Fed cattle market shows strength, resiliency in face of growing supplies

Just how far can the fed cattle market climb during the next several months?

October 10, 2018

There’s a saying that goes something like, “You can rate potential over performance.” It’s a call to realism; the point being an expectant outlook shouldn’t overshadow what’s occurring here and now. In the light of good news, that’s sound wisdom to ensure we don’t get ahead of ourselves.

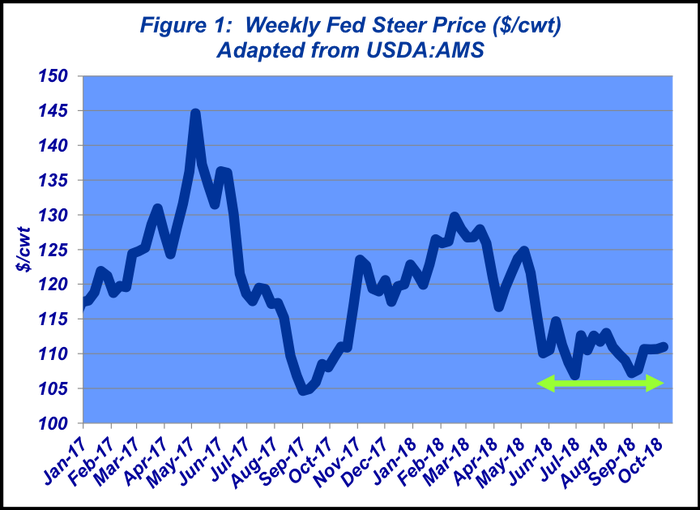

That’s easy to do as we transition into fall, seemingly with the lows behind us. The market has bottomed and has been working toward a solid base during the past month. To that end, the fed market was established at $106-$107 per cwt at the end of June. Steer and heifer trade then traded all around $110-$112 during the next several months, but ultimately retreated back to that $107 mark as August came to a close.

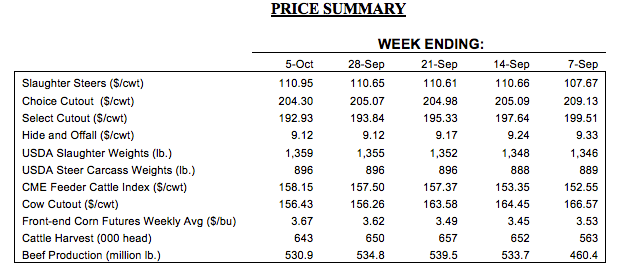

That brings us to September. The market gained a little ground the next week and then traded at the $110-$111 level for the next four weeks (Figure 1). More important, the real focus will now begin on potential gains ahead.

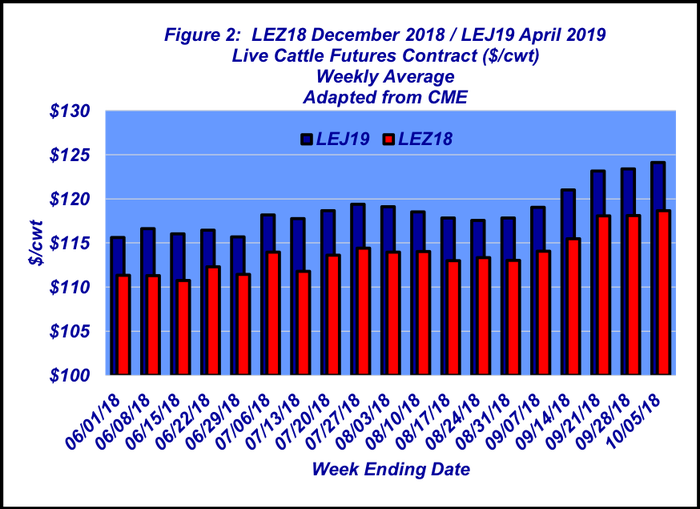

That is, just how far can the fed cattle market climb during the next several months? Seemingly, there’s lots of good news out there. The futures markets have reinforced that thinking by trending higher during the past several months (Figure 2). Stronger deferred futures have pulled feeder cattle higher, too.

The most favorable aspect working in the market’s favor revolves around beef demand. It’s clear that consumers are feeling good about both the product and their pocketbook. The best indicator of that comes from the year-over-year comparisons.

