April cattle futures surge on positive cutout and Fed news

While there are headwinds out in the broader economy, beef products’ improved quality and consistency are helping to buffer against significant setbacks in the market.

April 8, 2015

March was good to the cattle market. The fed market had largely chopped in a sideways pattern since mid-January and seemed poised for a sharp downturn midway through March. That wasn’t surprising given that cutout values were having trouble getting any traction.

But the middle of the month brought about a significant turnaround – largely on the heels of Federal Reserve Chair Janet Yellen’s press conference. Yellen’s inference regarding delayed timing of pending interest rate hikes sparked the financial markets, including cattle futures.

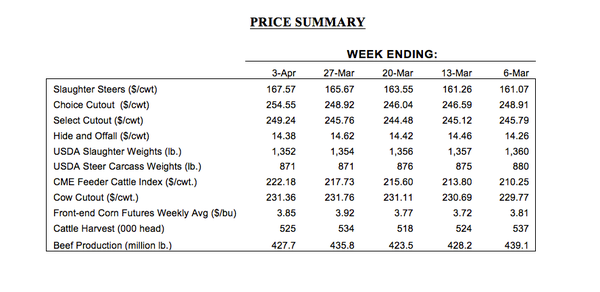

Accordingly, the April contract found renewed support and jumped from the mid-$150s to finish the month out at $161-$162. Meanwhile, better cutout values have also underpinned the fed cattle trade. The Choice cutout has gained nearly $15 during the past six weeks to close out March at $255 per cwt. Both factors helped pull fed cattle trade along. Fed steer and heifer trade added $7 per cwt throughout March with final sales ending mostly $167-$168.

Further gains from here may be somewhat more difficult to achieve given the broader economic backdrop. That assessment is largely based on the recent March jobs report: employers added just 126,000 new jobs in March – almost half of pre-report expectations.

Simultaneously, the Bureau of Labor Statistics revised downward the previously released January and February reports. While beef demand remains surprisingly robust (more on that below), the labor numbers draw attention to the broader economy and potential source of stagnation (or worse, downside risk) that needs to be monitored carefully in coming months.

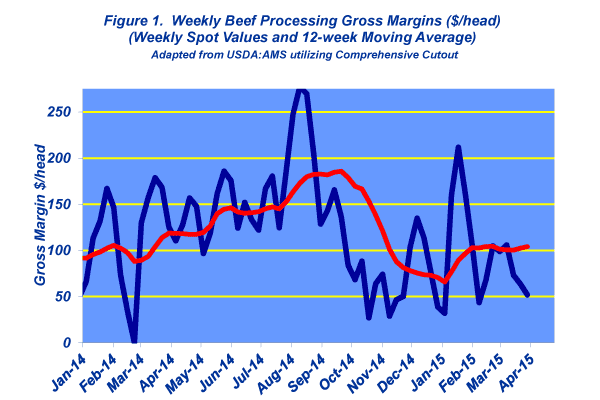

That discussion becomes even more important in light of packer margins in recent months (Figure 1). Beef processors continue to struggle to get ahead of fed cattle prices to achieve positive returns. August/September 2014 marks the last period in which the packer managed to consistently generate favorable results. Since that time (the past 30 weeks or so), spot margins have been mostly negative – the 12-week moving average is now running right at $100 per head. That’s especially important to remember as we progress into larger market-ready supply and the back-and-forth, week-to-week tussle for leverage.

The issue of leverage will be especially critical as we progress into the next several months – more so than we’ve witnessed during the past several years.

First, cattle coming out the feedyard were priced at last fall’s peak around $235-$240. The closeouts are ugly and feedyards may become reluctant sellers. And as mentioned above, packer margins are also challenging within a framework of some significant economic headwinds (both foreign and domestic). Therefore, as noted in last month’s column, “…basis will be a significant signal regarding packer demand for cattle balanced against the relative size of show lists on a weekly basis.”

Meanwhile, never mind any potential storm clouds hovering over the market, cattle feeders remain actively competitive when it comes to pricing replacements. The CME Feeder Cattle Index has staged a solid rally during the past month – adding nearly $14 to finish at $220 per cwt. As noted in two recent Industry At A Glance columns (How Much Additional Market Risk Can Cattle Feeders Absorb? and Feeder Cattle Pricing Trend Cooling Slightly in 2015): “While feeder cattle prices are off their highs from 2014, the relative strength of the feeder cattle continues to march on. Cattle feeders continue to aggressively pursue replacements and remain competitive to procure their inventory needs.”

Circling back around to the issue of beef demand, the month of March witnessed a significant and favorable benchmark that speaks to the positive long-run story for the beef industry. That is, the percentage of the fed steer/heifer slaughter mix grading Prime or Choice surpassed 75%. That level is a substantial improvement compared to just 10 years ago when the industry was challenged to achieve 55% Prime and Choice.

The outcome is significant for two reasons:

• First, Choice and Prime tonnage has increased by nearly 2 billion pounds during the past 10 years, while “other” tonnage (Select and No-Rolls) has declined by 3 billion pounds.

• Second, as a percentage of overall beef sales, wholesale Prime and Branded beef (combined) now account for approximately 17% of total beef revenue – and has now surpassed the Select category (about 14%) for the first time (see this week’s Industry At A Glance).

That broader reach of, and access to, more favorable beef products helps to ensure consumers make repeat purchases. And more significantly, it helps to ensure that the beef industry maintains improved pricing power at both the restaurant and retail levels (which has proven to underpin the market during 2014’s incredible market surge).

So while there are headwinds out in the broader economy, improved quality and consistency helps buffer against significant setbacks in the market. That doesn’t negate, though, the importance of potential volatility nor the levels of capital at risk now required to maintain daily business operations – no matter where you might be in the beef supply chain.

To close, the need for strategic risk management around both the market and your business has never been more important. Decision-making is tough work. Investing resources and time to obtain trusted, objective information coupled with disciplined review is essential to being successful.

You might also like:

60 stunning photos that showcase ranch work ethics

When should you call the vet on a difficult calving?

What's the value of a bred beef heifer in 2015?

Meet the nation's biggest seedstock operators

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)