Choice beef rules the consumer’s shopping cart

The beef complex is producing more beef that’s grading more favorably than ever. But the Choice-Select spread is at all-time highs. It appears there’s a new and more favorable demand for Choice product.

June 13, 2016

There’s been quite a bit of media attention on the Choice-Select spread in recent weeks. Deservedly so, as the spread has surged higher – approaching nearly $24 for the week ending June 10. That’s an important – and somewhat surprising – development within the market for several reasons.

First, the grading trend remains impressive; the 52-week average is running nearly 75% Prime and Choice. As such, the beef industry is producing more product that possesses higher quality grades. Second, overall throughput has also been swift in recent months. Beef production during April and May is running nearly 6% ahead of last year’s pace. In other words, the beef complex is producing more beef that’s grading more favorably than ever.

Normally, given those conditions, the expectation would be for the spread to narrow. That is, greater quantity (less scarcity) of Choice product would typically force it to garner a lower relative price to clear the market. But that’s not been the case. It appears the market is working within the framework of a new and more favorable demand for Choice product.

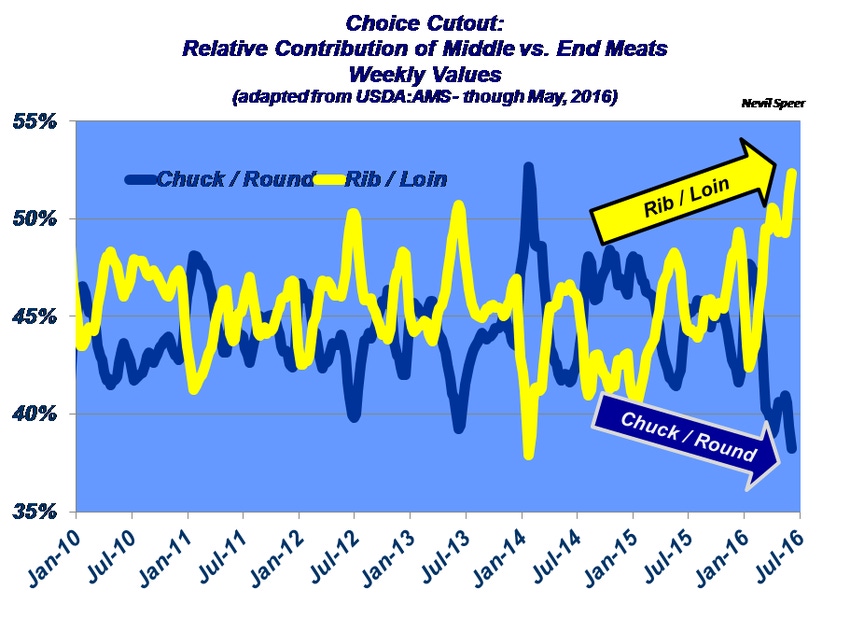

There’s a similar phenomenon occurring across the value of primals. This week’s illustration depicts the relative contribution of middle meats (rib and loin) versus end meats (chuck and round) to the overall Choice cutout. As May ended, the rib and loin comprised over 52% of the overall cutout value – approximately 10% higher versus the start of the year.

In combination, high-end, high-quality beef has been the driver of the market in recent months and appears to be the impetus for packers chasing cattle (and driving up basis) during much of April and May. That’s an important trend. How do you perceive these trends in the market? Does the trend denote a significant and lasting shift for the beef complex? How do you foresee this shaping up for the rest of the year – especially in light of consumer uncertainty about the economy? Leave your thoughts in the comment section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

6 tips for proper electric fence grounding

Rubes cartoons updated with new laughs

5 tips for preventing diagnosing & treating foot rot

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)