What's the market plan for those 2019 calves?

You have to budget your backgrounding enterprise before you select that as a marketing alternative. Both cost of gain and marketing loss need to be considered in making the backgrounding decision.

March 9, 2020

Marketing 2019 calves has proven to be a real challenge for my study rancher. In our January management meeting, we took a hard look at the mid-January 2020 market projections and then finalized a marketing plan for his 2019 calves.

Fortunately, the market took a favorable turn in January, and this resulted in some increased profit projections.

Cattle cycle review of value of original weaning weight. Our conversation soon turned to discussing why we have struggled throughout much of the last cattle cycle to market backgrounded calves. My study herd manager asked me to do a market study of why making a profit backgrounding calves has been so difficult throughout the past years.

We turned our discussion toward our 2019 backgrounding budget. The local sale-barn price in mid-October was $169 per cwt for 550-pound calves, and 800-pound feeders were projected at $147 in mid-January 2020, for a difference of $21 per cwt.

This, then, suggests that the original 550 pounds were valued at ($21 x 5.5), or $125, less. The projected cost of gain going from 550 pounds to 800 pounds was estimated at $92.40 per head. The marketing loss for these 2019-weaned, 550-pound steer calves fed to 800 pounds was 135% of the cost of gain!

When I got back home, I decided to do a study on the loss in value of the original weaning weight when backgrounding the calves over the last cattle cycle.

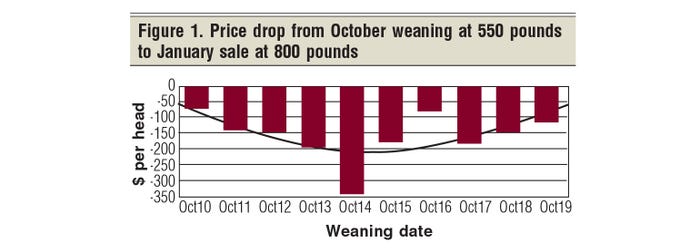

This study focused on the dollar drop from the weaning price of steers in October (weaning date) for 10 years of the last cattle cycle, compared to the dollar value of 800-pound backgrounded feeders marketed the following January (Figure 1).

It turns out the drop in the dollar value of the original weaning weight has a major role in determining the profit from backgrounding. It is every bit as important as the cost of gain associated with the added weight.

Figure 1 presents my analysis of this marketing loss for the last cattle cycle, 2010-19. Without knowing this price loss, you cannot assess the profit potential of backgrounding calves.

In summary, I argue that you have to budget your backgrounding enterprise before you select that as a marketing alternative. Both cost of gain and marketing loss need to be considered in making the backgrounding decision.

A budget takes both into account. Yes, you have to price your calves at weaning to properly make the backgrounding decision.

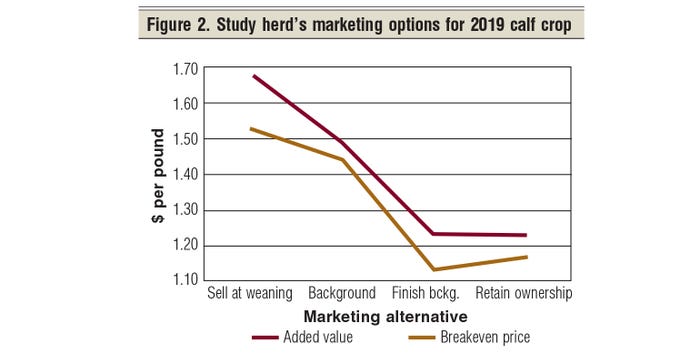

Final marketing plan for 2019 calf crop. Figure 2 summarizes this month’s projections for marketing 2019 calves. This is the first time in several years that the three marketing programs beyond weaning have all projected to be profitable. This, then, gives my study rancher some leeway for selecting his final marketing alternatives.

In October 2019, my study herd manager was faced with a bottom-line return to labor, management and facilities of $16,400 from the beef cow herd selling at weaning. This simply was not acceptable to my manager. Especially when the bottom line in 2018 from the beef cow herd was $34,500.

We expected 2019 to be somewhat less than the previous year, but the original projected $16,400 earned net return for 2019 was just too low.

He has now preconditioned his heifers for 60 days (summarized in last month’s column) and marketed them for a $10-per-head profit. Not great, but at least positive. They were sold before the end of the year to generate some needed cash.

Preconditioning his 128 steer calves is looking more favorable, based on January 2020 price analysis. Two different budgets for growing the 128 head of 2019 steer calves were reviewed in the January meeting. The first budget had a target average daily gain (ADG) of 1.5 pounds per day; the second, his traditional backgrounding program, had a target ADG of 2.5 pounds per day.

Since he was preconditioning his calves at the lower target ADG, our projected profit for the 90-day preconditioning program was a gain of $5,800, or $46 per head. The traditional higher ADG backgrounding program was projecting a total enterprise profit of $1,300 less.

Our final analysis at the end of the January management meeting was a projected profit of $16,700 from the beef cow herd selling 60-day preconditioned heifers, plus a calculated added profit of $5,800 from a 90-day preconditioning program for his steer calves, for a grand total of $22,500 for the 2019 calves. This is still $12,000 less than the net income generated by his 2018 calves.

My January 2020 budget projects a good profit from finishing his steer calves in a commercial feedlot. My study herd manager is still exploring this possibility.

Summary of January 2020 market price analysis. This was a fun month to analyze market prices. In general, corn prices were a little weaker, suggesting that costs of gain not only have peaked, but also that the costs of gain should go down slightly.

Annual feeder cattle prices for 2020 suggested a little strength over 2019 average prices. Every single month of Live Cattle Futures prices showed some strength over last month’s prices — an encouraging factor.

My analysis suggests that feeder cattle futures could be $10 per cwt higher at weaning time in October 2020. This suggests that we have finished this beef price cycle (2009-19), and that the 2020 calf crop would be marketed in the next beef price cycle.

To date, projections are for a gradual slow price increase over the next few years, with a potential top in the 2026-28 era. Unless something dramatic happens, we are not projecting a major market price top like in 2014. It will take a major positive market shock to generate another 2014.

Hughes is a North Dakota State University professor emeritus. He lives in Kuna, Idaho. Reach him at 701-238-9607 or [email protected].

About the Author(s)

You May Also Like