Consumers & The Weather Offer Double Whammy

Summer 2012’s challenging weather, along with rising consumer anxiety over the economy, are combining to make producers’ decision-making particularly challenging this season.

August 2, 2012

There just isn’t space to do it all justice. Consumers and weather – separately, each is a powerful market force – but mix them together and the result can be especially potent and fickle.

That’s precisely where we are – navigating the influence of both simultaneously. That creates lots of uncertainty and turbulence around the business. As noted in last month’s column, that’s an enduring theme of late making for difficult decision making.

On the people side, it appears the domestic consumer is retrenching. For example, July’s Consumer Sentiment reading (72.3) represents the low-water mark for the year. At the same time, overall consumer spending in June was flat.

Those indicators, along with several others, portray a very cautious attitude about spending among consumers and a muddling economic recovery. That’s influencing the food business all around. Recent quarterly results saw restaurants like McDonald’s, Starbucks and Chipotle all reporting spending restraint among consumers – a trend that’s seemingly accelerated during the past several months.

The hardest aspect within this environment, though, is predicting spending in the second half of the year. That’s especially true given convergence of ongoing job market stagnation, election-year politics, and continued worries regarding fallout from the Eurozone. That inherently invokes questions about beef spending, price resistance and market trends going forward.

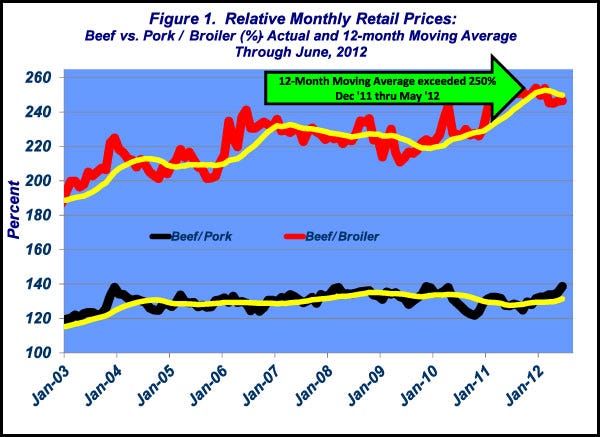

The primary concern revolves around business strategies and management of the margin mix associated with pork, poultry and beef. Figure 1 reflects beef’s relative retail price performance over time. The price trend, particularly the relationship vs. chicken, parallels the fed market’s run since late 2009. Increasing consumer restraint coupled with an outlook for food prices to rise could prove to be dicey. The primary question within that environment revolves around beef’s competitiveness in the months to come.

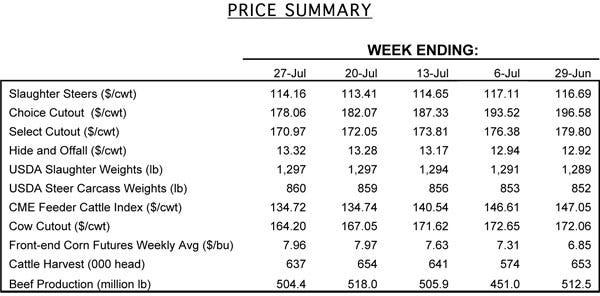

Nuts and bolts of the live market

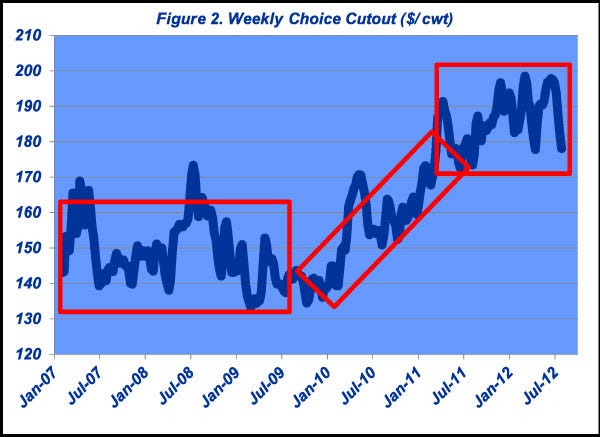

The discussion above mandates some perspective around the nuts and bolts of the live market. Figure 2 summarizes the weekly Choice cutout price trend since Jan, 2007. The market has exhibited three distinct phases:

A sideways chop between 2007 through 2009,

A significant (and surprising) upsurge beginning in late-2009 and lasting through the early part of 2011 and

A final period of back-and-forth between $180 and $200 for the past year or so.