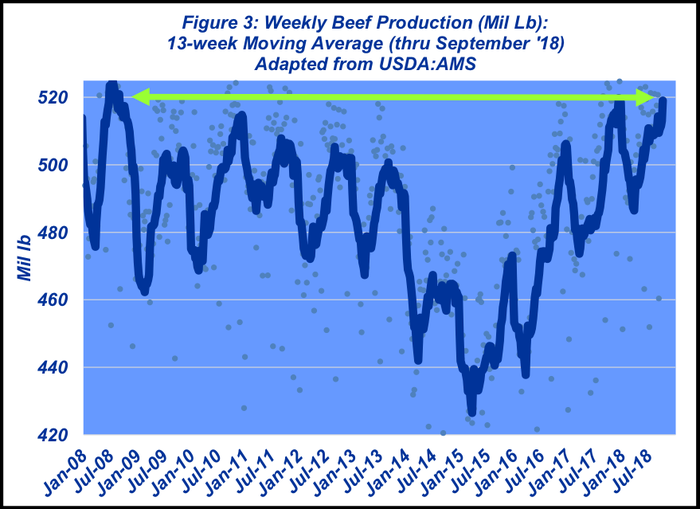

For example, the September market averaged around $110 per cwt across a four-week beef production average of 517.1 million pounds. The same period last year pegged an average $107 fed market while averaging 509.9 million pounds weekly. So, 2018 claims better prices on bigger throughput – that’s a favorable outcome of better beef demand.

And from a broader perspective, that trend becomes even more important as we look back 10 years: that was the last time beef production bumped up against current levels (Figure 3). In 2008, feedyards received an average of $97 per cwt during the peak production period. Fast forward to 2018, the industry is running at nearly the same throughput but with the market garnering $110 during the past several months. Strengthening demand over time translates to an additional $200 per head versus 10 years ago.

That’s all because beef has positioned itself in a very favorable position and been very successful in decommoditizing its product. The industry is no longer relegated to competing simply on price. Moreover, the quality and perception advantage gets even bigger with a thriving economy. To be sure, the economy is hitting on all cylinders right now – no matter the metric – labor, sentiment, GDP, etc. - it’s all culminating in a favorable manner.

But as noted above, there’s always a speed bump along the way. The source of those speed bumps are nothing new to the beef complex – it’s been the same old story for many months now. Big fed cattle supplies are keeping the pipeline full. The September Cattle on Feed report is seemingly old news by now, but it deserves a little extra digging in.

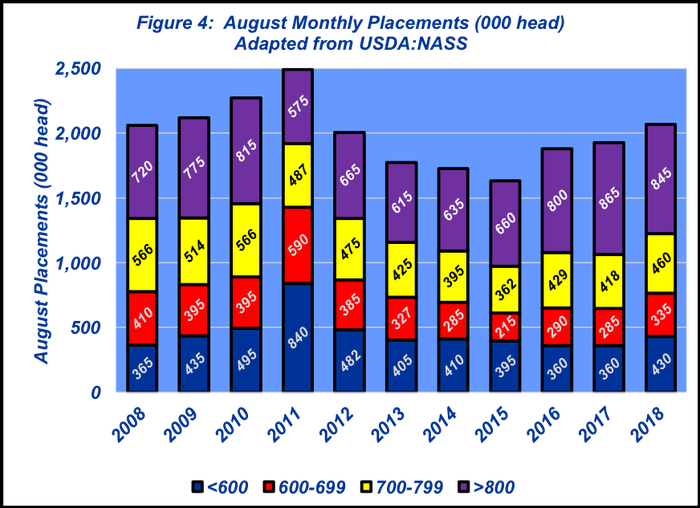

We’re in the heart of the fall run. And there was quite a bit of attention on lightweight placements made during August; particularly the fact they made up a larger portion of total placements in 2018 vs. 2017. Figure 4 puts that into some context.

Total placements equaled 2.07 million head. But 845,000 head weighed more than 800 pounds – the second biggest rate in the series’ history, second only to last year. Those heavyweight placements don’t offer much room to breathe as the business moves into late 2018, given already large front-end inventories.

Separately, last week’s Industry At A Glance focused on beef cow slaughter. Through August, beef cow producers have liquidated 2.02 million cows. During the past 30 years, beef cow slaughter between September and December represents about 56% of the January through August total.

Therefore, total cow liquidation through the end of the year should run somewhere around 3.15 million cows – or about 9.9% of the January 1 inventory. Based on previous years’ data, it appears that rate should result in a smaller starting inventory in 2019 versus 2018.

To close out, I recently read some decision-making advice from Carl Richards, author of the Behavior Gap, dealing with confirmation bias. He illustrates it as “have a theory – find evidence to support it.”

He goes on to explain that, “If you’re like me, you tend to make decisions first and do ‘research’ second. And your ‘research’ consists of summarily dismissing anything that disagrees with you, and instead gathering evidence that supports the decision you’ve already made. Of course, this isn’t research at all. It’s confirmation bias in action. Confirmation bias causes all kinds of problems in our financial lives…”

That’s why, every month, I include some sort of encouragement for producers to constantly be attentive to all details – no matter how unwelcome – that influence the market and/or their business. Therefore, be certain to obtain and objectively review meaningful information—coffee shop talk doesn’t count. That process helps to ensure more successful decision making along the way.

Nevil Speer serves as an industry consultant and is based in Bowling Green, KY. Contact him at [email protected].

About the Author(s)

You May Also Like