Fed cattle market: What a difference two years makes

Volatility has been the name of the game in the fed cattle market.

October 17, 2016

Several months ago, we highlighted the trends around feedyard revenue and the ensuring implications for the beef industry. Total feedyard revenue through the first half of the year declined to $18.4 billion compared with last year’s $21.4 billion. Ultimately, reduced revenue means less available money to flow back upstream to the stocker and commercial cow-calf sectors.

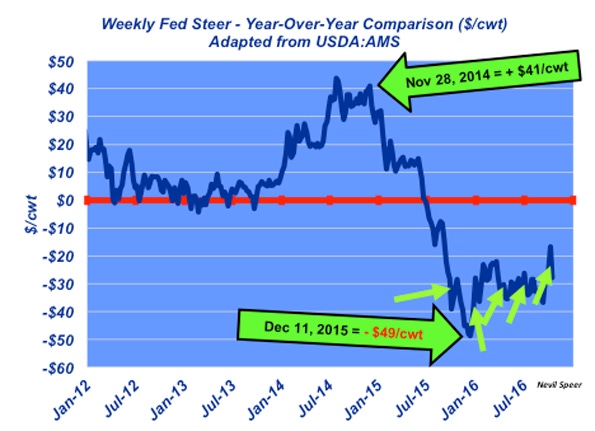

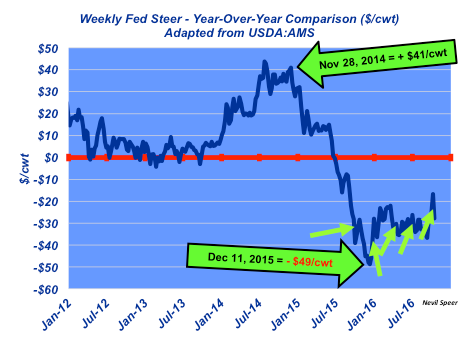

This week’s illustration looks at those challenges from a different perspective. The graph details the fed steer market on a year-over-year (YOY) basis. Stated another way, each data point reflects the difference in the fed market versus the previous year. Those deviations possess some important implications, especially during periods of large change and/or extended periods of negative values, like what’s occurred since last summer.

The YOY market peak occurred in late July 2014 at approximately $44 per cwt; at that point, a fed steer was worth about $600 per head more in 2014 compared with the same week in 2013. Better YOY values began in late September 2013 and lasted about 14 months through the end of November 2014.

The market then ran into trouble with negative YOY comparisons beginning in July 2015. That plunge reached a bottom last year in late December; just a year later, the YOY value had reached a bottom with the market retreating $49 per cwt versus 2014, the equivalent of nearly $700 per head. The negative YOY trend through September has now continued for 15 consecutive months, or five consecutive quarters as denoted by the arrows.

As such, the YOY rundown has lasted longer and been deeper than the run to the upside. That reality, coupled with softening fed futures values, possesses some important implications for feedyards. Most notably, in most cases, mark-to-market (MTM) determines feedyard inventory value on a quarterly or semi-annual basis – the MTM will subsequently dictates a feedyard’s borrowing base going forward. The consistent decline means a smaller borrowing base, reduced liquidity and/or the need to raise new capital to maintain business operations.

At what point do you think the market will find a bottom and we begin to trade even with year-ago levels? How do you perceive these trends influencing the industry? Given the risk to feeder prices, are you rethinking expansion in the years to come? Do you foresee liquidity challenges driving further consolidation in the feeding sector? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

Seven keys to ranch profitability

How to cull the right cow without keeping records

Burke Teichert's top 5 tips on bull selection

Young ranchers, listen up: 8 tips from an old-timer on how to succeed in ranching

4 tips for grazing corn stalks this fall

Head fake: September fed market fooled just about everybody

About the Author(s)

You May Also Like