Power of meat: Why transparency is important

Shoppers want to know how and where their meat was produced.

July 13, 2020

Several months ago, Industry At A Glance began diving into some of the implications of the most recent Power of Meat study (prior to COVID, of course). As background, the annual report is arguably the most comprehensive look into the various trends driving consumer behavior at the retail level.

Accordingly, it’s subtitled, “An in-depth look at meat through the shopper’s eyes.” The report is published by FMI (The Food Industry Association) and the Foundation for Meat & Poultry Research & Education, prepared by 210 Analytics LLC and primarily sponsored by Cryovac (a division of Sealed Air)

The first column focused on basic trends in terms of what’s important to shoppers. The discussion outlined the following:

…the brand/consumer relationship is becoming increasingly important with respect to meat/poultry sales. That has implications throughout the supply chain. The issues highlighted here [nutrition, food safety practices, animal care practices, environmental impact, worker welfare/safety, initiatives to give back to community] are all important with respect to how the industry positions its product to consumers – and increasingly demands certain practices and subsequent documentation flow through a committed supply chain to facilitate that occurrence.

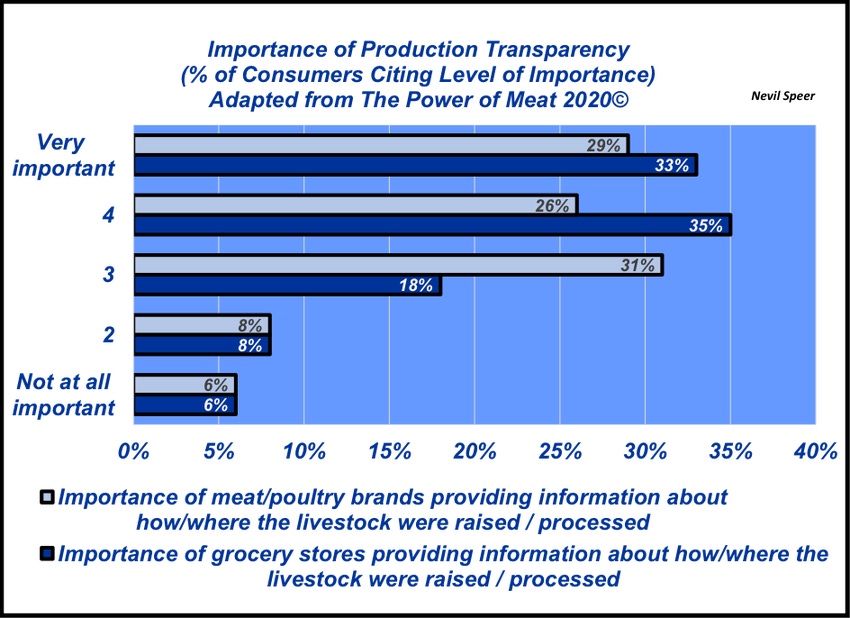

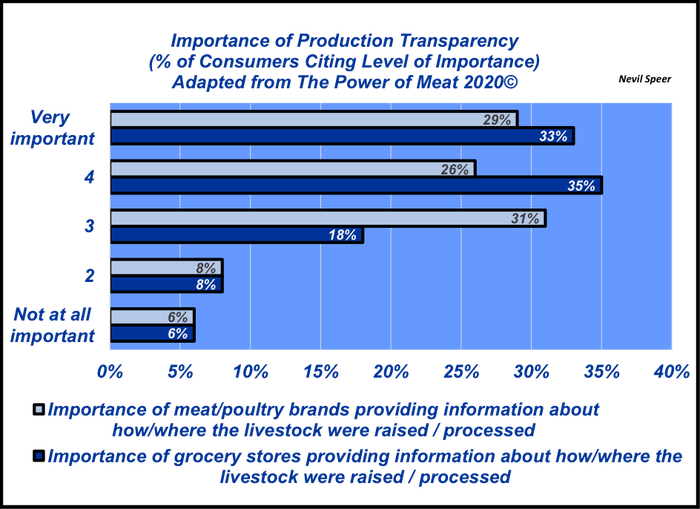

As follow-up to that column, this week’s illustration highlights the importance of production transparency to consumers. A slight majority of consumers, 55%, believe that meat and poultry brands should provide information about how livestock were raised. Meanwhile, 68% believe it’s important for grocery stores to provide that information.

Either way, it’s clear that a majority of shoppers are voicing desire for greater information when it comes to how/where livestock were raised and processed.

So, regardless of whether it’s the brand or the retail store providing that information – this has clear implications for the supply chain. Meeting that need increasingly means committed supply chain relationships, coordinated processes, and clear documentation from farm or ranch all the way to the end product.

As noted in last week’s column discussion around beef spending, “Being responsive to consumer preferences has paid, and continues to pay, real dividends.” Accordingly, failure to heed what consumers are telling us will likely erode the strong gains made in market share during the past 20 years.

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)