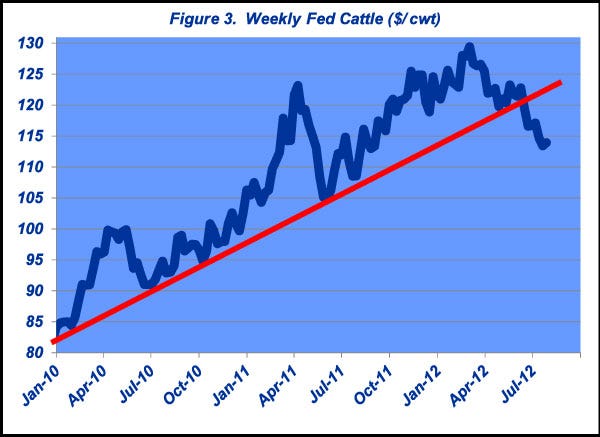

The third phase represents the period in which live prices have stalled out and breached the long-term trend line (Figure 3). The recent downturn isn’t surprising given that summer lows were likely to end up somewhere around $110. And so it appears the market is in the process of solidifying a seasonal bottom.

However, the really important question involves the extent to which live prices can recover and/or establish new highs. That’s particularly true given recent action in the futures market that has solidified a two-tiered market outlook. That is, August futures are trading around $119, while next April’s contract has encroached $135.

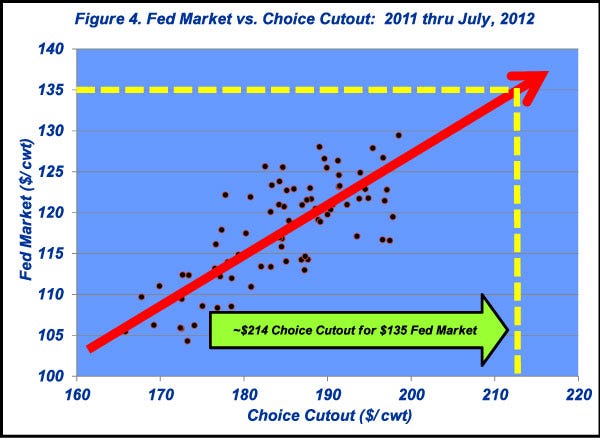

Meanwhile, Figure 4 provides some context around what needs to occur if fed trade is going to reach the mid-$130s next spring. The graph represents the relationship between the fed market and the Choice cutout since January 2011. Extrapolating the regression line out reveals the cutout needs to trade (more or less) around the $210-$215 level to support a $135 fed market (assuming steady drop values and normal leverage on both side of weekly negotiations).

That mark represents a significant gain in cutout values from current levels. Wholesale prices will need to advance about 16% from current levels – that’s doable but at the upper end of historical summer-to-spring advances.

Some of the gain should be supported by dwindling supply in 2013. But therein enters the question of sustainable beef demand and the influence of higher prices. Some discussion needs to occur about potential for price resistance – reduction in trade volume as prices work higher. However, coming full circle to the longer-term strategies, there’s also the question of demand destruction – that is, a decision to reposition and shift offerings because of price. All that remains to be seen, but it highlights the work ahead for the fed market and the beef business in general.

As mentioned earlier, there just isn’t sufficient space to cover it all. But let’s circle back around to the primary issue of decision making. The drought’s influence on the corn market has made that aspect especially difficult. Most importantly, heightened volatility only adds to the need for proper risk assessment. That’s because in these types of markets risk management can cut both ways in a short period of time:

Protection from danger (the market could work higher – I need to secure feed at these prices) and

Opportunity cost (the market was overpriced – I inadvertently purchased feed at the wrong time).

Whatever the priorities of the business, discipline is critical. But don’t forget to leave a little room for error (and self-forgiveness) along the way if you don’t get it exactly right – because in this game getting it exactly right is impossible. As always, remain objective, stay informed!

Nevil Speer is a Western Kentucky University professor of animal science. Contact him at [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)