Northeast Beef Comments: Factors other than profitability will influence what enterprise is best for your farm.

I recently received an email asking about the profitability of three different beef enterprises:

start with bred cows and sell calves

stocker cattle only

stock 50% of the farm with bred cows, and the remaining 50% with stockers

Here is a look at each option:

Breed cows and sell calves. A recent study — “Overcoming Supply Chain Barriers to Expanding Northeast Ruminant Meat Production” — answered part of this scenario. The model used was a May-calving herd of 25 cows, one bull and four replacement heifers. The 19 calves will sell in November.

The farm consists of 75 acres. All hay was produced, leaving the total 75 acres available for grazing. A $30-per-acre fee was charged for pasture. The total feed cost was estimated at $7,505 — $300 per cow.

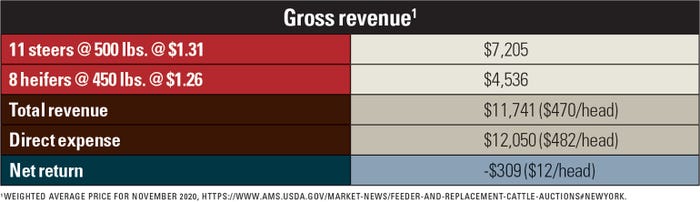

A report from the University of Minnesota’s Center for Farm Financial Management listed the median nonfeed direct costs from a cow-calf operation at $182 per head. Combined with the $300-per-head feed cost, the total direct expense was $482 per cow. The table below summarizes the estimated net return:

Well-managed cow-calf operators have better financials. They do this by focusing intently on reducing cost of production, especially feed. They also have lower calf death loss, meaning they sell more pounds of calf per cow.

Value-added management practices such as vaccination and a longer weaning period increase weight and, therefore, receipts per head.

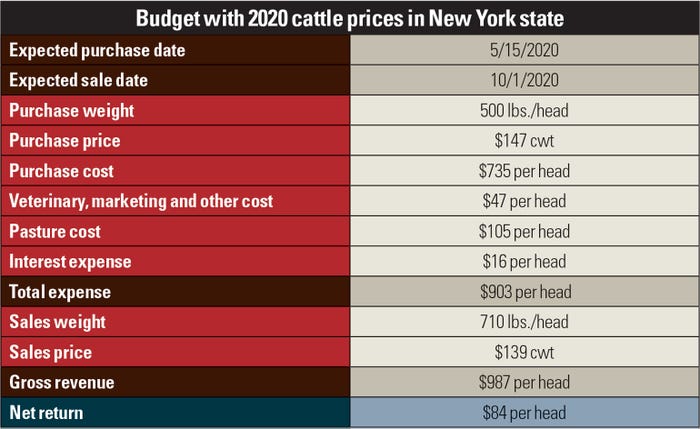

Stocker cattle only. The following budget was adapted from Oklahoma State University and populated with 2020 cattle prices in New York state as collected by state market news reporters.

This is a 140-day grazing season with steers gaining 1.5 pounds per day. They are grazed at 0.8 head per acre, which on 75 acres should support 60 head.

The cattle were purchased based on New York prices in May, and the sale price was based on the Yearling Board Sale held Sept. 12 at Empire Livestock in Bath, N.Y.

This budget produced a net return over direct expenses of $84 per head, higher than the loss of $12 per head for the cow-calf operation. Note that part of the difference between the two scenarios is that the cow-calf operation includes selling steers and heifers, while the stocker enterprise was budgeted using steers only.

While the cow-calf operation may not be much more than a breakeven proposition, it does have a market advantage. Weaned calves can be channeled to three different market outlets: backgrounder, stocker and finish. This can be done by direct sale or retaining ownership when market conditions are right.

The stocker calf has only one outlet: finishing. The owner has the option to sell or retain ownership.

Keep bred cows and stockers. Given that the projected return is minus $12 a head for the cow-calf enterprise and $84 a head for the stocker enterprise, I’m not sure that this third option is more viable than the stocker enterprise alone.

However, depending on forage quality, this could work. If there is a portion of the pasture that is rocky, shallower and generally of lower quality, this area could support cows nursing calves.

The nutrient requirements of a cow-calf pair are lower than a stocker calf. In this case, the combination of enterprises would increase utilization and efficiency of the land resource.

Another benefit is that later-born calves from the cow-calf operation could be the source of stockers, or they could be purchased. In a drought year, selling the stockers early would leave sufficient forage for the cow herd.

Finally, as compared to older, heavier calves, young and lighter-weight calves are more efficient and gain better. By reducing the grazing season from 140 days to 100 days and increasing average daily gain to 2 pounds, the difference in net return is only $4 a head.

Factors other than financial will guide the decision as to what enterprise, or combination of enterprises, will best fit your land, labor situation and market resources. However, if profitability is the goal, evaluation of net return is a good place to start.

Baker is a senior Extension associate in the Cornell Department of Animal Science.

About the Author(s)

You May Also Like