Ed Czerwien takes a look at beef prices and their complexity.

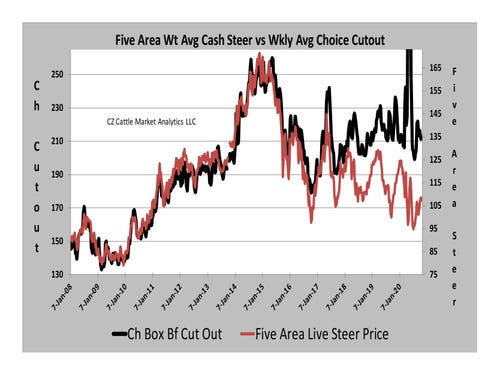

The main driving force in the fed cattle prices is the box beef cutout, which represents wholesale beef prices. However, during the last several years, there has been more deviation in the correlation between these two prices. As you can see on the graph below, they moved very closely for many earlier years, so this is important to watch.

It has some impact on long-term feeder cattle prices as well, because it impacts the profitability of feedlots, which raises or lowers bidding for feeder cattle. Years ago, when I worked for Wilson Foods, the carcass price was the wholesale price measuring stick. Today, the box beef cutout replaced the measuring stick and it is much more complex.

Let’s take a look at that complexity and break it down a little.

Box beef cutout

The box beef cutout represents a carcass that is disassembled into subprimal cuts of beef that have some bones and fat removed and then put in a Cryovac bag. This is a vacuum-sealed, heat-shrink, heavy gauge plastic bag that preserves fresh meat for a longer time without freezing. So Cryovac beef allows buyers to purchase exactly what they want and allows packing plants to manage supplies more diligently with longer storage time.

After many years of research, USDA, which has mandatory price reporting for packing plants, takes a lot of different product prices and puts together a cutout value, so the industry has a very good measuring stick today. Mandatory price reporting forces packing plants to accurately report all sales twice each day, so it has produced important data.

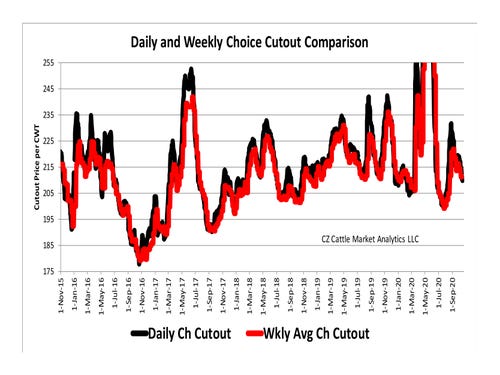

The daily Choice cutout that is reported twice every day has become the most watched item in the beef trade, but there are some other very important items that actually have a bigger impact on feedlot cattle prices. The daily cutout reported sales are actually cash-type spot sales and the weekly total loads sold for this daily report normally only represents approximately 8-10% of the total weekly loads sold. However, it does have some longer-term impact. More on that later.

So what does have the biggest impact on the fed cattle prices?

It’s the weekly average Choice cutout. It represents all the different types of sales including the daily Choice cutout, and is reported Monday afternoon when the weekly data is totally collected from the previous week by USDA. The formula type of sales are always slightly above or below 50% of the total sales, so this group has the biggest impact on the weekly average cutout price.

The out-front type of sales represent product that is purchased but not delivered for at least 21 days. This type of purchasing has grown tremendously during the last years. Out-front type sales are not totally new because when I managed the Wilson Foods Smoked Meat department at Albert Lea, Minn., many years ago, out-front type sales were very large for cured/smoked ham sales prior to Easter, Thanksgiving, and Christmas. Currently and for many years, out-front type beef sales normally represent 2-3 times more of the weekly volume than the daily spot sales, so they have a big impact on the weekly average cutout.

The export sales as reported on the weekly average box beef cutout report do not include the cheaper-priced variety meats, so they are not the total exports but are a very large portion of the total, so this information that is available each week gives an early picture of what is going on. The fact that our quality and the federal inspection safety in our packing industry is very well respected globally allows our product to be higher priced than many other countries, which helps our export volume.

However, the global beef market situation also has a big impact on sales, so when our prices skyrocket much higher than the global market, our export sales always drop lower. The global impact for meat sales is probably following what happened in grain sales, so we need to watch the global situation more closely as we go forward. These weekly export sales on the box beef report are usually higher volume than the weekly total for the daily cutout, so they also have impact on the weekly average cutout.

