A little perspective on cowherd expansion

Beef producers came into 2017 with an expansion mindset. While time will tell, it looks like many will make good on that promise.

April 6, 2017

“We’ve got a calf market this year that we think will remain stout enough to be profitable for cow-calf producers,” said Kevin Good, senior analyst with CattleFax, at that group’s 2017 Industry Outlook. “We would suggest that we will expand the U.S. cowherd by at least another 400,000 head this year.”

That’s on top of the 3.5% growth in the cowherd last year, according to USDA’s Cattle report. Depending on your leanings, such aggressive year-to-year growth was either stunning or a mirror image of expectations.

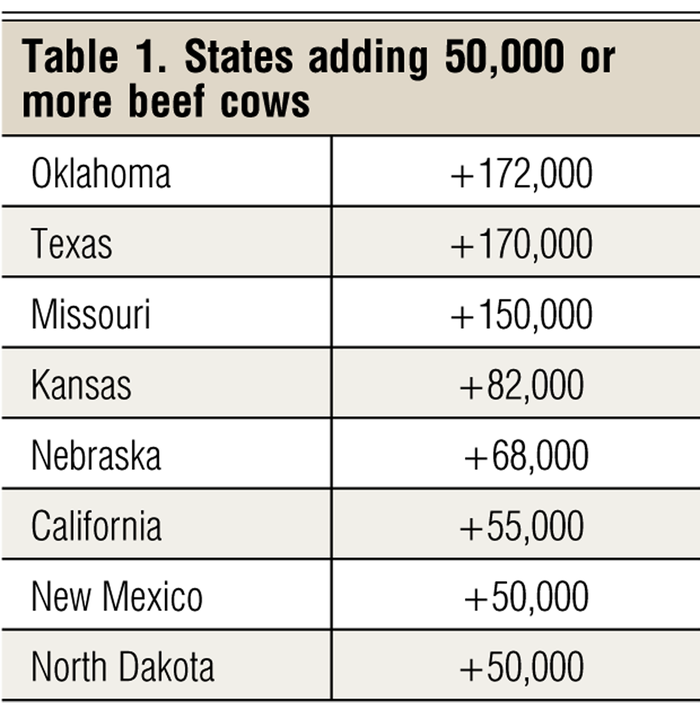

What’s more, producers added 2.1 million beef cows to the inventory since the recent low of 29.2 million head in 2014, says Derrell Peel, Extension livestock marketing specialist at Oklahoma State University. Much of the expansion continued in the Southern Plains (Tables 1 and 3) in what is likely re-stocking from the severe drought, rather than representing expansion from pre-drought levels.

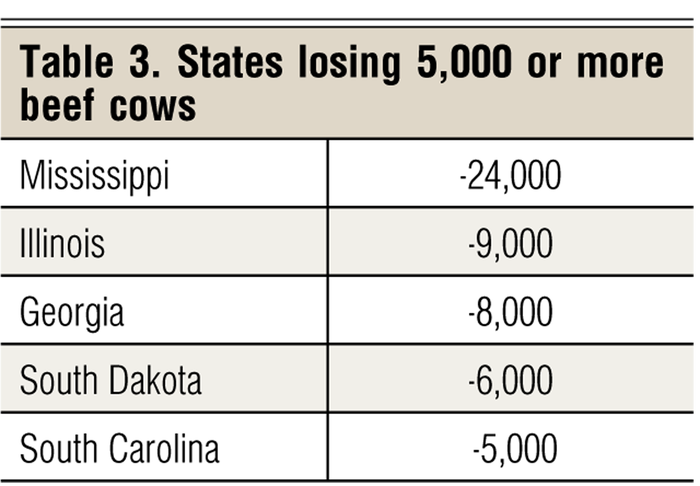

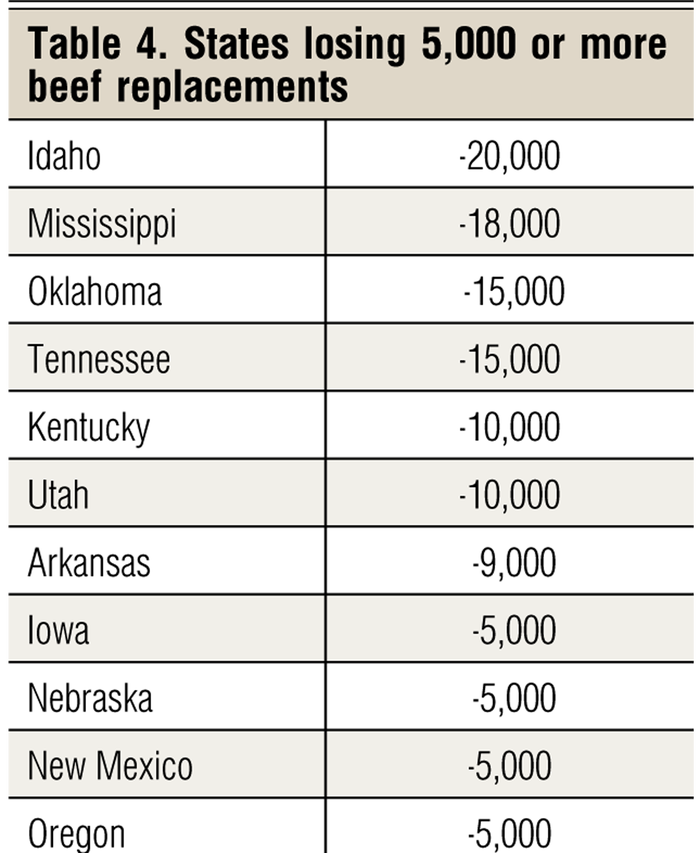

On the other end of the spectrum, much of the year-to-year herd contraction occurred in the Southeast (Tables 3 and 4).

