The Federal Reserve rate hike cycle will soon end, but commodity market supplies remain vulnerable

January 20, 2023

The U.S. economy will progressively slow through the first half of 2023. Fears of a recession are still high and still warranted.

Behind the economic showdown are interest rate increases intended to combat swiftly rising. But with the unemployment rate at a 53-year low and inflation trending lower, forecasts are turning a little less gloomy.

U.S. consumers are still spending but doing so by increasing dependence on credit. They are finally pushing back on price increases on goods, a response to continuous declines in real wages and dwindling reserves of pandemic savings. Like consumers, businesses are spending more cautiously, according to a new quarterly report from CoBank’s Knowledge Exchange.

The Federal Reserve raised its benchmark overnight rate by more than 400 basis points in 2022 and it is not finished hiking. The Fed has made it clear it is focused less on headline inflation and more squarely on the labor market and core services inflation excluding housing. With job growth far outpacing the availability of workers, the scarcity of labor is cause for concern, especially for the services sector.

China’s abrupt reversal of its zero-COVID policy is forcing shutdowns at manufacturing plants and causing major delays in trucking and at ports as infections increase. U.S. exporters are feeling the impacts now, as supply chain problems have been preventing the movement of many goods into and around China.

Grains, farm supply and biofuels

Grain markets balanced several challenges in the fourth quarter, from the war in Ukraine and economic slowdowns in China and Europe to interest rate hikes in the U.S. and other developed economies. The continuation of these factors and La Nina weather conditions into 2023 will likely put pressure on grain storage and merchandising margins.

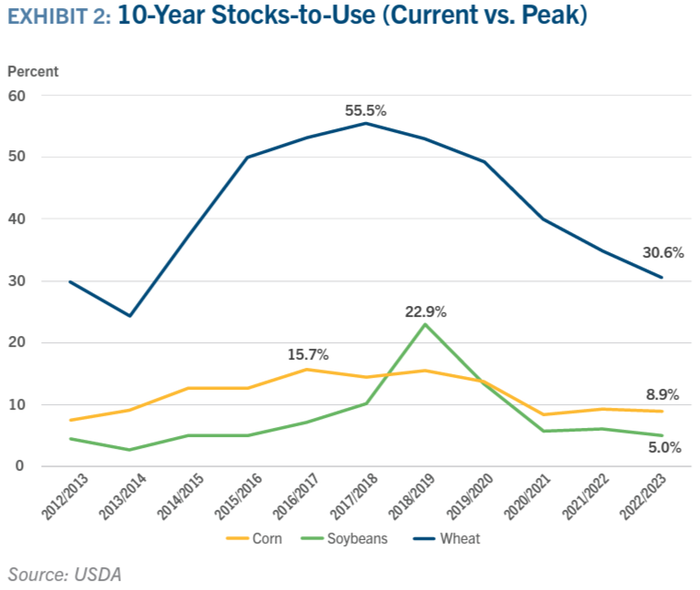

Stocks-to-use ratios for corn, soybeans and wheat finished 2022 at multi-year lows driven by strong domestic demand.

For the second year in a row, ag retailers posted exceptionally strong revenue and profit growth, driven by sturdy grain market fundamentals. Interestingly, despite high spring demand and tight global supplies, fertilizer prices declined during the fourth quarter amid falling prices for natural gas. While the farm supply sector begins 2023 on strong financial footing, rising wages, higher interest rates and continued high transportation costs are likely to tighten margins.

Ethanol production in the fourth quarter nearly caught up to pre-COVID levels, averaging 15.5 billion gallons for the quarter. Profit margins averaged $0.27/gallon compared to $0.25 for the first nine months of 2022 and long-run historical average levels of $0.25 to $0.30. Profitability was well above average during October and November, but increasing corn prices, coupled with a 12% decline in ethanol fuel prices, pushed down margins in December. Year-round sales of E15 gained momentum with the Biden administration’s announcement of its intention to review states’ proposals.

Animal protein and dairy

Animal protein production surged in the fourth quarter, with the weekly average increasing 6% compared to the third quarter. While cold storage inventories edged higher through the second half of the year, they remain below the five-year average due to the ongoing strength of demand.

