Calf marketing outlook: This is the year to sell added pounds

Beef economist Harlan Hughes breaks down the numbers and offers his feedback on extended calf marketing alternatives.

December 23, 2016

Calves are weaned, corn is harvested and dry cows are grazing cornstalks. Now my study herd manager is focusing on marketing his 2016 calves. All the heifer and steer calves were still on the ranch as this was written in late November, and he was considering a comprehensive 45-day preconditioning program.

At the end of that 45-day preconditioning period, his proposed plan called for sorting out his replacement heifers and making the decision to do one of the following:

Market the remaining calves, or to background the remaining calves for a target marketing in mid-March at about 850 to 875 pounds.

Move feeders to a commercial feedlot to be grown and finished with a target June harvest.

Let’s look at market price projections for each alternative, with a goal in mind to generate a positive return after covering the beef cow losses with the 2016 calf crop.

Price analysis

undefined

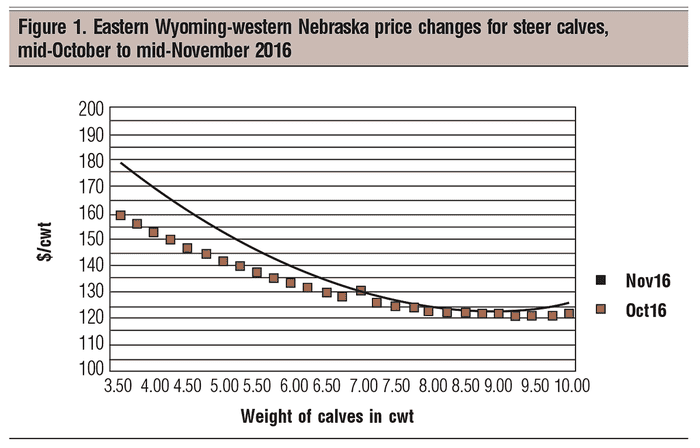

My November 2016 sale barn price analysis for eastern Wyoming-western Nebraska indicates a significant price increase over October 2016 prices for lightweight feeders (Figure 1). Indications are that corn farmers are going to market some of their lower-priced corn through cattle.

Sale barn prices in mid-November again indicated a large quality variation. There was a large discount for full or fleshy cattle. It appears that buyers rewarded quality and preconditioned feeders.

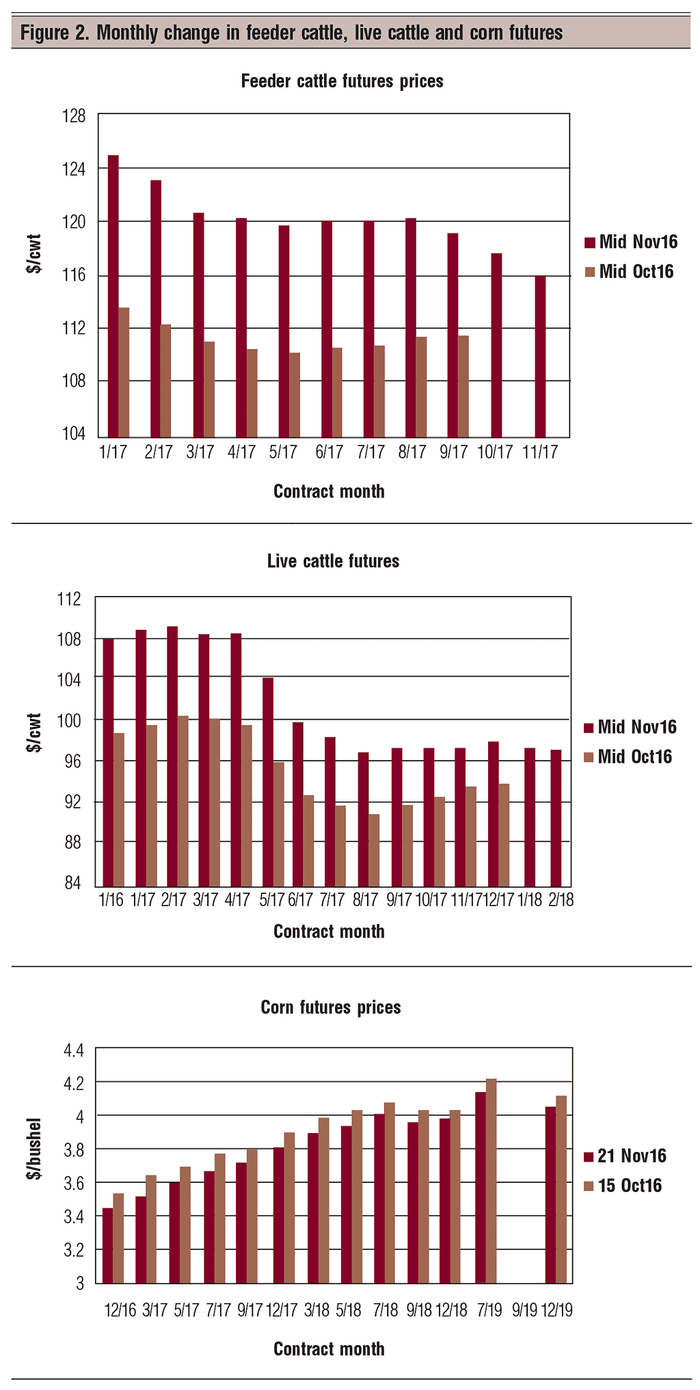

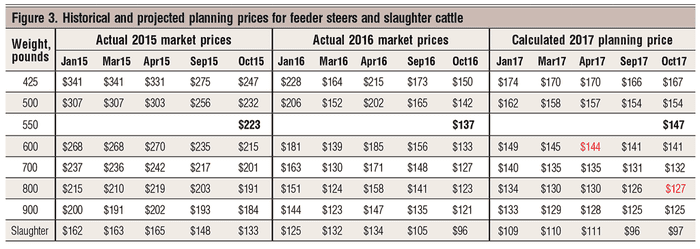

The higher mid-November futures prices presented in Figure 2 are reflected in my November price projections for the rest of 2016 and 2017 (Figure 3). Basically, this month’s price projections hint that we may have bottomed out for this price cycle. I sure hope so!

