Feedyard vs. cow-calf inventory returns: Who fared best in 2015?

Margin operators like cattle feeders struggled mightily in 2015.

November 23, 2015

Regardless of your position or interest in the beef business, the current state of affairs surrounding the cattle markets has likely captivated much of your attention the past several months. The market retreat has producers under pressure – especially margin operators who have gotten caught in the squeeze of the weekly or monthly requirement to buy and sell cattle.

Clearly, from strictly a market perspective, 2015’s plummet caught many analysts off guard. It was nearly impossible to foresee this type of sharp correction coming. However, what’s most important is the outcome of this year’s market action on the business in general.

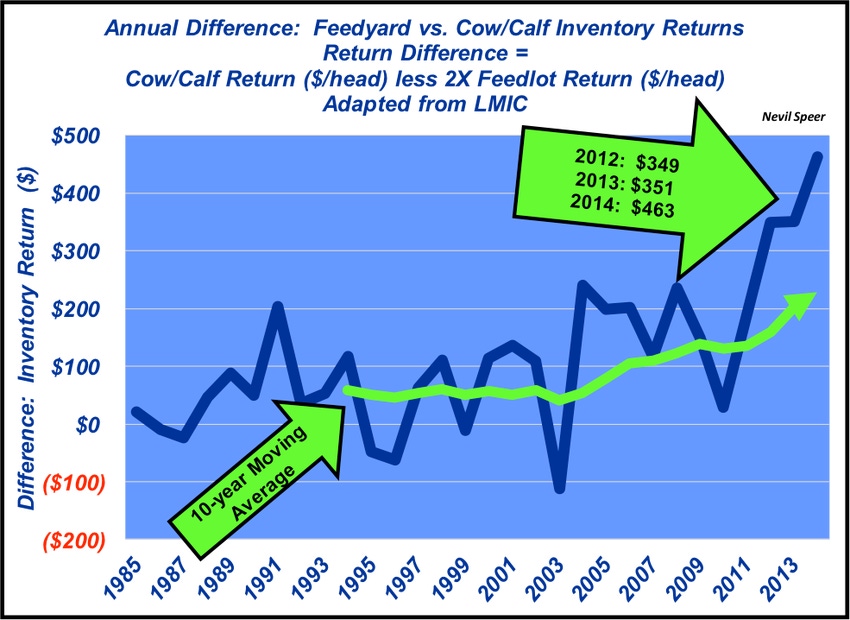

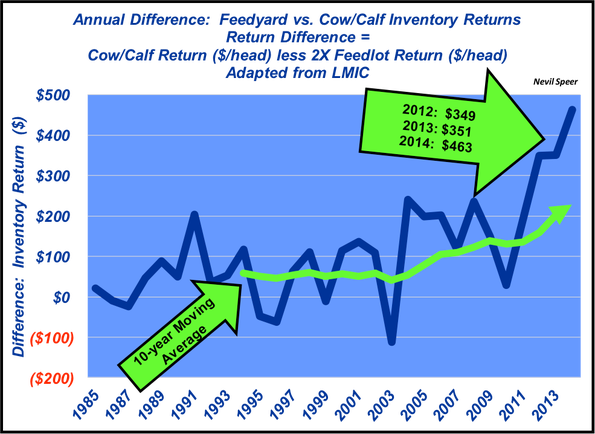

That’s especially true considering the long-run relationship among segments over time. With that in mind, this week’s illustration depicts the relative difference in annual inventory returns between the cow-calf and feedyard segments, respectively. The calculation reflects return per cow ($ per head) for the cow-calf segment, less return per feeding slot (double the annual $-per-head return reflecting roughly two turns of inventory per year).

The relationship was fairly steady and predictable through 2011. In general, the relative return difference hovered around $50 and slowly increased through 2011 toward $100. In other words, around 2010, the net return for a cow-calf operator, on average, was about $100 more than the average inventory return for a feedyard. And the industry operated in a fairly static mode around that general number.

That relationship changed dramatically in 2012 as feeder prices began to move sharply higher, with the difference reaching nearly $465 in 2014. Given the historic losses in the feedyard sector in 2015, it’s likely that difference will grow even larger this year.

That said, the push and pull around the feeder market could get especially rough in the coming year(s) to force that relationship back toward the historical trend. How do you see this year’s market action and feedyard losses influencing the feeder market going forward? Will the beef industry witness a dramatic shift favoring the cattle feeder going forward? Where might this relationship end up in the years ahead?

Leave your thoughts in the comments section below.

You might also like:

70 photos of hardworking beef producers

Cyclical trend will push prices lower

Let's eat! 75 photos of beef cattle bellied up to the feedbunk

Burke Teichert: Why working in sync with nature will benefit your operation

About the Author(s)

You May Also Like