Do cattle imports influence the fed market?

Imports are a hot-topic right now. But, the data shows the marginal change in import totals isn’t substantial enough to influence price change in the fed market.

June 18, 2020

Last week’s Industry At A Glance highlighted international trade. Specifically, it looked at the influence of trade balance (exports minus imports) between 2010-and-2019 from two different perspectives: Tonnage/volume basis and value/dollar basis.

A quick summary of that discussion:

The tonnage or volume basis: Imports of beef and veal (carcass weight basis) exceeded exports by 630 million pounds, resulting in a negative trade balance. That’s equivalent to around 1.2 million pounds per week. Thus, the marginal contribution of “beef” tonnage to the nation’s beef supply is roughly 0.2%. From a volume perspective, international trade is essentially a wash.

The value or dollar basis: During the last 10 years, the beef industry’s cumulative trade balance is nearly $13.5 billion; a positive trade balance; export value exceeds import value. From a dollar perspective, international trade proves advantageous and institutes substantial benefit for beef producers.

None of that discussion, though, accounts for an important component of international trade: imported cattle. Imports are derived in three categories:

Slaughter cattle from Canada. Includes fed steers and heifers, slaughter cows and bulls.

Feeder cattle from Canada.

Feeder cattle from Mexico.

Those cattle obviously contribute to the overall beef supply and thus influence the overall market.

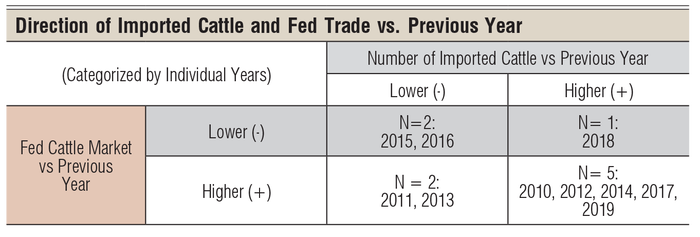

Given the broad trading range in the market during the past decade, the relative contribution of imported cattle to supply and the subsequent impact on the overall market is an important topic. To break that out in more detail, a year-over-year directional summary between import totals and the fed market is outlined in the table below. Note that every combination has occurred during the past decade.

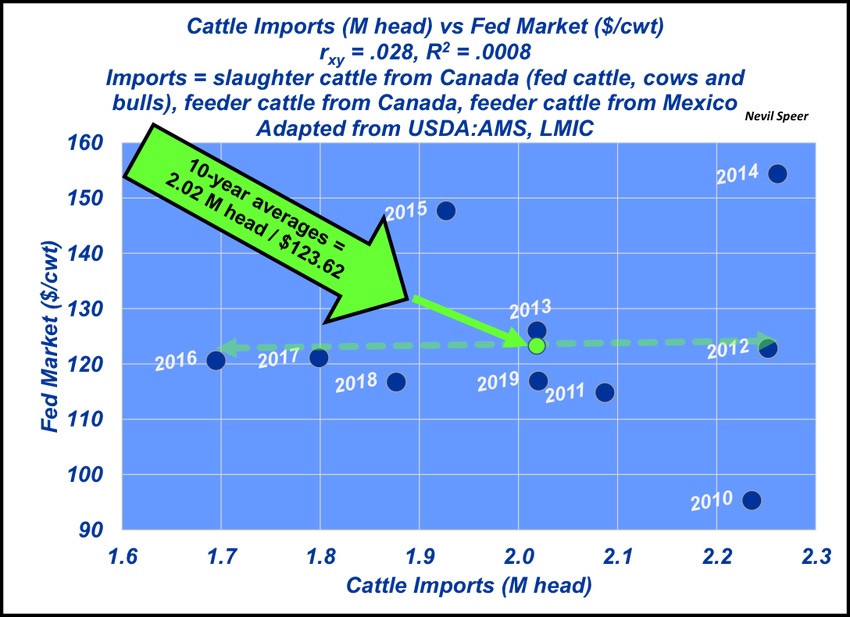

This week’s illustration takes that a step further and provides some additional context. It plots the annual fed market against respective import totals, including the line of best fit. Not surprisingly, given the absence of trend outlined in the table above, the correlation between the two is essentially zero (.028).

Accordingly, the R-squared is zero: None of the variation in fed price is attributable to variation in cattle imports. That’s seemingly counter-intuitive – Especially in light of much of the discussion that occurs around international trade.

But consider during the last 10 years, the swing up or down in the number of imported cattle from the overall average is only about 300,000 head. Even if a shift of that size happened over concurrent years, the difference would only be plus or minus about 6,000 head per week.

In comparison, federally inspected fed steer/heifer slaughter between 2010 and 2019 averaged 25.1 million head annually, or around 485,000 head weekly. That marginal change in supply one way or the other wouldn’t/couldn’t be a market-maker given the size of the U.S. cattle complex.

What’s the take-home lesson from this analysis? Based on the past decade’s worth of data, the cause and effect between cattle imports and the fed market is negligible: The marginal change in import totals isn’t substantial enough to influence price change in the fed market.

Year over year differences in import trade are simply buffered by, and absorbed through, a vastly larger domestic supply. Given the comparative magnitude of the domestic industry, the fed market is far more influenced by other factors such as domestic slaughter and total beef production.

Clearly, that could change if imported numbers were to suddenly surge or decline beyond what’s occurred during the past 10 years. But for the time being, given the limited variation in number of cattle being imported, changes in domestic cattle supply and subsequent beef production are far more significant in establishing general direction of the fed cattle market.

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)