Beef cow slaughter remains elevated

What's the biggest reason behind the uptick in beef cow slaughter?

June 8, 2022

A few months ago, Kenny wrote about beef cow slaughter outpacing 2021 levels. He discussed how drought and cull cow prices, among other factors, were contributing to high beef cow slaughter totals in 2022. I want to follow up on his article with the most recent data and also discuss some of the regional breakdowns of cow slaughter.

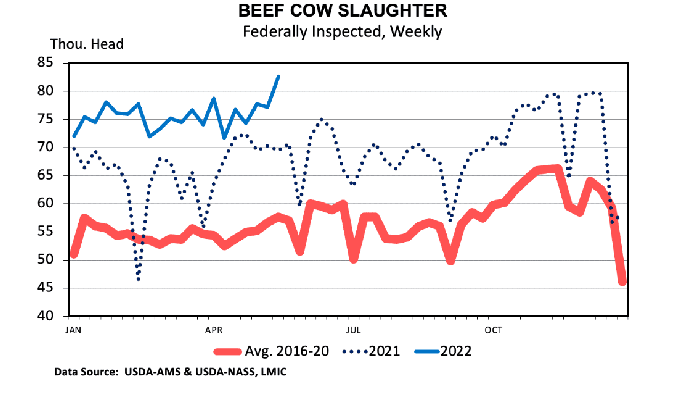

So far in 2022, beef cow slaughter is 15 percent higher than the same period in 2021. This is equal to approximately 200 thousand more head of beef cows processed this year. Beef cow slaughter averaged about 65 thousand head per week in 2021 but is averaging about 75 thousand head per week in 2022. In the most recently reported week, beef cow slaughter topped 80 thousand head for the first time since 2012.

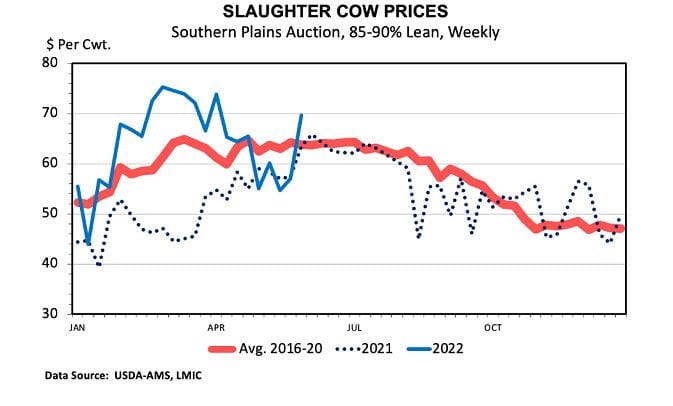

Drought, higher feed and other input costs, and stronger cull cow prices continue to be the likely reasons behind the increase. Slaughter cow prices in the Southern Plains did drop pretty sharply last month before rebounding as shown in the chart below. Looking at the regional slaughter data, it does appear that beef cow slaughter has increased more in areas with drought. Beef cow slaughter in Region 6 (AR, LA, NM, OK, and TX) is up 30 percent over 2021 and region 7 (IA, KS, MO, & NE) is up 29 percent. However, beef slaughter is also about 20 percent higher in Region 4 (AL, FL, GA, KY, MS, NC, SC & TN) where rainfall has not been as much of an issue.

Beef cow slaughter typically accounts for roughly half of total U.S. cow slaughter. Dairy cow slaughter makes up the other half, but dairy cow slaughter is down about 3 percent so far in 2022. Stronger milk prices are likely keeping more dairy cows in the herd and some expansion in the dairy herd could occur. Meanwhile, all signs continue to point toward continued contraction of the U.S. beef cow herd in 2022. This contraction would suggest continually tightening calf, feeder cattle, and fed cattle inventories over the next few years.

Source: Mississippi State University, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like