Could we see more beef cows coming to town?

If risk appetite for cows is dampening, the beef industry will likely witness more cows coming to town this fall as ranchers wean calves and cull cows

November 10, 2016

This time of the year marks not only the fall run, but also it serves as an important period in terms of culling decisions for most cow-calf producers. Many analysts are questioning the resilience of the current cowherd expansion, given the market’s sharp pullback that began in 2015. That’s a particularly important topic considering how quickly the markets have backed up and the subsequent margin pressure that’s occurred for the cow-calf sector.

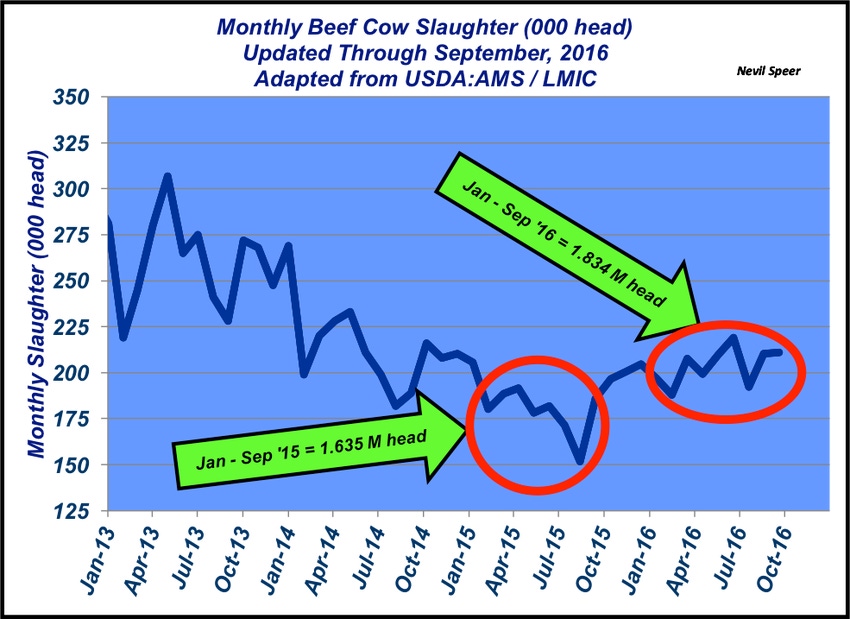

This week’s illustration depicts monthly beef cow slaughter over the past several years. Aside from major weather events, the overall trend can be telling about the collective decision making out in the country. During the first nine months of 2016, beef cow slaughter totaled 1.834 million head – about 200,000 head more on a year-over-year comparison, yet 100,000 head fewer versus 2014.

The relative slaughter rate is also telling; that is, beef cow slaughter versus January 1 beef cow inventory. Beef cow slaughter through September in 2016 represents approximately 6% of the inventory (30.33 million head). Meanwhile, the 2015 slaughter rate was 5.6% of the starting inventory (29.30 million cows). And 2014 beef cow slaughter through September equaled 6.6% of 29.09 million beef cows on January 1.

If risk appetite for cows is dampening, the beef industry will likely witness more cows coming to town. Therefore, as the beef industry enters the heart of keep-cull decision making and ongoing concerns around the market, where do you see these trends headed? Will beef cow slaughter increase in coming months and slow cowherd expansion? Alternatively, are feed supplies and pasture conditions, with the exception of the Southeast, sufficient for most producers to fight the market and hang on to their cows? Has your strategy for expansion changed because of recent market swings? Leave your thoughts below in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

About the Author(s)

You May Also Like