Cattle Market Outlook: Economic Indicators Point To Better Days Ahead

The best cattle market strategy for now is likely to “hold.”

April 3, 2013

One of the best-known scenes in the movie “Braveheart” (one of my favorites) is the representation of the Battle of Stirling. In the heat of the battle, William Wallace (Mel Gibson) implores his men to remain steady as the English soldiers bear down on the Scots. As the cavalry approaches, Wallace on four separate occasions orders his troops to, “Hold!” And then just at the right moment they raise their spears to successfully stop the horses from ripping through the Scots’ ranks.

If you’ve been a participant on the long/selling side of the market in recent months, you’ve likely felt like those Scottish rebels. The market has made it such that you’ve had to withstand the charge of the bears.

Last month’s column noted that February established a new unfriendly market tone, “…the first time that’s occurred in several years…the trade assumed worries about a variety of factors around the consumer and beef’s pricing power.” However, February’s close made it seem like all that had been finally repelled. There seemed to be some new life to the cattle market and hope for better prices in the months to come. That was all short-lived.

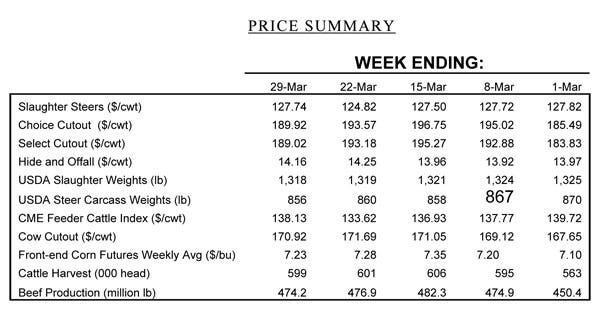

Fed prices managed to spike up to $127-128 on the heels of winter weather and better cutout values through the middle of March. However, the market couldn’t hang on to those gains. Traders punished contracts at the CME, the cutout softened $6 in nearly as many days, and March fed trade was right back to $124-125 – similar to much of February’s market level.

Finally, though, as March closed out the quarter, the appeal to hold looked to be rewarded. The first quarter finished cash business at $127-128. Perhaps more importantly, though, the CME staged a sharp reversal: the April and June live cattle contracts both jumped about $3 on the last two trading days in March.

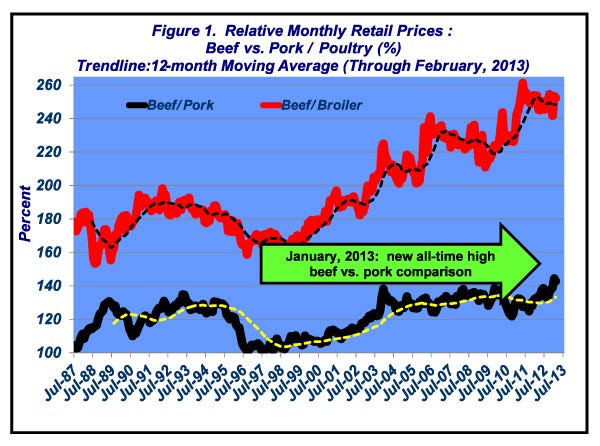

The bigger question always revolves around, “What happens from here?” Several items are crucial to the market’s general direction in the coming months. Although not new, the primary factor will be consumer reaction to beef’s relative pricing structure in the protein market as we head into grilling season (Figure 1).

As mentioned, that worry has been lingering for well over a year now. And it gained some traction within the broader discussion of market direction in the futures pits. However, January and February prices established new absolute highs for retail beef prices. Of course, that can be read one of two ways:

The bear call says beef is NOW too expensive and consumers will trade down to pork and poultry, or

The bull call argues consumers continue to shrug off higher prices and there’s no need to worry about the incremental gain.

Thus far, the evidence is in the bull camp; consumers continue to prove their collective willingness to buy beef – even at higher prices.

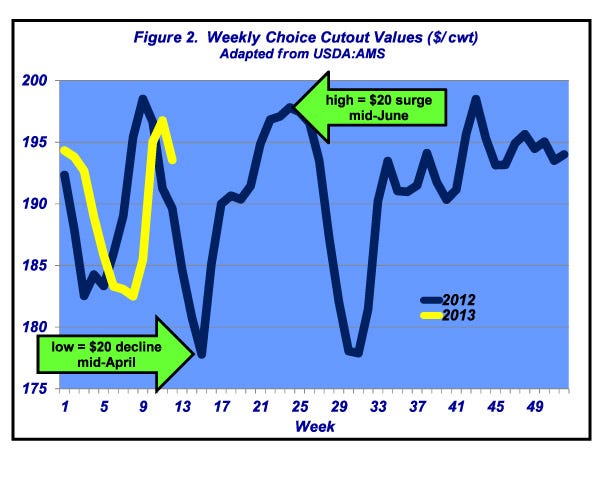

The wholesale beef market has more direct and immediate implications for cattle prices; as I’ve mentioned many times in this column – as the cutout goes, so goes the live market. And while that’s obviously influenced by the ability to pass higher prices on to consumers, cutout price patterns also possess their own characteristics depending upon seasonality, contracts built around featuring and/or specials, and overall beef supply.