I am projecting October 2017 weaned 550-pound steer calves at $147 per cwt — up $3 from October 2016. Not a very big improvement, but at least going in the right direction. The two red planning prices in the 2017 projections in Figure 3 suggest that next summer could be a good year to run short yearlings on grass.

Preconditioning projection

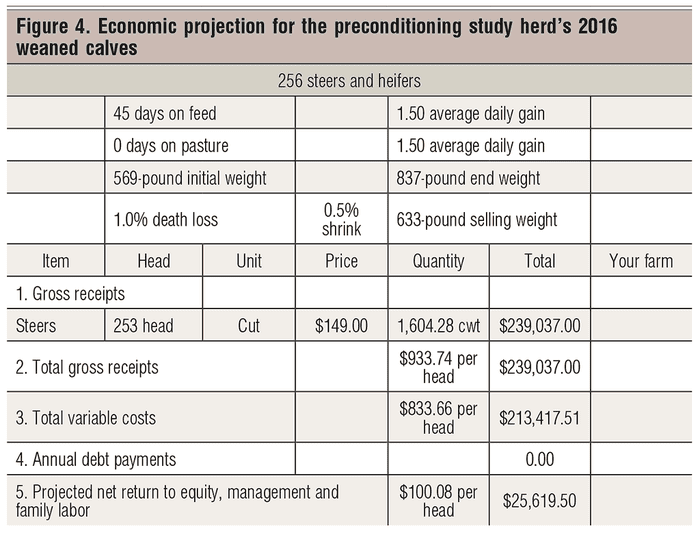

I turned to a Virginia Cooperative Extension budgeting model for projecting the economics of preconditioning the study herd’s 2016 weaned calves. Space only allows me to present a summary table of my preconditioning projections for the study herd (Figure 4).

If market prices stay the same from weaning through the end of preconditioning, I am showing only a $6-per-head gain. Clearly, my budget for preconditioning suggests that one has to get a market price increase to make money preconditioning 2016 calves.

The economic projection for preconditioning 2016 calves presented in Figure 4 is based on two critical assumptions. First, it is based on a projected $11-per-cwt marketing kick from mid-October 2016 to early December 2016. This is projected based on my November 2016 price analysis study.

Second, it is based on a $4-per-cwt price premium for preconditioned calves. Given these two assumptions, Figure 4 projects a $100-per-head premium this year for preconditioning October 2016 weaned calves and selling them 45 days later in early December 2016. The $100 per head seems high, but that is what the analysis suggests.

Postweaning projection

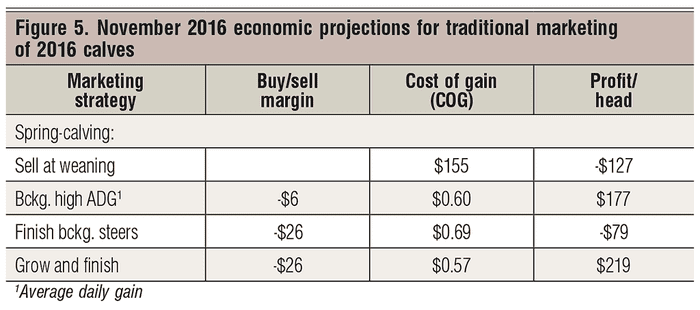

For several months now I have been presenting my updated monthly economic projections for backgrounding and/or retained ownership of this study rancher’s 2016 postweaned calves. Each month’s projections are updated with those latest planning prices. Figure 5 presents my latest projections for:

calves sold averaging 569 pounds at the local sale barn on their October 2016 weaning date

backgrounding 569-pound October 2016 weaned calves to 875 pounds on a high-gain ration and marketing in February 2017; even backgrounding at a 2.0 ADG projects a potential profit.

finishing those background calves in a custom feedlot with a scheduled harvest date of June 2017

or, retaining ownership by growing and finishing in a custom feedlot with a projected harvest date of May 2017. The key here is the May marketing date — a hard marketing date to hit. Harvest prices are projected lower in June 2017.

The two finishing programs have their final selling price hedged in the futures market to reduce the marketing risk associated with these feeding programs. The grow-and-finish custom program projects to be the most favorable, but probably is still the most risky of all the marketing programs.

Hedging the sale price of harvested animals should reduce some of that price risk. A professional marketing service is highly recommended. In most cases, the custom feeder will provide this marketing service.

In summary, the preconditioning program appears to be a viable marketing program that is projected to generate a positive $25,000 maximum net return for the study rancher with his 250-cow herd. It does not, however, cover the $31,000 loss generated by the beef cow herd.

The ranked marketing alternatives, in my opinion, are:

Background the steer calves and heifer calves not needed for replacement and sell them as feeders: the lower-risk alternative, but $9,000 less projected net income.

Retain ownership in a custom lot. The higher-risk alternative, but with a projected added $9,000 net income.

Preconditioning the calves and selling them in December 2016 would be my third choice.

A side note: My budget for wheat pasture cattle projects a positive return this year. In summary, this is the year to sell added pounds!

About the Author(s)

You May Also Like