China, Beef, and Corn

Where will China’s purchases go from here?

June 6, 2022

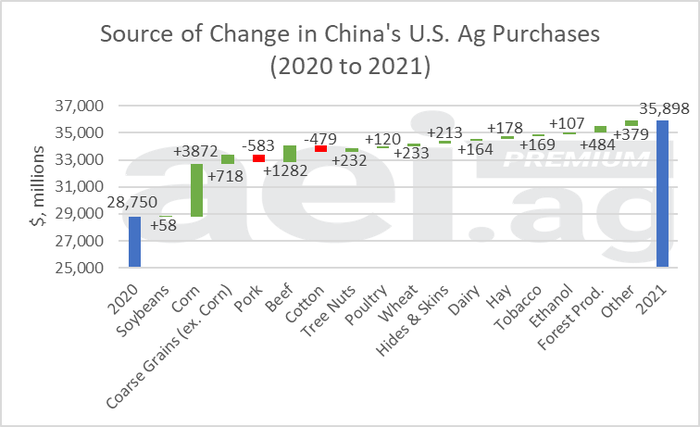

China purchased a record $35.9 billion in ag products from the U.S. in 2021. While activity fell short of the Phase 1 trade agreement thresholds – if that’s even a thing anymore – it was a roughly $7 billion, or 25%, increase from 2020 activity and the previous record of $29.0 billion (2013). This week’s article looks at the commodity-level changes in purchases.

Sources of Change

Figure 1 shows the sources of change in China’s U.S. ag purchases from 2020 to 2021. It’s been no secret that China has been making large purchases of corn, but the uptick in corn purchases was $3.9 billion higher from 2020 to 2021. These purchases are significant as they are 1) more than half of the total $7 billion increase and 2) a massive uptick from China’s recent corn purchases. In total, China’s purchased $5.1 billion of U.S. corn in 2021, up from $1.2 billion in 2020 and $55 million in 2019. Previously, China’s corn purchases exceeded $1 billion in 2012 ($1.3 billion).

The second major contributor to China’s record purchases was beef. In 2021, China purchased a total of $1.6 billion worth of beef, only slightly behind its pork purchases ($1.7 billion). Activity in 2021 was nearly $1.3 billion higher than in 2020 ($310 million).

Taken together, 72% of the $7.1 billion in new purchases came from corn and beef. While these two commodities might not come as a surprise, keep in mind China bought very little of these commodities in recent years. From 2010 to 2020, China purchased a total of $5.7 billion of corn and beef. To clarify, that’s the cumulative purchases of both commodities over 11 years. For context, combined purchases of beef and corn were nearly $6.7 billion in 2021. In other words, China bought 18% more beef and corn in 2021 than all it did in the preceding 11 years. The magnitude and short time frame in which these changes took place are hard to contemplate and put into an appropriate scale.

Exports Didn’t Increase For Every Commodity

Figure 1 provides two additional insights. First, not every commodity saw an increase in purchases. China’s pork purchases were nearly $600 million lower, as China recovered from the African Swine Fever (ASF) induced supply shocks. Cotton purchases also turned lower.

Second, China’s soybean purchases were essentially unchanged between 2020 and 2021. This is perhaps the biggest surprise in the data. Typically, soybeans account for 50% of China’s total purchases, so it’s a bit of a surprise that total purchases hit all-time highs and the largest single-commodity purchased didn’t meaningfully contribute to the surge. The combination of corn and beef purchases increasing as soybeans stayed unchanged resulted in soybeans accounting for only 39% of China’s total U.S. ag purchases in 2021.

Wrapping It Up

The majority of China’s new purchase record came from two commodities that China purchased very little over just two years ago. It’s also noteworthy that China’s purchase- soybeans- were largely unchanged.

It’s important to note that China’s record purchases in 2021 corresponded with a return of high commodity prices. This is to say, some of the increases were due to changes in the quantity purchased, while some of the changes were due to changes in the prices.

Where will China’s purchases go from here? As always, it will be important to keep an eye on soybean purchases, but also consider future purchases of corn and beef. It’s unclear, at this point, if corn and beef are a short-term phenomenon or the start of a new trend.

Source:Agricultural Economic Insights, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like