Some perspective from last year is beneficial (Figure 2). The market produced some big swings during the first half of the year. The Choice cutout bottomed in mid-April and then surged $20 in a little over eight weeks. So, while the cutout’s performance of late is disappointing (and has weighed on the futures market), it’s remarkably similar to last year’s pattern – it’s just running several weeks behind. And therein lays the real key to getting the market moving into positive territory – warm weather certainly would help induce consumers to get out, go shopping, eat at a restaurant and/or fire up the grill.

Sluggish sales because of weather aren’t unique to the beef complex. Many retail segments have reported weather-related, weaker-than-expected sales. A nationwide warm-up will likely spark another push in the wholesale market. The pervasive question remains, though: how high can the cutout go? The answer will dictate how high fed prices can climb in the coming several months.

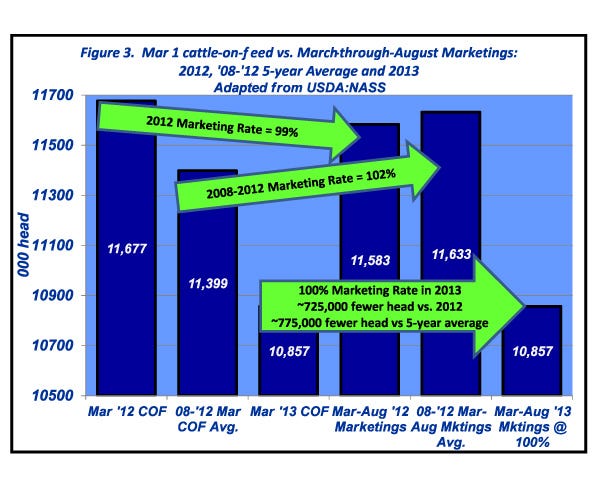

Last month’s discussion also included some focus upon the supply side of the equation. It’s useful to take another look there with a little different perspective. The March 1 cattle-on-feed population was pegged at 10.86 million head; that’s down 7% vs. last year’s mark, and 5% vs. the five-year average (Figure 3). Those cattle have largely been placed to be marketed over the next six months or so. IF all the March 1 inventory gets marketed between March and August, the deficit is nearly 775,000 head vs. the five-year average; the equivalent of approximately 130,000 head/month.

Let’s pull all of this together:

First, the economy is finally beginning to show some signs of vitality – there have been more positive indicators in recent months than negative assessments of growth. Although there is a lots of work yet to do, perhaps the consumer may begin to really perk up in the coming months. Not to mention, beef has survived higher prices even in the face of severe economic head winds.

Second, supply is very tight. Sure, we’ll make up for some of that with bigger cattle but that still doesn’t erase the potential deficit in the months to come.

So, there’s certainly reason to believe the market has some room to run from here as we begin to head into grilling season. Markets can always surprise and disappoint. But most indicators reveal there are some better days ahead – it’s too early to throw in the towel. So the best strategy for now is likely to “hold.”

Interested in more market news? Subscribe to Cattle Market Weekly for the latest cattle market trends every Saturday.

One last market observation comes on the heels of USDA’s March Grain Stocks report. It definitely threw the market a curveball with May corn sliding nearly 95¢ in two days as this column is being written. These huge swings have become increasingly frequent – the implications of which are best summed up by Darrell Good, University of Illinois Extension economist:

“While it should be expected that the market will not always correctly anticipate USDA estimates, the recent pattern of large and seemingly alternating direction of the surprises in the quarterly corn stocks estimates is problematic.”

So while volatility makes for welcome opportunities for risk management, huge deviations between private and USDA estimates seemingly makes that task seem like nothing more than gaming the reports. Indeed, that’s problematic.

Either way, as mentioned every month, reactive markets mandate the need to be vigilant about news, developments and estimates. Thus, it pays to remain informed and maintain objectivity around all aspects of the business.

You might also like:

BEEF Video: A Drought Management Plan Is Key

60 Stunning Photos That Showcase Ranch Work Ethics

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)