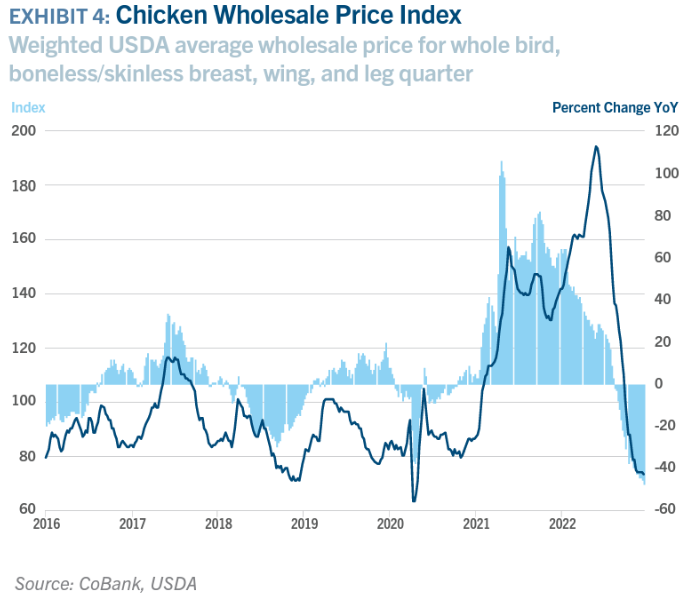

In a major shift from the prevailing conditions earlier in the year, chicken markets were well-supplied during the fourth quarter thanks to increased placements and higher live weights. Retail chicken prices remained elevated, averaging $1.85/lb. for the quarter. However, wholesale chicken prices crumbled amid the pressure of mounting supplies. Export markets have been less affected. Overall, U.S. chicken remains supported by global markets despite the weakening fundamentals at home.

Shrinking market-ready fed cattle supplies are bullish for cattle prices, but beef prices have drifted down from their summer highs. While retailers provided modest relief at the meat case during the fourth quarter, and a discount to year ago levels, consumer demand remained resilient despite comparatively high prices. At the wholesale level, however, beef prices have dropped from their elevated levels. From January highs to December lows, the boxed beef cutout lost 15% of its value. Processor margins suffered through the fourth quarter due to moderating beef prices and higher operating costs.

Nearby lean hog futures accelerated quickly to begin 2022 and had gained 68% in value by late July, peaking at $122/cwt. Hogs retained much of that support through the third quarter. But despite tight hog supplies, valuation succumbed to the pressure of seasonal tendencies and processing limitations during the fourth quarter. The lean hog index dropped into the upper $70s to end the year, and the hog market appears poised for a significant bounce in 2023.

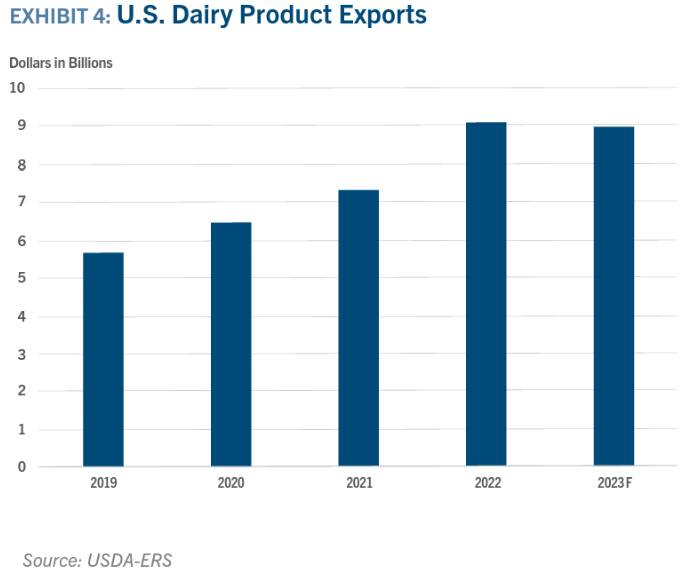

U.S. milk prices continued softening in the fourth quarter with Class III milk futures falling 5%.Butter prices have also fallen in a faster-than-expected retreat. Spot butter prices are down nearly 10% from the record highs scored in October. Record large total U.S. dairy exports for 2022 carried through the fourth quarter, underpinned by recent weakening of the U.S. dollar. However, the outlook for U.S. exports in the first half of 2023 is deteriorating. Dairy product prices are expected to grind lower as post-holiday season demand wanes amid uncertain global demand.

To learn more, read the complete CoBank Quarterly.

Source: CoBank Knowledge Exchange

About the Author(s)

You May Also Like