The USDA cattle report may signal higher prices on the horizon as heifer retention stalls.

August 5, 2019

Data from the USDA July Cattle Report suggests increasing beef supplies soon could come to an end, brightening the outlook for cattle prices in the medium term.

The July cattle report recently released by USDA provided the inventory count for key components of the U.S. cattle herd as of July 1, as well as a preliminary estimate for the size of the 2019 calf crop.

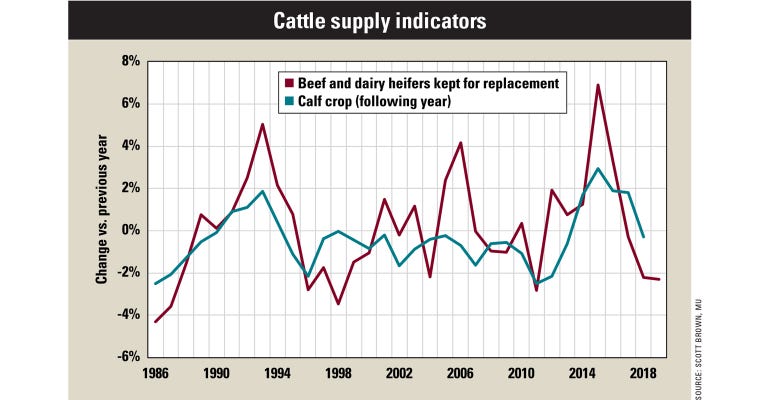

The number of heifers 500 pounds and over kept for either beef cow or milk cow replacement on July 1 was down 3.4% from a year ago, an even sharper reduction than the 2.3% drop indicated by the Jan. 1 inventory count.

In fact, the July 1 drop in this important indicator of future herd size growth posted its largest annual decline of any semiannual measurement since 1998.

Downward trend

Given the observed historical relationship between changes in the number of heifers kept for herd replacement on Jan. 1 and the change in the calf crop the following year, this report is signaling a high likelihood that smaller calf crops are on the way.

It is interesting to note from the graphic that two years in which the calf crop the following year failed to match increases in the heifers kept for herd replacement were two extremely dry weather years (2006 and 2012) that forced many heifers and cows to market because of poor pasture conditions, and that seldom has the change in the calf crop strongly exceeded the prior year change in heifers kept for replacement.

It is true that changes in U.S. beef output generally have been larger than changes in the calf crop, due to cattle imports and productivity gains. However, the annual increase in the ratio of beef production to the previous year’s calf crop has averaged 0.7% over the past 20 years, very similar to the average growth in U.S. population.

While it is possible to have individual years in which beef output does not closely follow changes in the calf crop, over the long term, the change in this relationship approximates the change in the number of domestic beef consumers.

Moving price

While cattle markets have performed reasonably well in the face of growing beef supplies since the large price declines in 2016, supply fundamentals have stifled the price response to strong domestic beef demand and positive developments in some export markets.

Although it will be critical for U.S. consumers to continue to show a willingness to pay for beef in the presence of growing pork and poultry supplies, and while international beef markets still will exert a large influence on cattle prices here at home, the time is growing short for increasing per-capita beef supplies. This provides optimism that cattle prices should be on the upswing more often than not in the next few years to come.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like