While COVID-19 has changed the business environment, consumers still demand beef.

November 12, 2020

There still’s work ahead. However, the business environment has found some normalcy following the initial blow from COVID. That is, the world is learning to live with COVID and is working hard to reestablish commerce continuity.

To that point, the beef industry has largely returned to business as usual (as much as possible) despite the overwhelming deficit of food service sales. The difference maker being remarkably solid demand in the retail sector. That is, retail strength has buffered food service weakness.

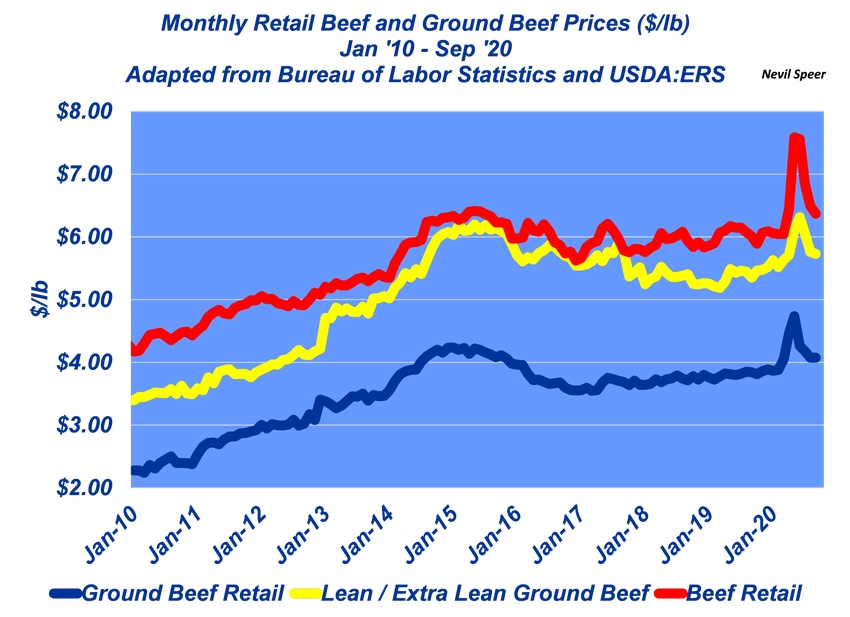

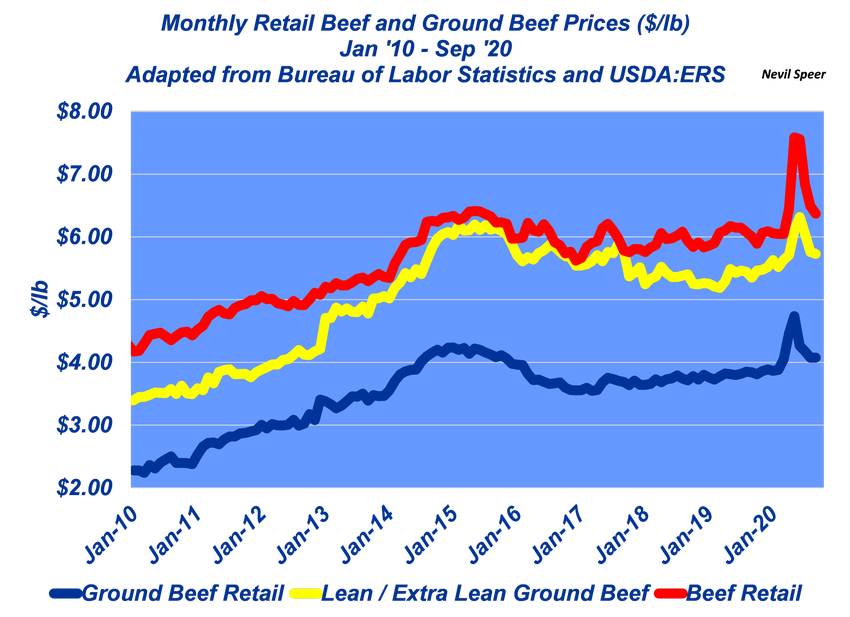

Accordingly, it’s useful to review some longer-term trends around retail beef prices. This week’s illustration highlights retail ground beef and overall beef price trends (through September).

A couple of items are of importance:

September’s beef retail prices averaged $6.37 per pound – off sharply from the peak of $7.56 in May – and almost even with the May/June 2015 previous high of $6.41 per pound.

Lean/extra-lean ground beef sold for an average of $5.73 per pound in September – down from the June COVID peak of $6.31 per pound.

Overall, ground beef has stabilized around $4.05-$4.10 per pound.

In the middle of this discussion, it’s important to emphasize the value of differentiation in the marketplace. That is, lean/extra-lean ground beef began diverging from regular ground beef in 2014 and 2015.

For example, in May, 2015 the difference between the two ground beef categories was nearly $2 per pound versus just $1.10 per pound in 2010. That advantage has largely remained in place – the difference at end of September was $1.65.

That indicates that consumers are very conscious about the difference and willing to pay accordingly. As noted several years ago, “…lean and extra-lean ground beef has diverged from overall trends and become an especially important category unto itself experiencing significant pricing power in recent years.”

The category has seemingly built significant loyalty over time and has clearly helped the beef industry to keep moving forward even with sharp downturn in restaurant activity. Category strength helps induce sales and total dollars coming into the industry. Quality and differentiation really do matter to consumers!

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

You May Also Like