April fed cattle market not for the weak-hearted

March saw fed cattle prices expand, only to fall back in April.

May 7, 2015

The cattle market found itself under pressure throughout April. Cash fed cattle trade was down three of the past four weeks, sliding from mostly $167-168 in March back to $160-161. So, in contrast to March when the fed market advanced about $9 per cwt, April turned around and gave most of those gains right back.

The retreat doesn’t come by surprise, however. As noted in last month’s column, “Further gains from here may be somewhat more difficult to achieve given the broader economic backdrop.” That discussion includes external considerations, such as unemployment and interest rates, plus internal factors including packer margins and comparative protein prices.

Perhaps most significant, prices backing up on the live side indicate a turn in leverage within the market. Last month’s column also noted that packers, since last fall, have endured a sustained run of sharply negative operating margins. “Beef processors continue to struggle to get ahead of fed cattle prices to achieve positive returns….That’s especially important to remember as we progress into larger market-ready supply and the back-and-forth, week-to-week tussle for leverage.”

Accordingly, the collective strategy going into seasonally larger supply has been to slow down throughput. April’s beef production ran nearly 7% behind last year’s pace, versus only 2% during the first three months of the year. That’s proven relatively effective in helping advance processing margins. However, packers remained challenged on the wholesale side; the Choice cutout took a stab at $260 but quickly found resistance—and the cutout ultimately finished the month only $2 ahead of month-prior levels.

Market analysis also needs to consider action at the CME. The April contract closed down the first three weeks of the month, giving up nearly $5 before it managed to rally with cash and ultimately expire at $160. That said, the real sign of shifting leverage surrounds the nearby basis—futures declined only $5 while cash declined nearly twice that. Therefore, the basis narrowed sharply during the past month and provides a far different take on the market going into the June contract versus last year.

From a more general perspective, though, managing basis shift over time can prove to be a challenging dynamic for both feedyards and packers. Accordingly, this week’s Industry At A Glance takes a deeper look into basis trends over time. Most notably, beginning last May, fed cattle basis (cash minus futures) assumed a positive turn. Additionally, basis swings have also comparatively amplified from previous expectations.

70+ photos showcasing all types of cattle nutrition

Readers share their favorite photos of cattle grazing or steers bellied up to the feedbunk. See reader favorite nutrition photos here.

Perhaps the most significant issue to address is if, and when, basis patterns might fall back in line with historical expectations. The implications are important from both a marketing and procurement standpoint. Either way, monitoring and managing basis has become ever more important during the past 12 to 15 months for both feedyard managers and processors.

Finally, there’s some consideration of the feeder cattle market. In my visits at various meetings this spring, producers are keenly interested in how the market might shape up for the coming year. Typically, my response generally makes reference to the fed cattle market.

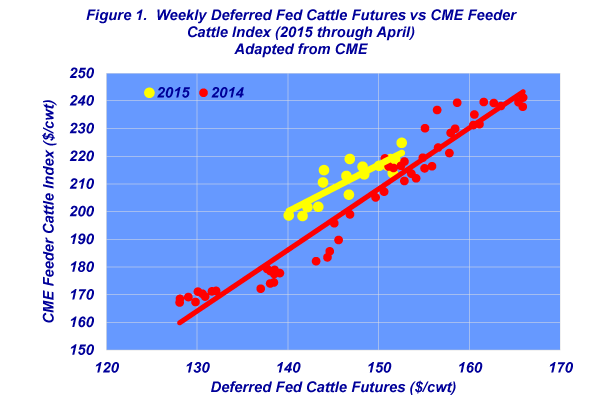

That’s best demonstrated by the chart below depicting feeder cattle price trends versus the fed cattle market. More detailed discussion can be found in the Industry At A Glance discussions: feeder cattle pricing trends and cattle feeder’s market risk.

There are several key takeaways from the chart. First, the feeder cattle market, while sharply off the highs established in 2014, remains comparatively strong in 2015. That is, at the same deferred fed cattle price, feeder cattle are bringing higher prices this year versus last year. Second, feeder cattle are largely purchased at breakeven prices – that’s based on expectations of ration costs and the deferred fed cattle futures contract against which the cattle are placed.

Subscribe now to Cow-Calf Weekly to get the latest industry research and information in your inbox every Friday!

The deferred fed cattle contract comprises the overwhelming component for the feeder market. As such, the graph highlights the relationship between the fed cattle futures market and the spot feeder cattle market. The inherent question among producers often goes something like, “What are feeder prices going to be this fall?” And the appropriate answer is, “That depends on what the board is telling us about fed prices.” And that’s why discussions about beef demand, packer margins, leverage, etc. are so important to the entire supply chain.

To close, as noted every month, capital requirements associated with business operations at all levels within the production chain are considerably larger now versus just several years ago. Therefore, careful consideration of risk management strategies around both the market and the business has never been more important. Strategic decision-making requires investment into acquiring accurate, trusted information and subsequently making sufficient time for disciplined evaluation. Both components are essential to being successful over the long-run.

You might also enjoy:

When should you call the vet on a difficult calving?

60+ stunning photos that showcase ranch work ethics

Try one of these 9 ranch management concepts to improve your ranch

How to treat lump jaw disease in cattle

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)