Boxed beef stages huge rebound

As evidence of strong consumer demand at retail, boxed beef prices are showing strength.

September 3, 2020

The world is slowly returning to normal and figuring out ways to co-exist with COVID-19. However, “normal” is a relative term.

That’s especially true when it comes to defining economic activity around the HRI (hotel, restaurant and institutional) sector – social distancing and slowdown in travel has greatly impacted the food service industry. That has broad implications for the beef industry; much of the industry’s high-end product gets funneled into food service.

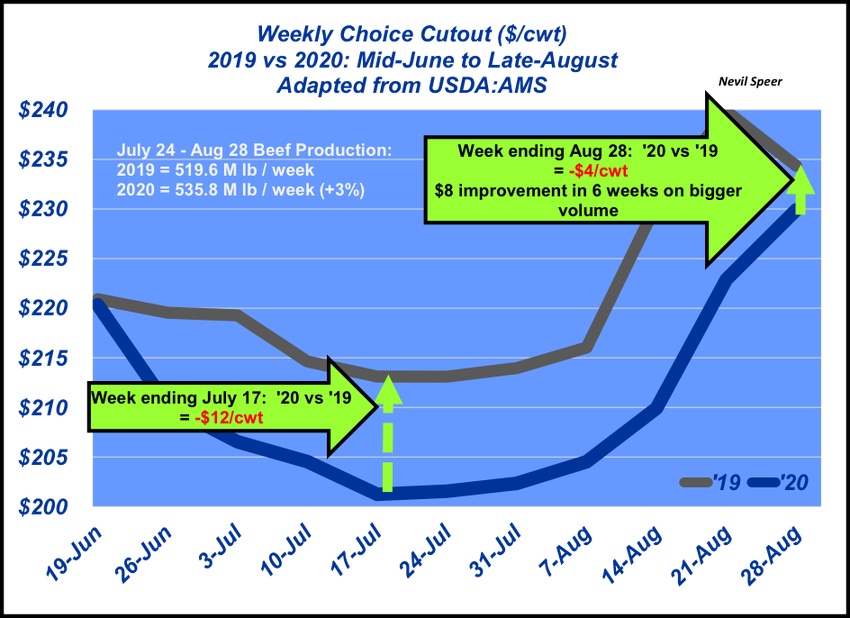

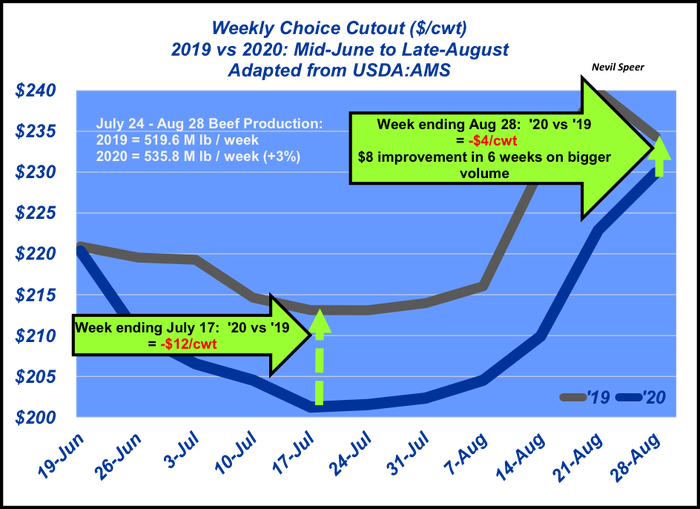

Meanwhile, though, wholesale beef prices have staged a huge recovery during the past several months. Consider that in mid-June, year-over-year (YOY) wholesale beef prices were essentially identical at $220 per cwt. From there, though, 2020 witnessed a decline down to ~$201 over the next four weeks – leaving this year’s mark about $12 behind last year. The relative under-performance in ’20 wasn’t surprising given the given the sharp slowdown from food service.

However, over the following six weeks, the Choice cutout closed the gap by $8 and finished August at nearly $230, just $4 behind on a YOY basis. Not only did the cutout close the gap since mid-July, but that happened on bigger beef volume – with 2020 weekly production up roughly 3% versus 2019. Best of all, that’s happened without much buying support from the HRI sector.

Seemingly, the beef industry is benefitting from very strong retail pull. Consumers are actively purchasing beef at the retail level – including high-end product – and establishing solid support for wholesale beef prices. That observation is best reinforced by renewed divergence between rib/loin versus round/chuck values.

This occurrence inherently invokes questions of whether or not this will be a permanent shift. That is, will consumers increasingly expect to purchase beef at retail at the high-end of the market?

Regardless of how this plays out going forward, it reinforces the importance of beef quality and consistency. The advances the industry has made during the past 10 to 15 years is all-important to consumer behavior – else we wouldn’t be witnessing this sort of market action. And it’s paid dividends at the most challenging time, enabling retail to backfill much of the load that’s often carried by the HRI sector.

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like