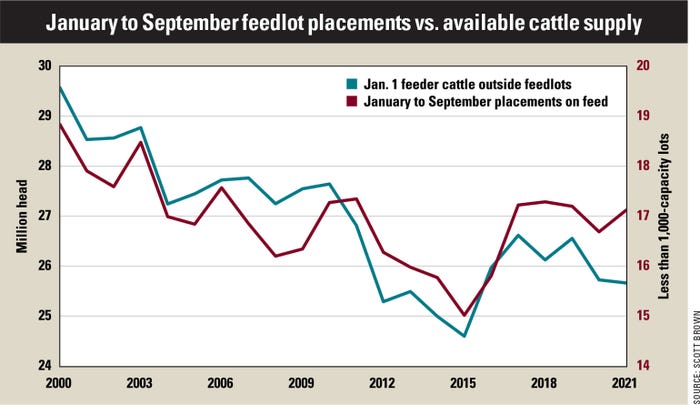

USDA calculates feeder cattle supply outside feedlots on Jan. 1 based on four categories from its annual cattle inventory report. The sum of steers over 500 pounds, plus heifers over 500 pounds, plus calves under 500 pounds, less heifers held for herd replacement and animals already on feed leaves the supply of animals with the potential to enter feedlots.

Comparing this figure to the number of cattle placed into feedlots from monthly USDA Cattle on Feed reports gives insight into the rate that available cattle are being placed on feed.

With nine months of feedlot placement data currently available for 2021, the 66.7% rate of feedlot placement through September has been a record high and well above the average of 62.8% from 2000-20. This has kept feedlot inventories higher than the average of the past three years for eight of 10 months thus far in 2021, while also depleting the supply of animals for future placement.

According to the Livestock Marketing Information Center, some of the reasons for higher recent placement rates include drought conditions over much of the western U.S. and positive Southern Plains cattle-feeding returns for 11 of the past 13 months.

However, there is a limit to how long large numbers of cattle can continue to be pulled into feedlots while available feeder animals continue to decline.

Heavier cattle still in play

There is more than just feedlot placement data to consider. The amount of beef produced ultimately depends upon cattle slaughter rates and carcass weights.

The supply of cattle on feed for a relatively long period of time continues to run sharply above year-ago and five-year average levels. Though below last year’s record levels, dressed steer weights remain much higher than the 2015-19 average. The processing of these cattle will continue to keep beef production relatively strong in the short term.

The outlook remains bright for cattle prices because of both demand and supply factors. Once the current abundance of market-ready cattle supplies can be processed out of feedlots, supplies will tighten significantly.

This fact is fueling the 3% decline in beef production currently projected by USDA for next year, including a 5% decline for the second half of 2022. While it is difficult to know exactly when the pendulum will shift to much tighter cattle supplies, that day is approaching soon.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like