Cash fed cattle trade and feedyard returns

Are packers colluding to manipulate the cash fed cattle market? The data say otherwise.

May 29, 2019

Over the past few weeks, this column has highlighted some industry perspective regarding captive supplies. The purpose being to provide some perspective surrounding R-CALF’s lawsuit against the four major packers.

The lawsuit alleges the four major packers conspired to violate U.S. antitrust laws in order to artificially depress prices paid to U.S. cattle producers. R-CALF further alleges that conspiracy occurred through an organized reduction of cattle purchased in the weekly cash market. The implication being that undue influence on the cash market by the packer led to unprecedented profits – at the expense of beef producers.

Last week’s graph featured the relationship between the level of cash trade and Tyson’s operating margins between for fiscal years 2010 through 2018. Several things are important from that data:

The relationship between cash trade and operating margin is positive – that is, as cash trade increases, operating margin also improves. That trend runs contrary to R-CALF’s contention against the packing industry.

Second, that said, the relationship between cash trade and operating margin is weak – nearly 86% of the variation in operating margin is explained by something other than a relationship with the proportion of cash trade.

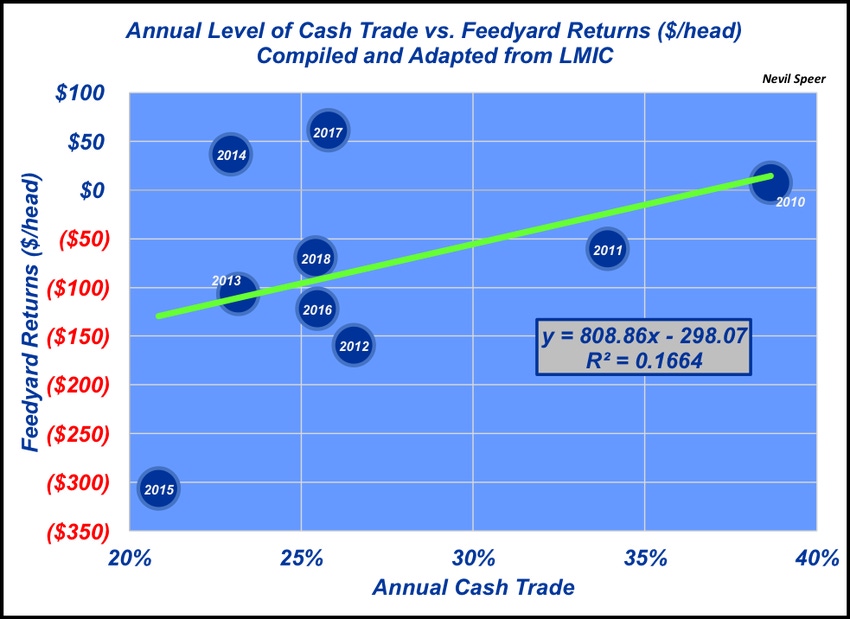

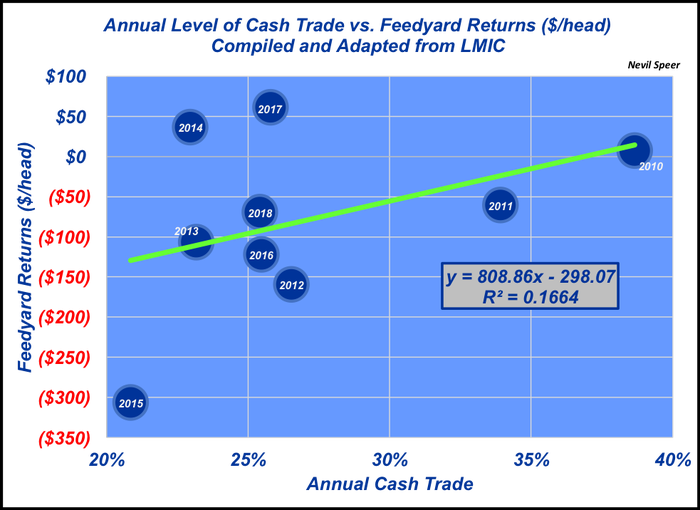

This week’s illustration looks at the relationship between cash fed cattle trade and annual feeding returns. The relationship between the two is positive. That is, as cash trade increases, feedyard returns also improve.

However, parallel to last week’s discussion, like packer operating margins, the causal relationship is weak: approximately 85% of the variation in feedyard profitability is explained by something other than a relationship with the proportion of cash trade.

Similar to last week’s summary, based on this data, it’s a stretch to draw any conclusions about manipulation of the cash market and its influence on closeouts. In both cases, packer operating margins and feedyard returns, there are numerous other factors at work besides the proportion of cash trade.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected]

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)