There’s more

As previously mentioned, the daily reported cutout sales are only roughly 8-10% of the weekly total loads sold, so they don’t have as big an impact that same week as the following week. That’s because many but not all formula sales are priced off the previous week’s daily sales. That usually makes the weekly average Choice cutout follow the daily Choice cutout more slowly because the formula sales are about half of the total sales. However, the larger volume of other sales, like the out-front sales, can also influence the changing weekly average prices.

To look at the latest full week of data available, the daily spot Choice box beef cutout ended the week on Friday, Oct 16. at $210.03, which was $4.03 lower compared to previous Friday. The weekly total for the daily cutout was 820 loads which was about 10 % of the weekly total loads sold. Last year it was $218.04 on the same Friday, which was $2.38 higher. So last year it started the normal mid-October increase, climbing $6 higher in the last two weeks.

The weekly average Choice cutout for week ending Oct. 17, which includes all types of sales including the daily Choice cutout was $211.36, which was $3.07 lower following the previous week's daily cutout decline and is now slightly below last year.

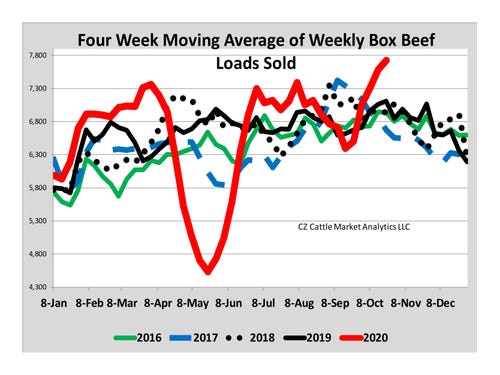

There were 7,905 total loads sold for the week, which was 795 loads higher than the previous week. So, the many weeks over 7,000 loads indicates retail demand has been good along with the highest four weeks of exports ever shown. The four-week moving average graph of weekly total loads sold has now jumped higher than all the years shown. Also, it was higher than last year most of the time except when COVID-19 shut down or slowed many of the packing plants, which forced total sales much lower than normal.

The out-front sales which get delivered after 21 days were 2,331 loads, which was 733 loads higher than last week but did include much larger forward contracts again, which were over 900 loads on the week that are spread out over a big portion of the year.

The exports as reported on the Box Beef report were very good with 1,065 loads and that was 128 loads higher compared to the previous week. Our NAFTA neighbors took 216 loads and 849 loads were going overseas. The four-week moving average graph shows that the last four weeks are the highest ever seen. Exports continue to really help move a large volume of box beef loads.

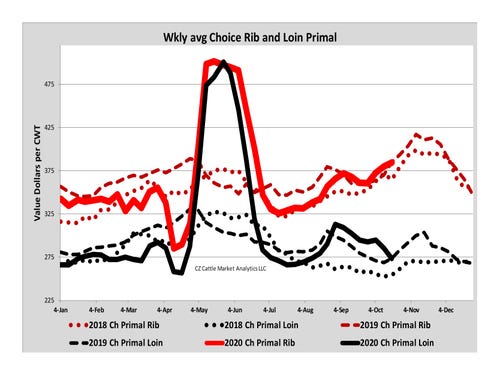

Formula sales were at 3,359 loads, which was 110 loads lower than last week and about 42% of the total loads sold for the week. The formula sales included about 2.8 million pounds of Choice ribeye products which no doubt helped the rib primal price go higher again. There have been several weeks of big formula ribeye sales, which is normal ahead of prime rib cooking season.

Primal cuts

Taking a look at the major primal cuts, the weekly average Choice chuck and round primals were $2-$3 lower, but we’re coming to the time of year when they normally go higher with more of these products used during colder weather. The weekly average Choice rib was $5 higher, staying very close to last year’s rally, and the Choice loin primal was $12 lower. However, the Choice rib always goes much higher ahead of the Prime rib-type cooking for Thanksgiving and Christmas parties. Whether or not it will follow a similar trend this year remains to be fully spelled out.

Czerwien is a market reporter in Amarillo, Texas. From the heart of Cattle Feeding Country, Ed follows the fed cattle, feeder cattle, slaughter cow and wholesale markets to keep beef producers up to date on the market moves that affect them. He previously worked with USDA as a market news reporter. Ed is now semi-retired and continues to work with cattle trade analysis.

About the Author(s)

You May Also Like