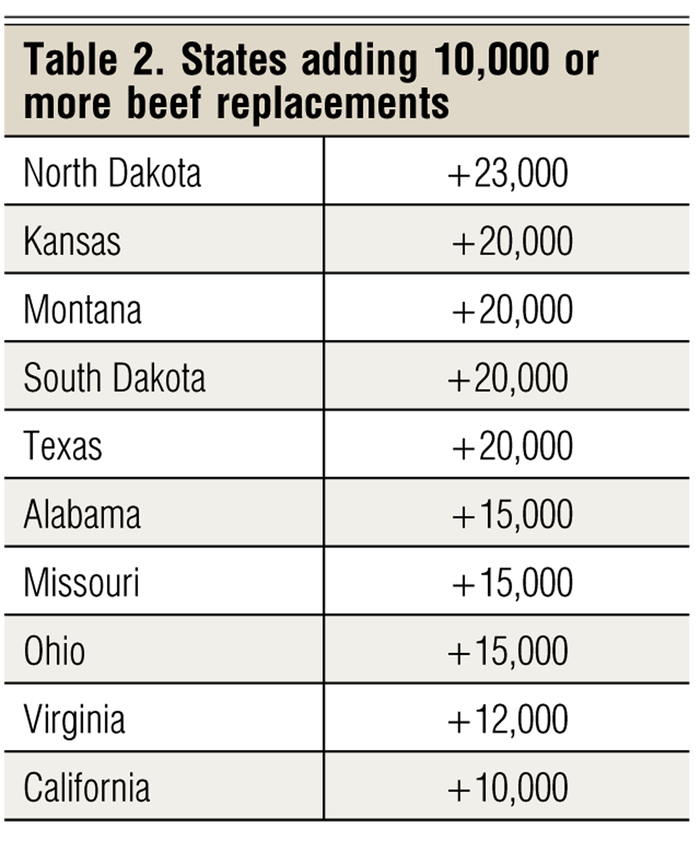

“This level of beef replacement heifers is 20.6% of the cow herd inventory, down just slightly from last year, and a level that suggests significant herd expansion will continue in 2017,” Peel explains.

For many, the rate of heifer retention was the most surprising part of the USDA report.

“Market expectations were generally for a decline of 5-7% (replacement heifers), driven by the trend in calf prices, which posted a 50% decline from the peak in the spring of 2015 to the fall of 2016,” according to analysts with the Livestock Marketing Information Center (LMIC), in a recent Livestock Monitor.

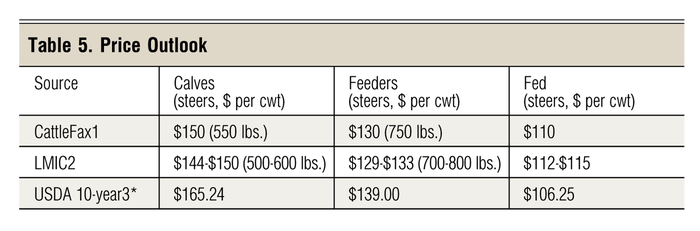

Yes, that’s on average and depends on the particular dataset. In general terms, though, while current prices are a long way from the historic highs, they’re still higher than what cattle producers dealt with for much of history (Table 5).

Regional expansion and contraction

Southern Plains

Kansas and Texas were among the five states adding 50,000 or more beef cows year to year, along with at least 10,000 more beef replacement heifers. Combined, Texas, Oklahoma and Kansas added 424,000 beef cows to the inventory last year and began the year with 35,000 more beef replacement heifers.

Northern Plains

Nebraska led expansion in the Northern Plains with 68,000 more beef cows (+4%) on Jan. 1. North Dakota was closed behind with 50,000 more cows (+6%). Producers in North Dakota also added 23,000 more replacement heifers (+13%) than the previous year.

Although South Dakota began the year with 6,000 fewer beef cows, producers there added 20,000 more replacement heifers (+5%) than the previous year.

West

California (+55,000 head) and New Mexico (+50,000 head) led the western states in expansion with 9% and 12% more beef cows that had calved, respectively, compared to the previous year. There were 655,000 beef cows in California Jan. 1; 465,000 head in New Mexico.

The only state west of the Rockies showing a year-to-year decline in beef cows was Idaho with 3,000 head fewer (-1%) for a total of 500,000 to begin the year.

Southeast

Alabama (+3%) and Tennessee (+3%) led the region in expansion, with beginning-year beef cow inventories of 693,000 head (+20,000 head) and 909,000 (+23,000 head), respectively.

The largest year-to-year decline in the Southeast and in the nation in terms of percentages was -5% in Mississippi with a beginning-year total of 476,000 beef cows (-24,000 head). Georgia was down 2% (-8,000 head) for a beginning total of 497,000 head.

Corn Belt

There were 7% more beef cows (+14,000) in Indiana at the beginning of the year for a total of 210,000. There were 3% more (+25,000 head) in Iowa for a total of 965,000 head.

On the other hand, there were 2% fewer beef cows (-9,000) in Illinois for a total of 387,000 head.

Upper Midwest

By order of percentage expansion: Michigan added 12,000 head (+11%) for a total of 120,000 head; Wisconsin added 20,000 head (+7%) for a total of 290,000; Minnesota added 20,000 head (+6%) for a total of 370,000 head.

East

Pennsylvania led the region higher with 15,000 more beef cows (+9%) at the beginning of the year for a total of 185,000 cows.

About the Author(s)

You May Also Like