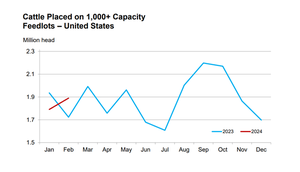

The April cattle on feed report had a few surprises for analysts.

Cattle Market Outlook

Fewer cattle but more in feedlotsFewer cattle but more in feedlots

Is it time to rebuild herds? Derrell Peel takes a look at the latest cattle on feed report.

Subscribe to Our Newsletters

BEEF Magazine is the source for beef production, management and market news.

.png?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)