The IRS issued some news regarding the weather related sales of livestock tax rules

October 17, 2022

Over the past several months I have received many calls from livestock producers wanting information concerning the application of the Weather Related Sales of Livestock Rules provided by the IRS.

Last week, the IRS released Notice 2022-43: Extension of Replacement Period for Livestock Sold on Account of Drought. It reports that livestock producers in all 77 Oklahoma counties qualify for the 4 year extended period for replacing breeding, dairy, and draft animals that were sold in excess of normal beginning September 1, 2021 and during 2022. The beginning of the replacement is the first 12 month drought free period (September 1 to August 31). Producers electing to replace animals will have until December 31 of the fourth year. More detailed information can be found by using Google and searching for IRS Notice 2022-43.

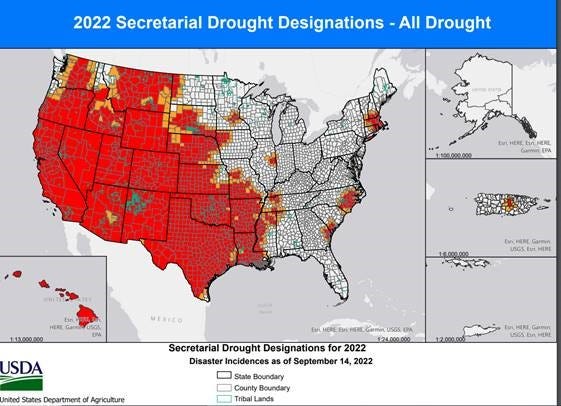

In addition, the Secretary of Agriculture federal disaster declarations for this year allow livestock producers to postpone reporting the gain from sales of any livestock in excess of normal for 2022 to be reported on their 2024 income tax return. The following map provides proof of the declarations by county from the secretary. More detailed information can be found by using Google and searching for USDA Secretary of Agriculture Drought Disaster Designations

In both scenarios, the treatment only applies to the number of animals sold in excess of normal annual sales.

Source: Oklahoma State University

You May Also Like